In the realm of options trading, the vertical spread strategy stands as a cornerstone technique, offering both profit potential and risk management. For those looking to venture into this exciting world, a comprehensive vertical options course can serve as an invaluable guide.

Vertical Spreads Decoded: A Guide to Complexity

Vertical spreads involve combining two options with different strike prices but the same expiration date. The essence of this strategy lies in leveraging the bullish or bearish outlook of the underlying asset. By pairing two options in this manner, traders can create a defined risk-reward profile as opposed to the open-ended nature of single option trading.

Strikes and Premiums: A Balancing Act

Understanding the concept of strikes is paramount for successful vertical spread trading. Strike prices represent the levels at which the underlying asset can be bought or sold at the option’s expiration date. Furthermore, the premium paid for the option, referred to as option premium, plays a critical role. Traders seek spreads where the net premium paid is minimal while maximizing the potential profit.

Trading Strategies Unveiled: From Basic to Advanced

The vertical spread strategy encompasses a spectrum of approaches, ranging from simple to intricate, each catering to specific market movements. Among the most prominent strategies is the Bull Call Spread, which involves buying a lower-strike call option and selling a higher-strike call option. This strategy reflects optimism that the underlying asset will rise in value, as the trader profits if the spread widens on the upside.

Bearish Bets and Hedges: The Versatile Power of Vertical Spreads

Conversely, the Bear Put Spread leverages bearish expectations, employing a lower-strike put option purchase and a higher-strike put option sale. This strategy anticipates a decline in the underlying asset, profiting from a narrowing spread on the downside. The versatility of vertical spreads extends to hedging strategies, where they are utilized to reduce risk exposure for existing positions in stocks, ETFs, or other instruments.

Empowering Traders: Expert Tips for Success

To navigate the complexities of vertical options trading, guidance from experienced experts is invaluable. One crucial tip is to meticulously define entry and exit points, establishing clear parameters for trade execution and risk management. Furthermore, keeping a watchful eye on the Greeks, particularly delta and theta, helps traders understand the sensitivity of their spread to underlying asset movements and time decay.

Trade Small, Trade Smart: Risk Mitigation in Practice

Risk management plays a pivotal role in successful vertical spread trading. Prudent traders start by trading small, gradually increasing position size as they gain experience and confidence. Diversification through multiple spreads on different assets can also mitigate risk and enhance overall portfolio performance. Finally, incorporating position monitoring and adjustment strategies ensures proactive risk management.

FAQs: Unraveling the Mysteries of Vertical Options

Q: What is the key advantage of vertical spreads?

Image: tradebrains.in

A: Vertical spreads offer defined risk-reward profiles, minimizing the downside potential while pursuing upside profit.

Q: Are vertical spread strategies suitable for beginners?

A: With proper education and guidance, vertical spread strategies can be accessible to both beginners and experienced traders.

Q: How do I learn more about vertical spread trading?

A: Consider enrolling in a comprehensive vertical options course, seeking mentorship from experienced traders, and diligently studying the subject through books, articles, and webinars.

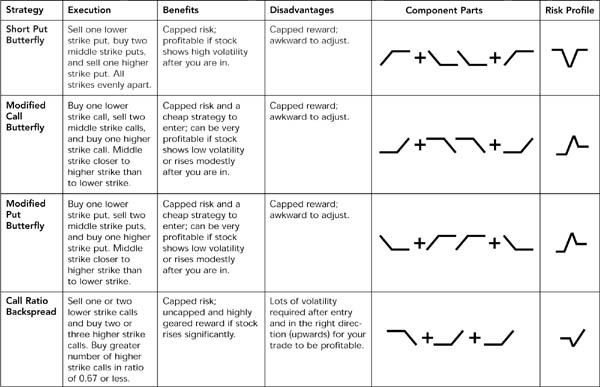

Image: www.oreilly.com

Basic Option Strategies Trading Vertical Options Course

Conclusion: Embracing the Power of Vertical Options

Unveiling the intricacies of vertical options trading can empower traders with the knowledge and tools to navigate market complexities successfully. By comprehending the concepts, strategies, and risk management techniques, traders can harness the potential of vertical spreads to optimize their trading endeavors. If you are eager to delve deeper into this fascinating world, consider enrolling in a tailored vertical options course and unlocking the gateway to informed trading decisions.

Interested in Unlocking the Secrets of Vertical Options? Discover Our In-Depth Course Today!