The world of options trading offers a myriad of strategies, each designed to cater to specific risk-reward preferences. Among these strategies, vertical spreads stand out as a versatile tool that empowers investors with the potential to navigate market volatility and enhance their portfolios. Join us on a journey to unravel the intricacies of vertical spreads, unlocking the secrets to informed and successful option trading.

Image: www.randomwalktrading.com

Understanding Vertical Spreads: A Path to Precision Investing

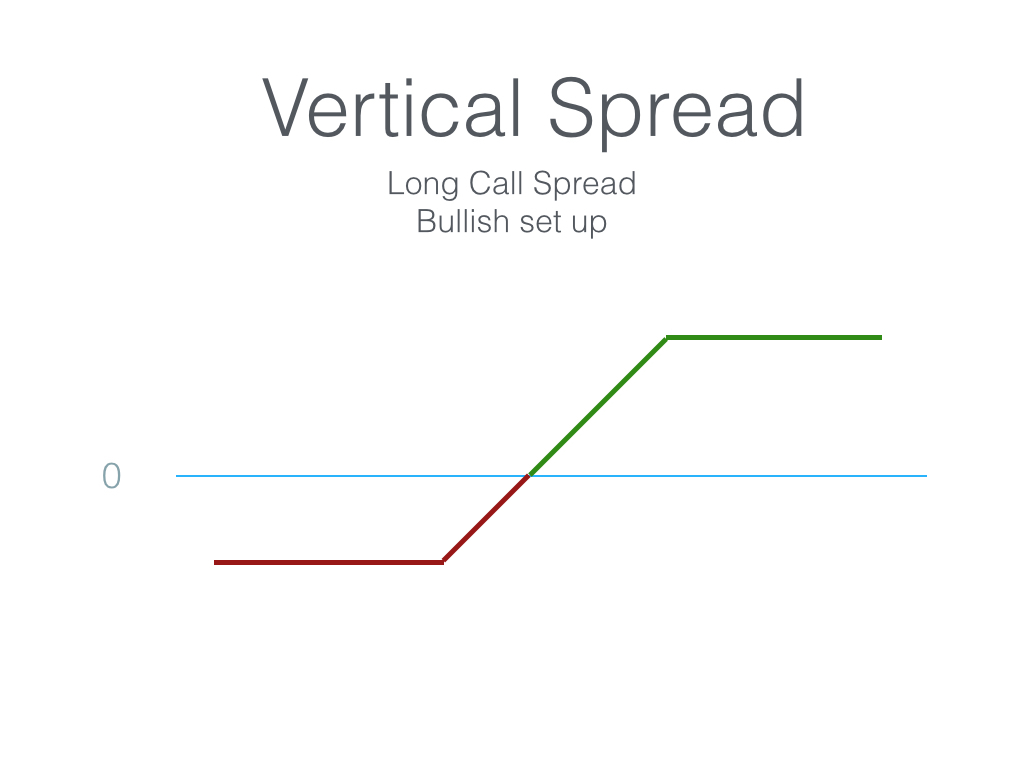

In its essence, a vertical spread is a combination of two options with different strike prices but the same expiration date. The investor holds a position where one option is purchased (the long leg) and another is sold (the short leg). By strategically selecting the strike prices and option types, investors can tailor the risk-reward profile of their spread to suit their specific objectives. This flexibility makes vertical spreads a popular choice for both experienced traders seeking advanced strategies and novice investors looking to finesse their trading approach.

Variations in Vertical Spreads: Tailoring to Diverse Trading Goals

The universe of vertical spreads encompasses several variations, each with its unique characteristics. The most prevalent are the Bull Call Spread and the Bear Put Spread, each suited to different market expectations. Bull Call Spreads convey bullish market sentiment, anticipating a rise in underlying asset prices. Conversely, Bear Put Spreads reflect bearish market views, hedging against potential price declines. Understanding these variations and their nuances empowers investors to make informed decisions aligned with their market forecasts.

Bull Call Spread: Capitalizing on Optimism

A Bull Call Spread involves buying a lower-strike call option (long leg) while simultaneously selling a higher-strike call option with the same expiration date (short leg). This strategy embodies a bullish outlook, expecting the underlying asset to appreciate in value. By constructing the spread this way, the investor limits their potential gains but also significantly reduces their overall risk compared to outright purchasing a single call option.

Image: www.askmoney.com

Bear Put Spread: Embracing Caution

In contrast to the Bull Call Spread, a Bear Put Spread represents a bearish market view. Here, the investor buys a lower-strike put option (long leg) and sells a higher-strike put option (short leg). This configuration positions the investor to benefit from a potential decline in the underlying asset’s price. Once again, by employing this spread strategy, the investor hedges their positions, mitigating the potential losses associated with a single put option purchase.

Expert Insights: Unlocking the Wisdom of Seasoned Traders

When it comes to options trading, tapping into the knowledge and experience of experts can prove invaluable. Seasoned traders recommend focusing on constructing spreads that align with one’s market outlook. They also emphasize the importance of managing risk through proper position sizing and careful strike price selection. Additionally, they advise against excessive spread positions, advocating for a disciplined approach that balances potential rewards with calculated risk management.

Actionable Tips: Emulating Trading Success

To put these insights into action, consider these practical tips:

- Determine your market outlook and identify the most appropriate vertical spread strategy to align with it.

- Use option chains to compare and contrast different strike prices and select the ones that suit your risk-reward preferences.

- Set clear profit targets and stop-loss levels to manage your positions effectively.

- Monitor your spreads regularly and adjust them as needed to adapt to changing market dynamics.

- Practice disciplined risk management techniques, never overextending your positions beyond what you can afford to lose.

What Is A Vertical Spread In Option Trading

Conclusion: Elevating Your Option Trading Journey

Vertical spreads are a powerful tool that can add depth and precision to your option trading strategies. By understanding the concepts, variations, and expert insights outlined in this article, you are well-equipped to make informed decisions that harness the benefits of vertical spreads. Remember to approach trading with a strategic mindset, embracing a disciplined approach to position sizing and risk management. As you master the art of vertical spreads, you unlock the potential to navigate market volatility, enhance your portfolio performance, and achieve your financial aspirations.