Introduction:

Image: www.fxleaders.com

In the realm of cryptocurrency trading, options trading has emerged as a sophisticated tool that can amplify returns and hedge against risk. Binance.US, a leading regulated digital asset exchange in the United States, has introduced its own options trading platform, offering investors a secure and compliant gateway to this potentially lucrative market. This article aims to provide a comprehensive overview of Binance.US options trading, exploring its features, benefits, and strategies for successful trading.

Understanding Options Trading:

Options are financial contracts that give the buyer the right, but not the obligation, to buy (in the case of call options) or sell (in the case of put options) an underlying asset at a predetermined price within a specified period. Unlike futures contracts, options provide the flexibility to choose whether or not to exercise the right, making them a versatile risk management and income-generating tool.

Benefits of Binance.US Options Trading:

- Regulated Platform: Binance.US operates under the strict regulatory oversight of the US Financial Crimes Enforcement Network (FinCEN), ensuring compliance with anti-money laundering and know-your-customer (KYC) regulations. This provides traders with peace of mind and protects against illicit activities.

- Reliable Infrastructure: Binance.US is backed by the world’s leading cryptocurrency exchange, Binance, ensuring robust infrastructure, high liquidity, and advanced trading technology.

- Variety of Options Available: Binance.US offers a range of options contracts on popular cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Cardano (ADA). This diversifies investment portfolios and allows traders to capitalize on various market conditions.

- Leverage for Enhanced Returns: Options trading allows traders to gain exposure to potentially large price swings in the underlying asset with relatively small capital commitments. This can provide leverage to amplify returns or magnify potential losses.

Trading Strategies:

- Bullish Call Options: Traders bullish on the underlying asset’s price can purchase call options to lock in a specific price at which they can buy the asset in the future. If the price rises above the strike price before expiration, the options holder can exercise their right to buy at the lower price, capturing the price appreciation.

- Bearish Put Options: Conversely, traders bearish on the price can buy put options to sell the asset at a predetermined price. If the price falls below the strike price, they can exercise their right to sell at the higher price, profiting from the price decline.

- Covered Put Options: This strategy involves selling a put option while owning the underlying asset. If the price rises, the trader keeps the asset and collects the premium received for selling the put option. If the price falls below the strike price, the option may be exercised, obligating the trader to sell the asset at the predetermined price.

- Collar Strategy: A collar strategy combines bullish call options and bearish put options to create a range of protection around the underlying asset’s

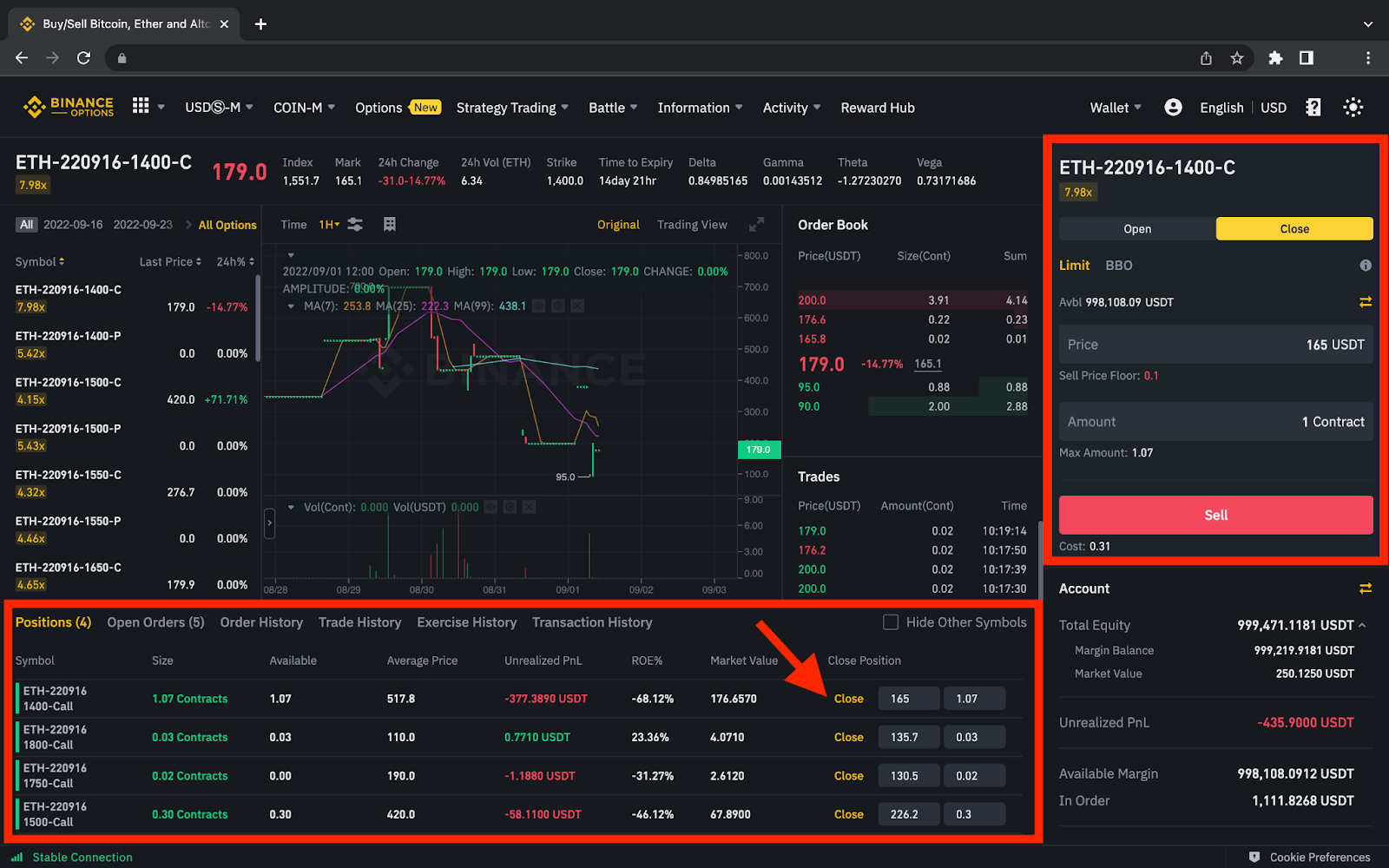

Image: www.binance.com

Binance.Us Options Trading

Image: www.binance.com