Introduction

In the world of investing, options trading has emerged as a popular way to potentially generate substantial profits. However, it’s essential to be aware of the tax implications associated with these investments. Navigating the complex tax code can be daunting, but understanding the rules and regulations surrounding options trading is crucial to maximize returns and avoid costly mistakes.

Image: dividendonfire.com

Options are financial contracts that give the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) within a specified time frame. When these options are exercised or sold, they can result in significant profits. However, the tax treatment of these profits is dependent on a variety of factors.

Taxation of Options Profits

Generally, profits from options trading are taxed as short-term capital gains or losses if the option is held for less than one year. This means they are taxed at the individual’s ordinary income tax rate, which can range from 10% to 37%. If the option is held for longer than one year, the profits are taxed as long-term capital gains, bénéficier from lower tax rates ranging from 0% to 20%.

Determining the Holding Period

The holding period for options begins on the day after the option is acquired and ends on the day it is sold or exercised. It’s important to note that the holding period is determined by the trade date, not the settlement date.

Additional Tax Considerations

Beyond the basic tax treatment, there are several additional factors that can impact the taxation of options profits:

-

Wash Sales: If an option is sold at a loss and a substantially identical option is acquired within 30 days, the loss may not be recognized for tax purposes.

-

Covered Calls: When an option is sold against an underlying asset that the taxpayer already owns, the resulting profit may be taxed as a long-term capital gain, even if the option is held for less than one year.

-

Straddles: A straddle involves the simultaneous purchase or sale of both a call and a put option on the same underlying asset. The tax treatment of straddles can be complex and depends on whether the straddle is considered “mixed” or “unmixed.”

Image: gogoheh.web.fc2.com

Expert Insights

“Understanding the tax implications of options trading is crucial,” says Dr. Susan Collins, a certified financial planner with over 20 years of experience. “By familiarizing yourself with the relevant tax laws, you can make informed decisions that maximize your returns and minimize your tax liability.”

“Remember that options trading involves both potential profits and potential losses,” adds Mark Jenkins, a tax accountant with a specialization in investments. “It’s essential to factor in the tax consequences when considering any options trades to avoid any surprises.”

Actionable Tips

-

Consult with a qualified tax advisor or financial professional to ensure an accurate understanding of the tax implications specific to your situation.

-

Keep detailed records of all your options trades, including the acquisition and disposition dates, strike prices, and exercise prices.

-

Be aware of the different tax rates applicable to short-term and long-term capital gains.

-

Consider using tax-advantaged accounts, such as IRAs or 401(k)s, for options trading to defer or reduce tax liability.

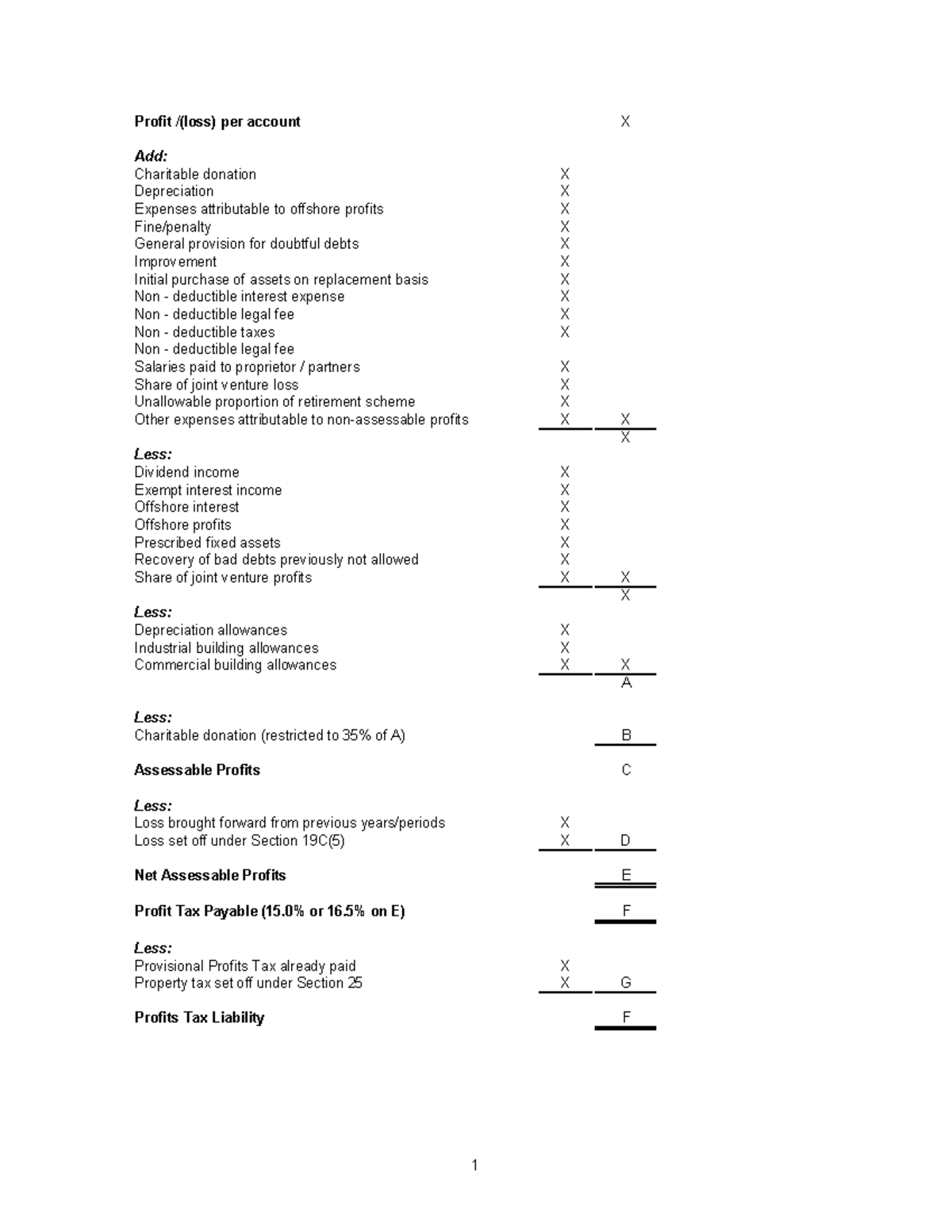

Tax On Profit From Options Trading

Image: www.studocu.com

Conclusion

By understanding the nuances of tax on profits from options trading, investors can make informed decisions that help them optimize their returns while minimizing their tax burden. Whether you’re a seasoned trader or just starting out, it’s essential to seek professional guidance and stay up-to-date on the latest tax regulations to navigate the complexities of this financial instrument and make the most of its potential.