The world of investing can feel overwhelming, with countless strategies and options available. For many, the idea of options trading can seem particularly daunting – a complex, risky endeavor reserved for experienced traders. But what if I told you that options trading, with its potential for high returns, could be accessible to even novice investors? As a long-time Fidelity customer, I discovered that the platform is a surprisingly approachable entry point for those curious about the world of options.

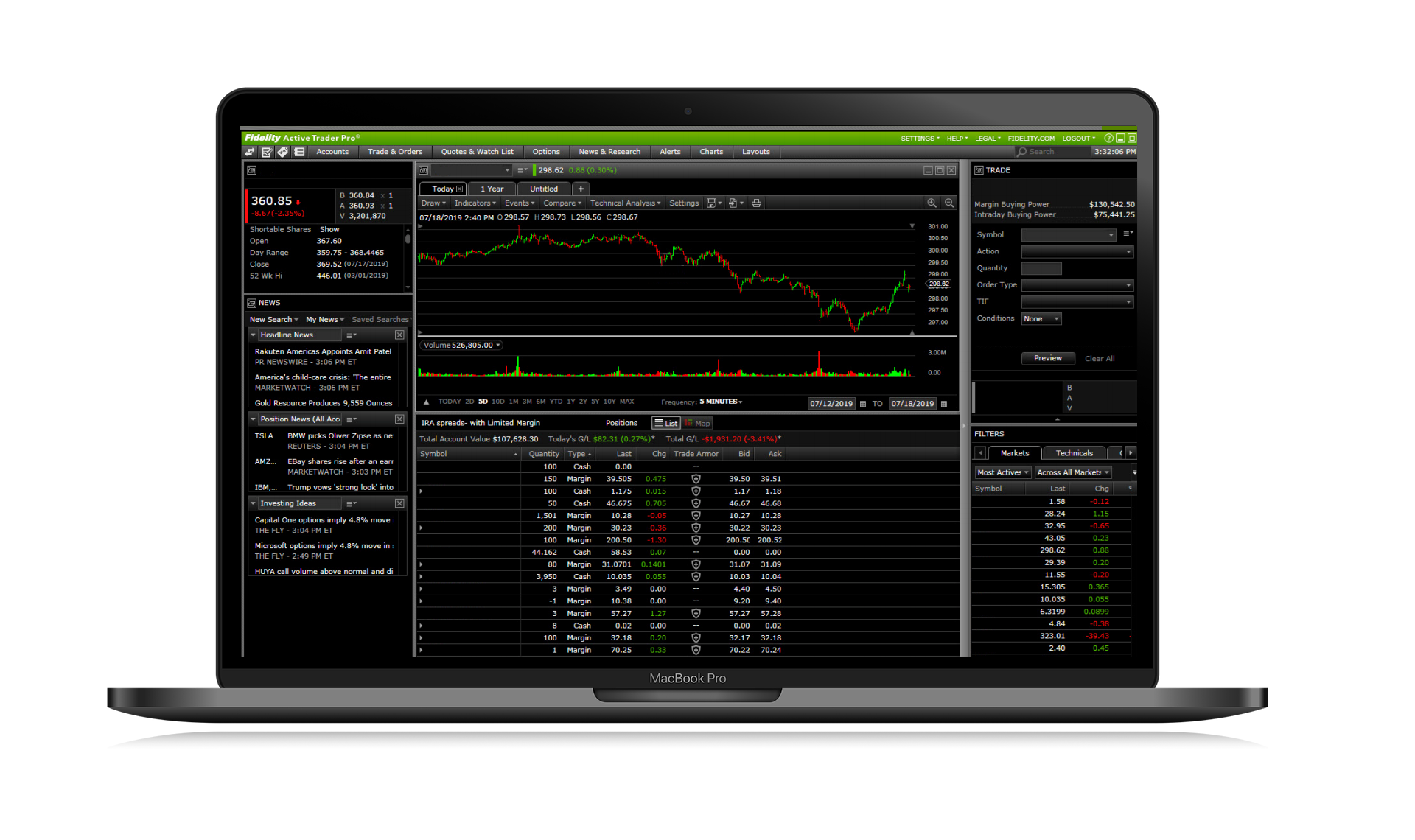

Image: douglascuffman-portfolio.com

This article will guide you through the basics of options trading on Fidelity, exploring the nuances of this powerful investment tool and demystifying its complexities. Whether you’re a seasoned investor looking for new avenues or a beginner taking your first steps into the market, this comprehensive guide will equip you with the knowledge to navigate the exciting world of options trading on Fidelity.

What are Options?

Options are contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset at a specific price (known as the strike price) on or before a specific date (the expiration date). The asset can be a stock, an index, a commodity, or even a currency.

