Introduction: Delving into the World of Index Option Spread Trading

In the realm of financial markets, index option spread trading has emerged as a powerful strategy that astute investors can harness to navigate market volatility and enhance their profitability. By understanding its nuances and employing it strategically, traders can effectively manage risk while seeking maximum returns. This comprehensive guide unpacks the intricacies of index option spread trading, empowering you with the knowledge to make informed decisions and capitalize on market opportunities.

Image: www.pinterest.com

Index Options and Spread Trading: The Cornerstones of the Strategy

Index options, as opposed to single stock options, represent contracts that provide the right, but not the obligation, to buy or sell a specific stock index at a predetermined price (strike price) on a specific date (expiration date). By combining multiple index option contracts with different strike prices and expiration dates, traders create option spreads. This strategy enables them to tailor their risk-reward profile, enhance their potential gains, and mitigate potential losses.

Exploring Common Index Option Spread Trading Strategies

The versatility of index option spread trading manifests in various strategies tailored to different risk tolerance and profit objectives. Bullish strategies, like vertical call spreads, capitalize on expectations of rising stock prices. Conversely, bearish strategies, such as vertical put spreads, seek to profit from declining market conditions. Neutral strategies, like iron condors, aim to generate income from premiums while limiting potential losses. By understanding the intricacies of each strategy, traders can align their trading approach with their financial goals and risk appetite.

Benefits of Index Option Spread Trading: A Multifaceted Approach to Market Opportunities

The allure of index option spread trading lies in its inherent advantages. Diversification, a cornerstone of prudent investing, is achieved by spreading the risk across multiple options contracts, reducing reliance on a single stock’s performance. Enhanced efficiency stems from combining different strike prices and expiration dates, allowing traders to customize the spread to their specific objectives. With the potential for limited risk and the allure of capped profits, option spreads provide a compelling proposition for investors seeking to navigate market uncertainty and maximize returns.

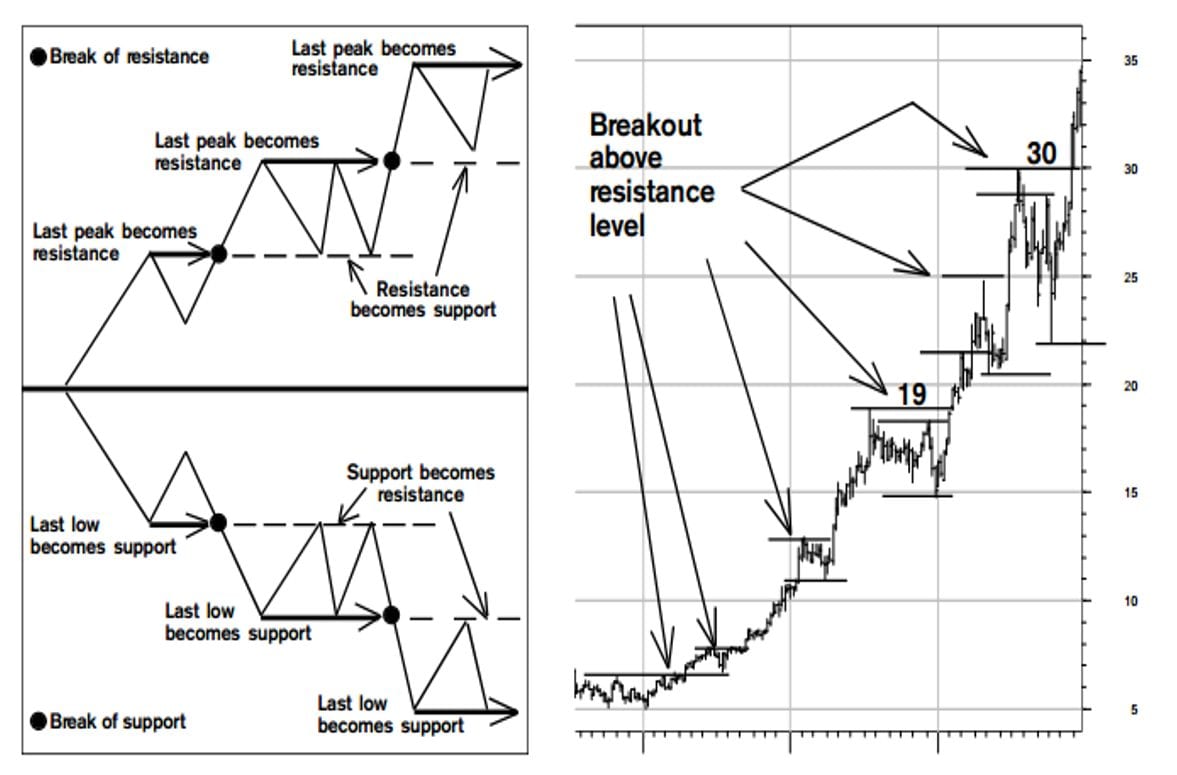

Image: www.options-trading-mastery.com

Assessing the Risks: Navigating Potential Pitfalls in Index Option Spread Trading

While index option spread trading offers promising opportunities, it is imperative to acknowledge the associated risks. Market volatility can result in rapid price swings, potentially leading to substantial losses. Implied volatility, a key factor in option pricing, can be unpredictable and significantly impact strategy performance. Traders must diligently manage risk by meticulously selecting strike prices, expiration dates, and spread types. Moreover, employing proper stop-loss orders and maintaining adequate capital reserves are crucial to mitigate downside risks effectively.

Index Option Spread Trading

Image: www.stockinvestor.com

Conclusion: Empowering Investors with the Insights of Index Option Spread Trading

In the ever-evolving realm of financial markets, index option spread trading stands as a sophisticated yet accessible strategy for discerning investors. By understanding its mechanics, benefits, and potential pitfalls, traders can harness the power of option spreads to navigate market volatility, optimize risk management, and pursue enhanced returns. With meticulous planning, diligent research, and a disciplined trading approach, index option spread trading can empower investors to make astute decisions and achieve their financial objectives.