Navigating the Nuances of Cross-Border Trading

Trading stock options offers a multitude of opportunities for investors seeking to tap into the financial realm. However, for Canadians venturing into the expansive US markets, selecting the most favorable pricing structure becomes paramount to maximizing returns. This article delves into the intricacies of stock option pricing, specifically tailored to Canadian traders navigating the US markets, empowering them with the knowledge to make informed decisions.

Image: www.inknetng.com

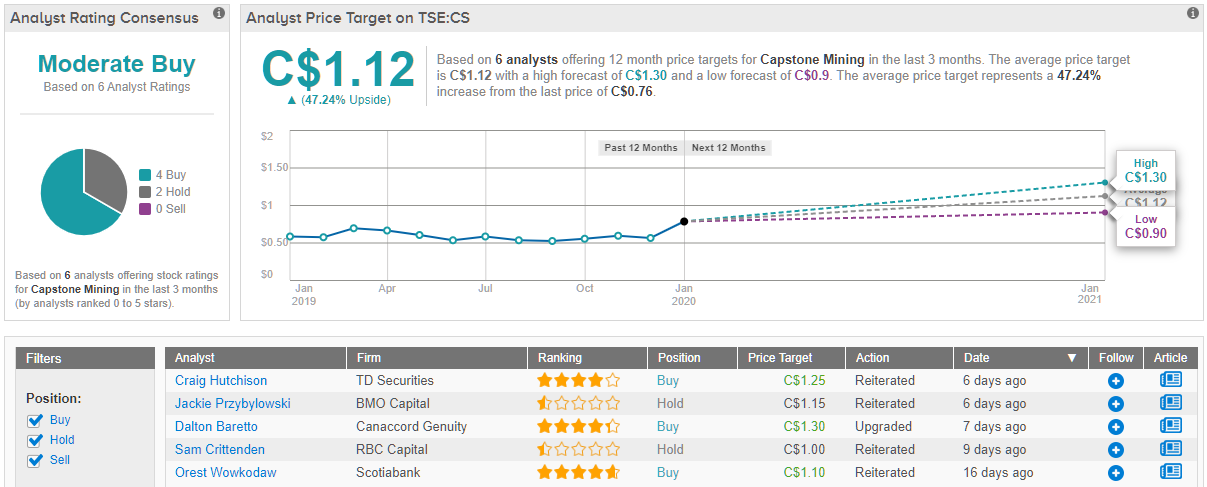

Understanding Option Premiums and Pricing Models

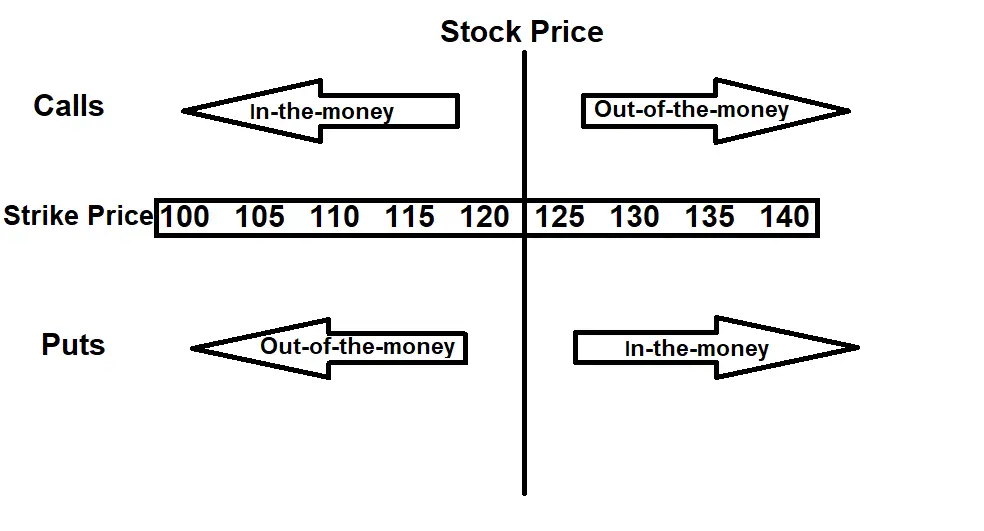

Stock options, derivative instruments bestowing the right but not the obligation to buy (call option) or sell (put option) an underlying stock at a specified price (strike price), are priced based on intricate methodologies encapsulating a myriad of factors, including the stock’s volatility, time to expiration, and the prevailing interest rates.

Among the most prevalent pricing models employed is the Black-Scholes model, a mathematical formula factoring in crucial parameters to derive option premiums, the cost of acquiring options contracts. These premiums fluctuate dynamically, reflecting changes in underlying factors and market sentiments.

Finding the Best Pricing Brokers

For Canadian traders venturing into the US markets, selecting a brokerage that offers competitive stock option pricing is essential. Numerous brokers cater specifically to Canadians, providing access to US markets while offering tailored pricing structures.

Carefully comparing brokerage fees, trading commissions, and account maintenance charges is vital to identify the most cost-effective विकल्प। Additionally, inquiring about any special promotions or discounts available exclusively to Canadian traders can yield substantial savings.

Optimizing Trading Strategies

Beyond selecting the appropriate broker, a prudent trading strategy is crucial for maximizing returns. Understanding option pricing dynamics enables Canadians to craft tailored strategies that align with their risk tolerance and financial objectives.

For instance, adopting a covered call strategy involves selling (writing) call options against stocks already owned, generating additional income while potentially limiting downside risk. Conversely, purchasing deep in-the-money call options offers enhanced leverage, albeit with a higher premium outlay.

Image: www.youtube.com

Tax Implications and Reporting Requirements

It is imperative for Canadian traders to be cognizant of the tax implications associated with US stock option trading. Dividends and capital gains realized from US options are generally subject to both Canadian and US taxation.

Thoroughly comprehending the tax reporting requirements is crucial to avoid penalties and ensure compliance with both countries’ tax regulations. Maintaining meticulous records of trades, including costs, premiums, and proceeds, facilitates accurate tax preparation.

Best Stock Option Pricing For Canadians Trading On Us Markets

Image: www.newtraderu.com

Conclusion

Harnessing the power of stock options can provide Canadian traders with lucrative opportunities in the lucrative US markets. By understanding option pricing models, selecting the most favorable brokerage options, and employing strategic trading techniques, Canadians can optimize their returns while mitigating risks.

In this rapidly evolving financial landscape, staying abreast of regulatory changes and market trends is essential. Continuously educating oneself and seeking guidance from reputable sources empowers Canadian traders to navigate the complexities of cross-border option trading with confidence and reap its boundless rewards.