In the realm of financial markets, where risk and reward intertwine, Greek trading options have emerged as indispensable tools for sophisticated traders. As an avid enthusiast of these complex financial instruments, I’ve experienced firsthand the thrill and potential rewards of navigating the world of Greek options. Allow me to guide you on an enlightening journey through their intricacies and empower you with insights to unlock market opportunities.

Image: www.paytmmoney.com

Delving into the Greek Alphabet of Trading

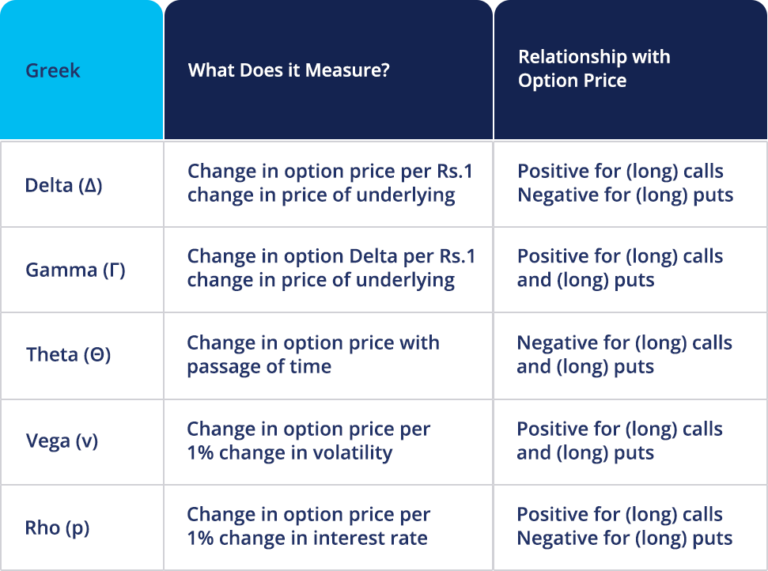

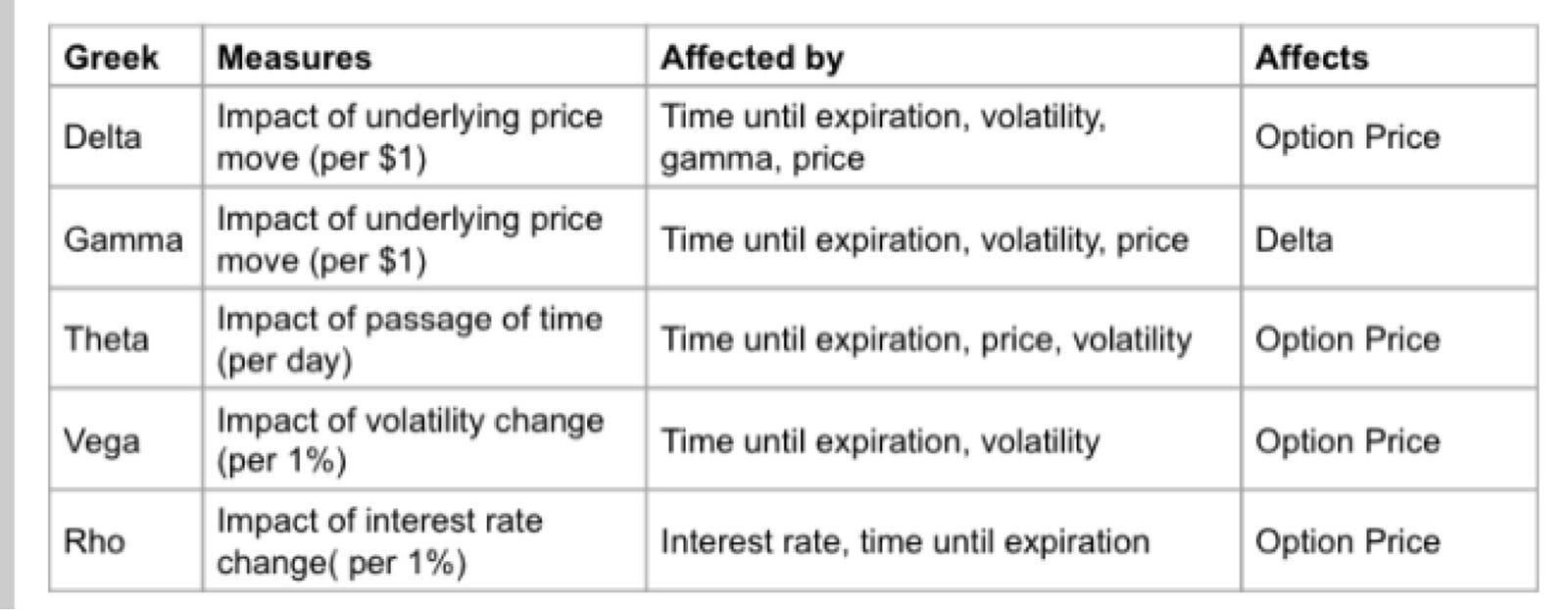

Greek options derive their name from the Greek letters used to represent their key characteristics. Delta (Δ), gamma (Γ), theta (Θ), vega (ν), and rho (ρ) each measure different sensitivities of an option’s price to various market factors. Understanding these Greek letters is fundamental to comprehending and utilizing these powerful tools effectively.

Delta: The Sensitivity of Option Price to Underlying Asset Price

Delta quantifies the change in option price in relation to a one-dollar change in the underlying asset price. Its value can range from -1 for a put option (indicating an inverse relationship) to +1 for a call option (reflecting a positive relationship).

Gamma: Measuring the Rate of Change in Delta

Gamma measures the rate at which Delta changes as the underlying asset price fluctuates. A positive gamma indicates that Delta is increasing and vice versa. This sensitivity plays a crucial role in hedging strategies and option pricing adjustments.

Image: medium.com

Harnessing the Power of Greek Options

The judicious application of Greek options can yield substantial benefits for seasoned traders. By tailoring option positions to specific market scenarios, traders can enhance portfolio diversification, mitigate risk, and augment income streams. Let’s delve into some expert advice and tips to empower you in the realm of Greek options.

Understanding Option Premiums

