In the realm of financial markets, option trading stands as a versatile tool that empowers investors to navigate the intricate tapestry of risk and reward. To harness the full potential of this sophisticated instrument, traders rely on the guidance of option trading analysis apps—sophisticated software that unravels the complexities of option contracts, empowering informed decision-making and maximizing investment outcomes.

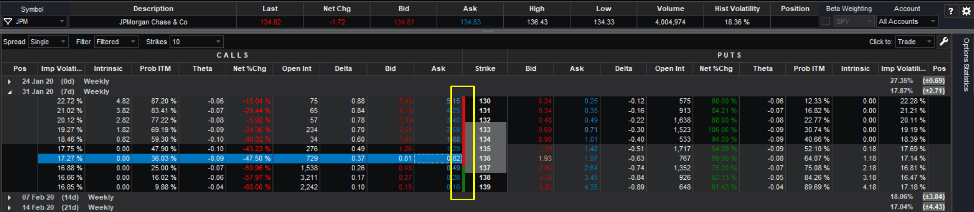

Image: www.tradestation.io

Defining Option Trading Analysis Apps: A Roadmap to Success

At their core, option trading analysis apps serve as indispensable companions for option traders, providing a comprehensive suite of analytical tools and insights to decode market intricacies and execute profitable trades. These apps empower users to:

-

Decipher Option Contract Dynamics: Unravel the complexities of option contracts, including type (call or put), strike price, expiration date, and premium.

-

Analyze Historical Data: Delve into historical market data, identifying patterns and trends that can shed light on potential future outcomes.

-

Simulate Trading Scenarios: Practice option trading strategies in a risk-free environment, testing different parameters and variables to hone skills.

-

Track Market Movements: Monitor real-time market data, staying abreast of price fluctuations and economic events that can impact option valuations.

Navigating the Option Trading Arena: A Journey through Key Concepts

Navigating the terrain of option trading requires a firm grasp of its key concepts:

-

Calls and Puts: Calls convey the right to buy, while puts offer the right to sell an underlying asset at a predefined price, providing flexibility in market positions.

-

Strike Price: This critical value serves as the price point at which the underlying asset can be bought (call) or sold (put) upon execution.

-

Expiration Date: Options have a finite lifespan, with expiration dates marking the end of their validity period.

-

Premium: The fee paid to acquire an option contract reflects its intrinsic value and time value, influenced by market dynamics.

-

Risk vs. Reward: Option trading entails a spectrum of risks and rewards, with careful consideration and risk management essential for success.

Unveiling the Power of Option Trading Analysis Apps: A Step-by-Step Guide

Harnessing the full potential of option trading analysis apps involves a systematic approach:

-

Selecting the Right App: Explore various options, comparing features, user reviews, and compatibility with trading platforms.

-

Customizing Analysis Parameters: Tailor the app to specific trading strategies and preferences, adjusting parameters such as risk tolerance, time horizons, and market assumptions.

-

Interpreting Results: Decipher the insights generated by the app, including probability of profit, potential return on investment (ROI), and risk-reward ratios.

-

Executing Trades: Integrate the app’s analysis with actual trading decisions, executing trades with confidence and precision.

![8 Best Binary Options Brokers January 2024 [UPDATED] - Public Finance ...](https://www.publicfinanceinternational.org/wp-content/uploads/list-binary-options-brokers-featured-1024x545.png)

Image: www.publicfinanceinternational.org

Charting the Course: The Evolution and Application of Option Trading Analysis Apps

Originating in the early days of option trading, analysis apps have evolved significantly:

-

Initial Simplicity: Basic apps provided rudimentary functions like premium calculation and historical data analysis.

-

Advanced Features: Modern apps incorporate sophisticated algorithms, risk management tools, and real-time data integration.

-

Mobile Revolution: Mobile apps empower traders with on-the-go access to analysis and trading functionality.

-

AI Integration: Emerging apps leverage artificial intelligence (AI) for predictive analysis and enhanced decision-making.

The Future of Option Trading Analysis Apps: A Glimpse into the Horizon

The future of option trading analysis apps is brimming with potential:

-

Intelligent Trading Assistants: Apps will evolve into intelligent assistants, offering personalized recommendations and real-time guidance.

-

Portfolio Integration: Seamless integration with portfolio management tools will facilitate comprehensive risk management and optimization.

-

Gamification: Gamified elements will engage traders, fostering learning and skill development.

-

Enhanced Security: Advanced security measures will safeguard user data and protect against cyber threats.

Option Trading Analysis App

Empowering Traders: The Role of Option Trading Analysis Apps in Decision-Making

Option trading analysis apps play a transformative role in empowering traders:

-

Informed Decision-Making: Data-driven insights facilitate informed decisions, increasing the likelihood of profitable outcomes.

-

Risk Management: Comprehensive risk assessment tools minimize potential losses and protect capital.

-

Time Optimization: Automation and efficiency tools free up time, allowing traders to focus on strategic planning.

-

Knowledge Enhancement: Educational resources and tutorials within apps promote continuous learning and skill development.

In conclusion, option trading analysis apps are indispensable tools for navigating the complex world of option trading. By leveraging their analytical capabilities, traders can unravel market complexities, execute informed trades, and maximize their investment potential. As these apps continue to evolve, they will further empower traders, shaping the future of option trading with innovation and enhanced decision-making.