Perhaps the most appealing aspect of options trading is its potential for **leveraged returns**. Because options contracts are designed to magnify gains or losses on the underlying asset, a small investment in options can lead to significant profits or losses. However, this inherent leverage also emphasizes the importance of understanding the risks associated with options trading.

Types of Options

Call Options

A **call option** grants the holder the right to buy the underlying asset at the strike price. Investors buy call options when they believe the underlying asset’s price will rise. If the price goes up, they can exercise the option and buy the asset at a lower price than the current market value, locking in a profit.

Image: badinvestmentsadvice.com

Put Options

A **put option** grants the holder the right to sell the underlying asset at the strike price. Investors buy put options when they believe the underlying asset’s price will fall. If the price decreases, they can exercise the option and sell the asset at a higher price than the current market value, again generating a profit.

Understanding the Options Trading Ecosystem on Fidelity

Fidelity provides a robust platform for options trading, encompassing comprehensive resources and tools that cater to both beginners and seasoned traders. The platform allows you to:

- Analyze market data: Fidelity provides real-time quotes, charts, and historical data to inform your options trading decisions.

- Place and manage trades: Fidelity’s user-friendly interface allows you to easily place and manage options trades, ensuring secure and efficient execution.

- Build and monitor strategies: Fidelity offers tools to create and manage complex options trading strategies, allowing you to tailor your approach to your specific risk tolerance and financial goals.

The platform also offers educational content and online resources, catering to various levels of experience. Fidelity’s comprehensive options trading guide provides in-depth explanations of different strategies, risk management techniques, and market analysis tools. Additionally, their dedicated customer support team is readily available to answer any questions or assist with any technical difficulties

Tips for Success in Options Trading on Fidelity

Options trading is a dynamic and challenging field, requiring a good understanding of market dynamics, risk management, and trading strategies. When navigating the options trading landscape on Fidelity, here are some essential tips to consider for success:

- Start Small: Begin with small investments and gradually increase your exposure as you gain experience and confidence. This allows you to manage risk and avoid significant losses in the early stages.

- Educate Yourself: Dedicate time to learning about options trading strategies, risk-management techniques, and market analysis tools. Fidelity offers extensive online resources and tutorials to help you build your knowledge base.

- Practice with a Paper Trading Account: Fidelity’s paper trading account allows you to experiment with different options strategies without risking real money. This is an invaluable tool for practicing your trading techniques and gaining experience in a risk-free environment.

- Use Stop-Loss Orders: Stop-loss orders automatically sell your options positions when they reach a specific price, limiting potential losses. This is a crucial risk-management tool, especially for beginner traders.

Remember, options trading is a complex endeavor. It’s important to approach it with a realistic understanding of the inherent risks and potential rewards. As you gain experience and knowledge, you can refine your strategies and adjust your risk tolerance accordingly. By adopting a disciplined and informed approach, you can build a sound foundation for successful options trading on Fidelity.

Commonly Asked Questions

Q: What are the costs associated with options trading on Fidelity?

A:

Fidelity charges a commission of $0 per options contract when you trade online through their platform. You will need to pay the fees associated with the underlying asset, and you might also need to pay for clearing and other fees depending on your trades. However, Fidelity waives certain fees, so always check their website for the most up-to-date information.

Q: How can I get started with options trading on Fidelity?

A:

To begin options trading on Fidelity, you’ll need to open an account with them.

- Visit their website and click the “Open an Account” button.

- Follow the prompts to provide your personal and financial information.

- Once your account is approved, you can access their options trading platform and begin exploring their various trading tools and resources.

Q: What are the benefits of options trading on Fidelity?

A:

Options trading on Fidelity offers a number of advantages, including:

- Access to a wide range of options: Fidelity offers a comprehensive selection of options contracts on various underlying assets, allowing you to diversify your portfolio and customize your strategies.

- User-friendly platform: Fidelity’s platform is designed for ease of use, with intuitive tools and clear navigation.

- Robust educational resources: Fidelity provides a wealth of educational content, including online tutorials, guides, and articles to help you learn about options trading.

- Strong customer support: Fidelity offers dedicated customer support to assist you with any questions or technical difficulties you may encounter.

Options Trading On Fidelity

https://youtube.com/watch?v=QEAUAJaO0VM

Conclusion

Options trading on Fidelity offers a powerful tool for investors looking to diversify their portfolios and potentially increase their returns. While this approach comes with inherent risks, a disciplined and informed approach can empower you to navigate this complex world successfully. Remember, starting small, educating yourself, and practicing with a paper trading account are essential steps to building a solid foundation for your options trading journey on Fidelity. Don’t hesitate to leverage the vast resources and support Fidelity provides to optimize your options trading experience.

Are you interested in exploring options trading further? Do you have any questions about getting started or about specific options strategies? Share your thoughts and questions in the comments below!