Option premiums are the prices paid by option buyers to option sellers. Premiums incorporate the intrinsic value and time value of options, and they fluctuate based on various factors, such as asset volatility and time to expiration. By evaluating the premium and comparing it to the underlying asset price, traders can determine if an option is over- or underpriced.

Selecting the Right Options Strategy

Numerous Greek trading options strategies exist, each tailored to specific market conditions and investment objectives. Call and put options can be combined to create spreads, while exotic options like butterflies and iron condors offer complex risk-reward profiles. Choosing the appropriate strategy requires a deep understanding of market dynamics and a well-defined investment plan.

FAQ: Demystifying Greek Options

Q: What is the role of Theta in option pricing?

A: Theta measures the time decay of an option’s value as it approaches expiration. As the option nears maturity, its price erodes, creating a natural incentive for traders to close their positions before they expire worthless.

Q: How does Rho impact option prices?

A: Rho gauges the sensitivity of option prices to changes in risk-free interest rates. A positive Rho indicates that the option’s value will increase as rates rise, and vice versa. This is particularly important for long-dated options where interest rate fluctuations can have a significant impact on pricing.

Greek Trading Options

Image: www.slideshare.net

Conclusion: Empowering Investors with Greek Options Proficiency

Embracing the intricacies of Greek trading options can transform you from a novice trader into a confident market navigator. By grasping the nuances of Delta, Gamma, and other Greek sensitivities, you can unlock the full potential of these sophisticated financial instruments. Whether you seek to enhance diversification, mitigate risk, or generate additional income, Greek options offer a boundless realm of opportunities for savvy investors. Embrace their power, hone your strategies, and embark on a journey of financial empowerment.

Are you intrigued by the world of Greek trading options? Share your thoughts and questions in the comments below, and let’s delve deeper into the complexities of these market-shaping tools.