Introduction: Unleashing the Power of Options Trading on Binance

In the realm of cryptocurrency trading, Binance has emerged as a prominent exchange, offering a diverse range of financial instruments to enhance investor opportunities. Among them, trading options on Binance has gained considerable attention due to its flexibility, versatility, and potential for profit maximization. Binance trading options provide traders with the ability to speculate on the future price movements of cryptocurrencies, opening doors to both strategic hedging and speculative profits. Understanding the nuances of Binance trading options is paramount for traders seeking to navigate this dynamic market successfully.

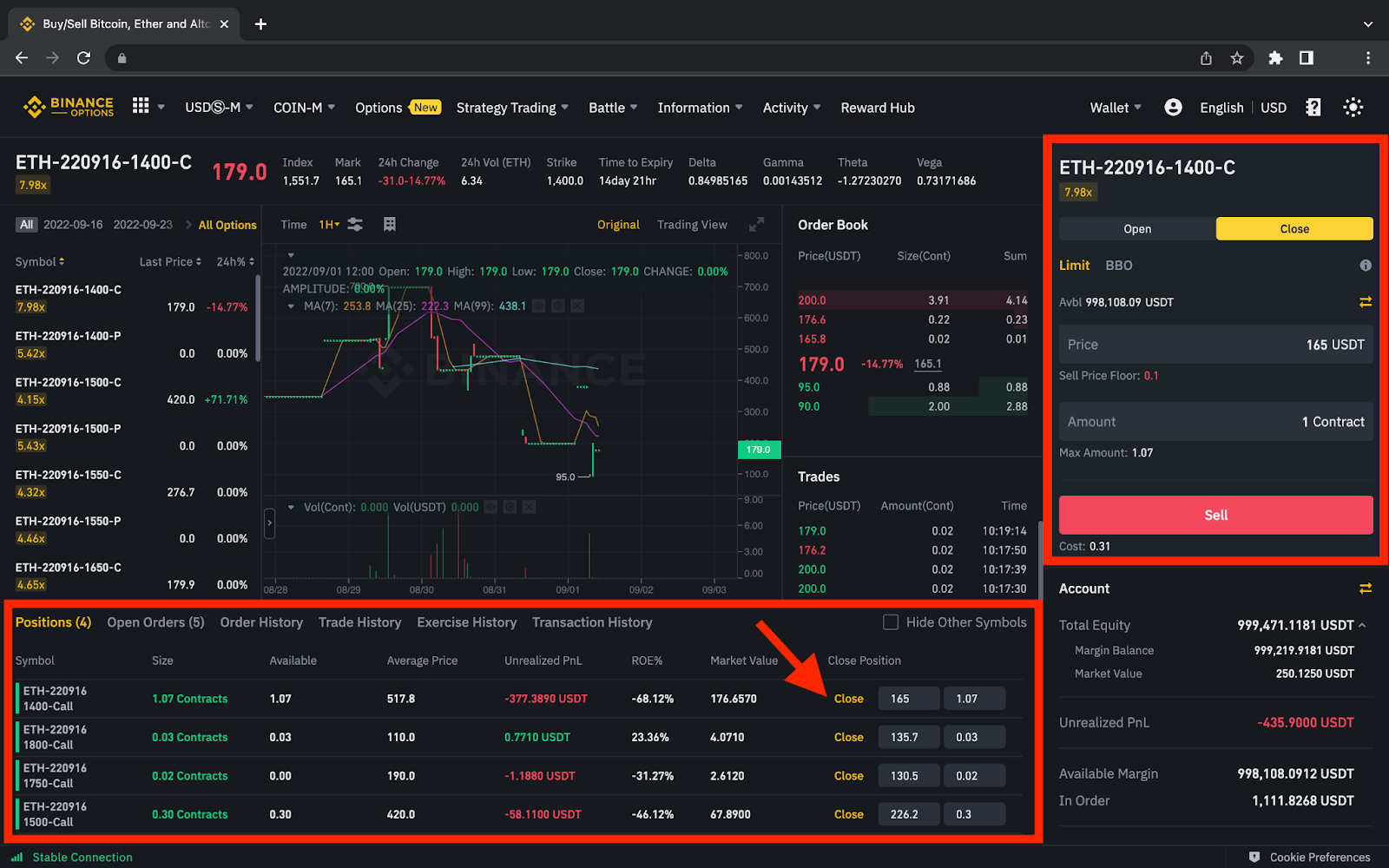

Image: final-blade.com

Binance Trading Options: A Primer

Binance trading options, in essence, are standardized contracts granting the holder the right, but not the obligation, to buy or sell a specific cryptocurrency at a predefined price (the strike price) on or before a specified date (the expiration date). This empowers traders with the flexibility to wager on the future price trajectory of their chosen cryptocurrency without the imperative to buy or sell. Fundamentally, Binance offers two types of trading options: call options and put options. Call options convey the right to buy a particular cryptocurrency at the strike price, while put options bestow the right to sell.

Unveiling the Mechanics of Binance Trading Options

To delve into the operational intricacies of Binance trading options, it is imperative to grasp a few fundamental concepts. Intrinsic value, for instance, represents the difference between the underlying cryptocurrency’s spot price and the strike price. If the intrinsic value is positive for a call (or negative for a put), the option is regarded as “in the money.” Conversely, if the intrinsic value is negative for a call (or positive for a put), the option is deemed “out of the money.” Moreover, time decay plays a pivotal role in options trading. As an option’s expiration date draws near, its value diminishes gradually regardless of price fluctuations.

Exploring the Advantages and Risks of Binance Trading Options

The allure of Binance trading options stems from their inherent advantages. Enhanced flexibility is one such advantage, as options bestow upon traders the discretion to capitalize on price movements without incurring the obligation to trade. Another advantage is the ability to harness leverage, allowing traders to amplify their potential profits with a lesser amount of capital outlay. However, it is essential to note that leverage amplifies not only profits but also potential losses. Consequently, traders should exercise caution and employ leverage judiciously.

As with any investment endeavor, Binance trading options are not devoid of risks. Prominent among these risks is the possibility of losses exceeding the initial investment. Due to the ephemeral nature of cryptocurrency prices, options can fluctuate significantly in value within short periods. It is therefore crucial for traders to possess a comprehensive understanding of options trading dynamics, market risks, and their own risk tolerance before venturing into this arena.

Image: www.fxleaders.com

Mastering the Art of Binance Trading Options: Strategies and Tactics

To navigate the complexities of Binance trading options, numerous strategies are at the disposal of traders. A popular approach is the covered call strategy, where an investor sells a call option while simultaneously holding an equivalent amount of the underlying cryptocurrency. This strategy generates income from the option premium while affording the possibility of profiting from a rise in the cryptocurrency’s price. Another notable strategy is the protective put, where an investor buys a put option to hedge against potential losses on a long position in the underlying cryptocurrency.

Binance Trading Options

Conclusion: Empowering Traders Through Binance Trading Options

Binance trading options have transformed into a valuable tool for traders seeking to maximize their returns from cryptocurrency markets. The flexibility, leverage potential, and strategic opportunities offered by options trading empower traders with advanced risk management techniques and profit-generating capabilities. Yet, it is imperative to approach Binance trading options with a well-informed mindset, a calibrated risk appetite, and a thorough understanding of market dynamics. By embracing education, practicing prudence, and continuously honing their skills, traders can unlock the full potential of Binance trading options, paving the way for strategic successes and substantial profit generation.