Introduction

In the ever-evolving world of digital asset trading, options have emerged as a powerful tool that empowers traders of all levels to enhance their strategies and navigate market complexities with greater control. Binance, the world’s leading cryptocurrency exchange, offers a robust options trading platform that provides users with access to a wide range of opportunities in the crypto market.

Image: www.bitcoininsider.org

Whether you’re a seasoned options trader or just starting your journey into this dynamic world, this comprehensive guide will equip you with the knowledge and insights you need to navigate the intricacies of options trading on Binance effectively. We will delve into the foundational concepts, explore the latest trends, and unlock the potential for maximizing returns while managing risks.

Understanding Options Trading

To fully comprehend the benefits of options trading, it’s essential to establish a solid foundation in the fundamental principles. In essence, options are financial instruments that grant the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specified price on a future date. This flexibility offers traders the opportunity to hedge against risk, speculate on price movements, or generate passive income through premium collection.

Options Contract Components

At the heart of every options contract lie several key components that determine its value and functionality:

-

Underlying Asset: This refers to the asset that the option contract is based on. Cryptocurrencies like Bitcoin or Ethereum serve as common underlying assets in crypto options trading.

-

Strike Price: This is the price at which the holder of the option has the right to buy (call option) or sell (put option) the underlying asset.

-

Expiration Date: This specifies the date on which the option contract expires. Options with different expiration dates can cater to various trading strategies.

-

Premium: This is the price paid to the seller of the option contract in exchange for the rights it conveys. The value of the premium fluctuates based on market conditions and the time remaining until expiration.

