Trading Vega and Gamma Options: A Guide to Profiting from Volatility

Image: www.optionstradingiq.com

Introduction

In the fast-paced world of finance, investors are constantly seeking strategies to navigate market volatility and enhance their returns. Enter vega and gamma options, two powerful tools that allow traders to harness the power of volatility to generate substantial profits. Join us on an enthralling journey to unravel the intricacies of trading vega and gamma options, empowering you with the knowledge to unlock exceptional investment opportunities.

Understanding Vega and Gamma

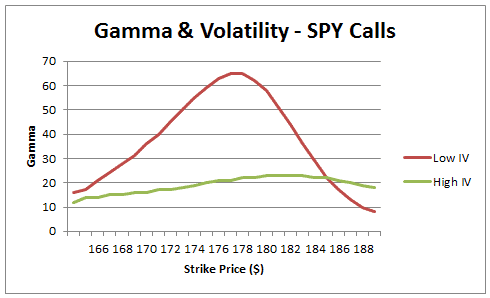

Vega measures the sensitivity of an option’s price to changes in implied volatility. Higher vega implies that the option’s price will rise rapidly as volatility increases. Gamma, on the other hand, reflects the rate at which an option’s delta changes with respect to changes in the underlying asset’s price. Positive gamma indicates that the delta will become larger as the asset’s price moves in the desired direction.

The Interplay of Vega and Gamma

The interplay between vega and gamma can lead to significant profit opportunities. When volatility is low, traders can buy vega-positive options (options with high vega) and delta-negative options (options with negative delta). As volatility rises, the option’s price will increase due to higher vega, while the delta-negative position will help mitigate potential losses from an unfavorable asset price movement.

Conversely, when volatility is high, traders can sell vega-positive options and buy delta-positive options (options with positive delta). In this scenario, if volatility falls, the option’s price will decrease, generating profits from vega, while the delta-positive position will benefit from a favorable asset price movement.

Expert Insights

“Trading vega and gamma options requires a deep understanding of market dynamics and a calculated approach,” advises renowned options expert Dr. Mark Richards. “By monitoring volatility and anticipating market trends, traders can position themselves to capitalize on price fluctuations and maximize their returns.”

Dr. Richards emphasizes the importance of managing risk, highlighting the potential for significant losses if these options are not traded properly. “It’s crucial to set clear stop-loss levels and constantly monitor market conditions to adjust positions as necessary,” he cautions.

Actionable Tips

- Choose appropriate options: Identify options with high vega and positive or negative delta based on the prevailing market conditions.

- Set precise stop-loss levels: Determine the maximum loss you’re willing to tolerate and place stop-loss orders accordingly.

- Monitor volatility: Continuously monitor implied volatility and adjust your positions as needed to take advantage of changing market conditions.

- Understand your risk: Recognize that trading vega and gamma options involves potential losses and ensure you are comfortable with the level of risk involved.

Conclusion

Trading vega and gamma options can be a lucrative strategy for harnessing volatility and generating substantial profits. By mastering the concepts of vega and gamma and applying the expert insights provided, you can navigate market fluctuations with confidence and unlock exceptional investment opportunities. Remember to approach these options with caution, manage your risk diligently, and constantly seek knowledge to enhance your trading acumen.

Image: www.pinterest.com

Trading Vega And Gamma Options

Image: www.stockinvestor.com