Options are indispensable financial instruments that offer investors and traders unparalleled opportunities for profit and risk management. At the core of options trading lies the fundamental theorem, a cornerstone of modern finance that unravels the intricacies of pricing and risk assessment. In this comprehensive guide, we delve into the depths of the fundamental theorem of options trading, exploring its historical roots, essential concepts, and wide-ranging applications.

Image: math.stackexchange.com

Delving into the History and Importance of the Fundamental Theorem

Before embarking on a journey through the fundamental theorem, it is essential to trace its historical roots. The concept emerged in the latter half of the 20th century, with notable contributions from Fischer Black and Myron Scholes in 1973. Their groundbreaking work laid the groundwork for the Black-Scholes model, a widely employed tool for pricing European-style options.

The fundamental theorem of options trading gained prominence due to its ability to accurately determine option prices and quantify the risks associated with these complex instruments. These capabilities have revolutionized financial markets, enabling investors and traders to make informed decisions and navigate the complexities of options strategies.

Understanding the Essence of the Fundamental Theorem

At its core, the fundamental theorem of options trading articulates the tantalizing truth that the price of an option can be unequivocally expressed as the difference between its intrinsic value and its time value. Intrinsic value, representing the immediate and tangible worth of an option, is determined by subtracting the exercise price from the underlying asset’s price for call options or vice versa for put options. Time value, on the other hand, captures the value of the option’s potential future gain should the underlying asset’s price move favorably.

The fundamental theorem elucidates that an option’s premium (its market price) is contingent upon three primary determinants: the exercise price, the current price of the underlying asset, and the time remaining until the option’s expiration. By understanding the interplay of these variables, traders can estimate option prices, gauge the sensitivity of options to price fluctuations, and discern optimal hedging strategies.

Exploring Practical Applications of the Fundamental Theorem

The fundamental theorem of options trading finds widespread use in diverse financial spheres. It serves as the bedrock for pricing options, enabling investors to determine the fair value of these instruments and make informed investment decisions. The theorem also empowers traders in constructing sophisticated hedging strategies, using options to mitigate risks associated with underlying assets.

Moreover, the fundamental theorem underpins the development of advanced pricing models, such as the Black-Scholes-Merton model for European options and the Binomial Options Pricing Model for American options. These models provide deeper insights into option pricing dynamics, allowing traders to refine their strategies and maximize their returns.

Image: messots.blogspot.com

Latest Trends and Developments in Options Trading

The dynamic landscape of financial markets has witnessed continuous evolution in options trading practices. The advent of electronic trading platforms has accelerated order execution and enhanced market liquidity. Additionally, the emergence of alternative data sources and algorithmic trading techniques has empowered traders with unprecedented data insights and computational power, enabling them to optimize their options strategies.

Furthermore, regulatory changes and the introduction of new options products, such as exchange-traded funds (ETFs) and exchange-traded notes (ETNs) backed by options, have expanded the scope of options trading strategies and opened up new avenues for investors.

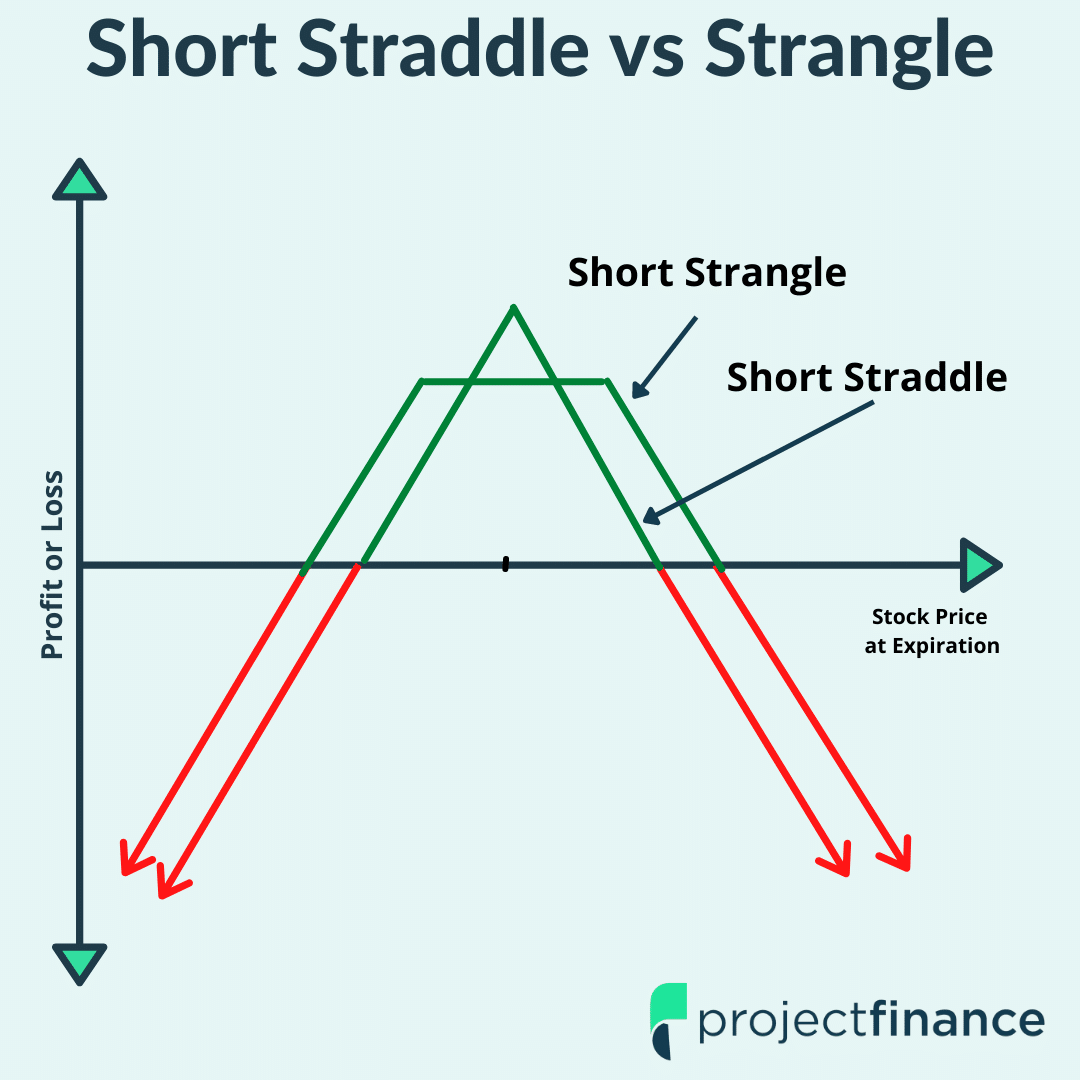

Fundamental Theorem Of Options Trading

Image: www.projectfinance.com

Conclusion

The fundamental theorem of options trading stands as a pivotal cornerstone in the financial world, offering a profound understanding of option pricing and risk management. With a rich history dating back decades, the theorem has shaped the very fabric of options trading and continues to guide investors and traders alike. As financial markets continue to evolve, the fundamental theorem will undoubtedly remain an indispensable tool for navigating the complexities and harnessing the opportunities offered by this fascinating realm of finance.