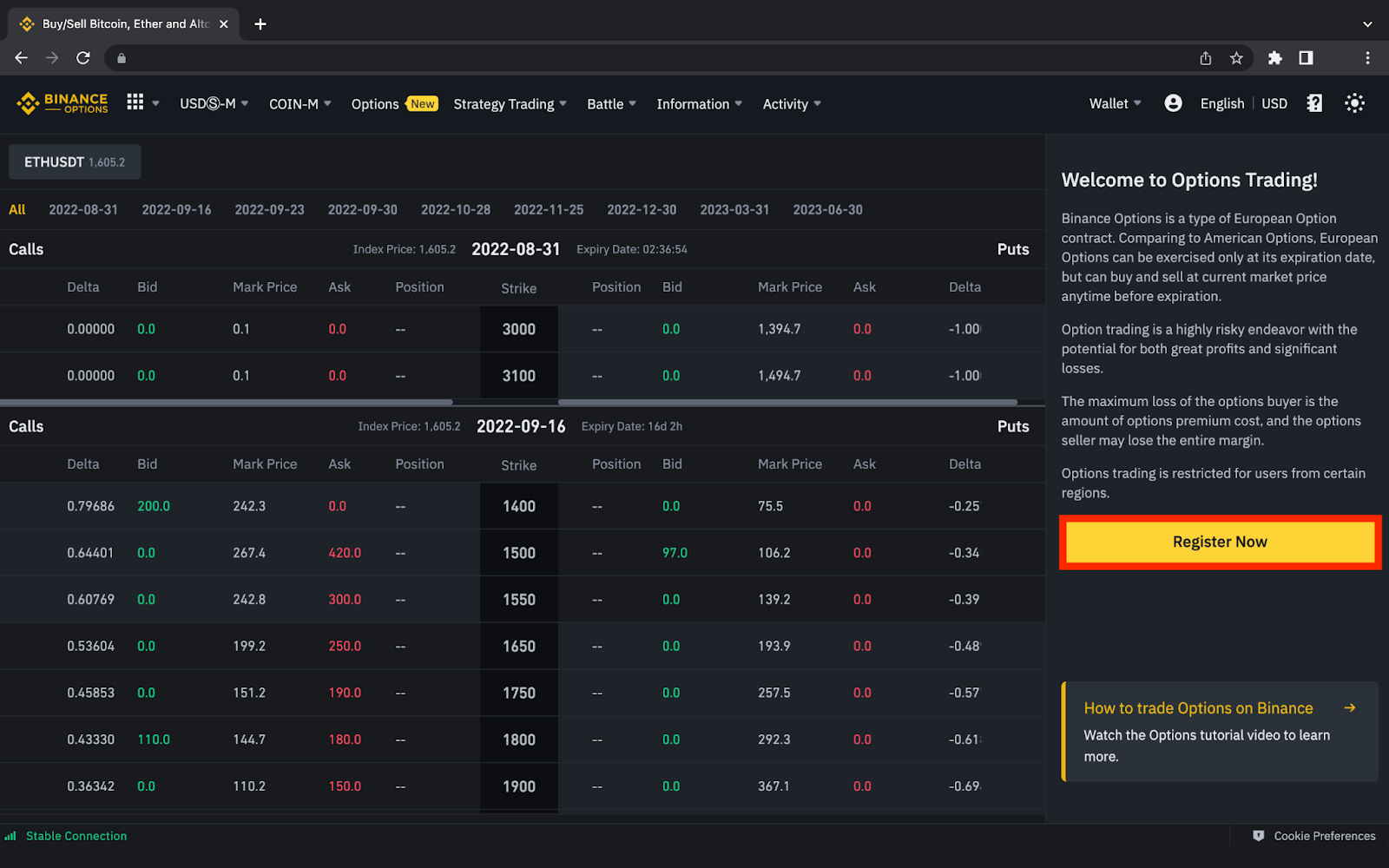

Call vs. Put Options

Options are broadly classified into two types: call options and put options. Each type serves a distinct purpose:

-

Call Option: This grants the holder the right to buy the underlying asset at the strike price on or before the expiration date. Call options are preferred when traders anticipate an increase in the asset’s value.

-

Put Option: This gives the holder the right to sell the underlying asset at the strike price on or before the expiration date. Put options are typically used when traders expect the value of the asset to decline.

Image: www.fxleaders.com

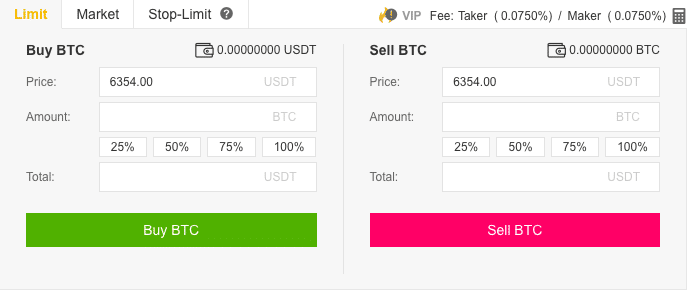

Trading Options on Binance

Binance’s user-friendly platform simplifies options trading, making it accessible to traders of all experience levels. To get started:

- Create an account and complete the KYC process for verification.

- Fund your account using supported cryptocurrencies or fiat currencies.

- Navigate to the “Options” tab within Binance’s trading interface.

- Select the desired underlying asset, strike price, and expiration date to create an order.

Advanced Options Trading Strategies

Once you grasp the fundamentals, explore more advanced strategies to enhance your trading proficiency:

-

Covered Call: This strategy involves selling a call option while owning the underlying asset. It limits potential upside but generates income through premium collection.

-

Protective Put: This strategy utilizes a put option to hedge against potential downside risk. It provides downside protection while sacrificing some profit potential.

-

Bull and Bear Call/Put Spreads: These strategies involve combining multiple call or put options with different strike prices and expiration dates to create tailored positions. They offer flexibility and risk management capabilities.

Risk Management in Options Trading

Options trading, while rewarding, carries inherent risks. To mitigate these risks:

-

Understand the Risks: Grasp the potential losses and risks associated with each options strategy before implementing it.

-

Set Stop-Loss Orders: This automated tool triggers a sell order when the asset price falls below a specified level, protecting you from significant losses.

-

Manage Position Size: Trade within your risk tolerance and avoid over-leveraging your positions.

Expert Insights and Actionable Tips

To gain valuable insights from seasoned experts in the field:

- Follow reputable options traders on social media or trading forums.

- Attend webinars or workshops conducted by industry professionals.

- Study trading books and articles to enhance your understanding.

Options Trading On Binance

Call to Action

Embrace the boundless potential of options trading on Binance with confidence. Utilize this comprehensive guide as your compass to navigate the complexities of this market effectively. Implement the strategies outlined, manage risks prudently, and embark on the path towards unlocking lucrative opportunities in the world of crypto options.