Introduction

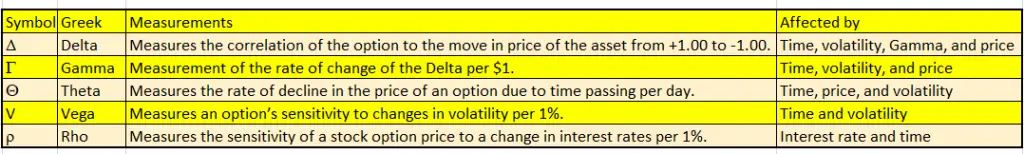

The ever-evolving world of finance has given rise to a labyrinth of intricate financial instruments, and among them, options stand out as a veritable chameleon, capable of morphing into versatile forms to cater to a wide spectrum of investment objectives. To navigate this complex landscape, traders rely on a cadre of metrics known as the Greeks, each carrying a distinct Greek letter designation, which provide indispensable insights into the dynamics of an option’s behavior. In this comprehensive guide, we will delve into the enigmatic realm of the Greeks, deciphering their roles and revealing how they empower traders to make informed decisions in the exhilarating arena of option trading.

The Alphabet of Option Metrics

The Greeks constitute a veritable alphabet of metrics, each representing a facet of an option’s characteristics and risks. These metrics are indispensable for traders seeking to understand an option’s sensitivity to various factors, such as underlying asset price fluctuations, time decay, volatility, and interest rate changes. By mastering the intricacies of the Greeks, traders gain a competitive edge, enabling them to navigate the ever-changing financial landscape with greater precision and confidence.

Delta: Delta, the cornerstone of the Greeks, measures the responsiveness of an option’s price to changes in the underlying asset’s price. A positive Delta signifies that the option’s price will move in tandem with the underlying asset, while a negative Delta indicates an inverse relationship.

Image: www.newtraderu.com

Gamma: Gamma gauges the rate of change in an option’s Delta in response to fluctuations in the underlying asset’s price. A positive Gamma implies that the Delta will become more positive or less negative as the asset price changes, while a negative Gamma indicates the opposite.

Vega: Vega captures the sensitivity of an option’s price to changes in implied volatility. A positive Vega indicates that the option’s price will increase as implied volatility rises, and vice versa.

Theta: Theta measures the time decay inherent in an option’s value as it approaches its expiration date. A negative Theta indicates that the option’s value will erode over time, while a positive Theta suggests the opposite.

Rho: Rho gauges the sensitivity of an option’s price to changes in interest rates. A positive Rho implies that the option’s price will increase as interest rates rise, while a negative Rho indicates a decrease in price.

Unveiling the Secrets of the Greeks

To unravel the secrets hidden within the Greeks, consider the following real-world scenario:

Imagine an investor holding a call option on a stock currently trading at $50, with an exercise price of $52 and an expiration date in three months. The stock’s implied volatility is 20%.

-

Delta: A Delta of 0.8 indicates that the option’s price will increase by approximately $0.80 for every $1 increase in the stock price.

-

Gamma: A Gamma of 0.05 suggests that the Delta will increase by approximately 0.05 for every $1 change in the stock price.

-

Vega: A Vega of 0.25 implies that the option’s price will increase by approximately $0.25 for every 1% increase in implied volatility.

-

Theta: A negative Theta of -0.02 indicates that the option’s value will decay by approximately $0.02 per day as the expiration date approaches.

-

Rho: A positive Rho of 0.01 suggests that the option’s price will increase by approximately $0.01 for every 1% increase in interest rates.

Strategic Deployment of the Greeks

Armed with the knowledge of the Greeks, traders can devise sophisticated strategies to enhance their trading abilities. For example:

Delta Hedging:

Delta hedging involves adjusting the number of options or underlying assets held to maintain a desired Delta, thereby mitigating the risk of price fluctuations.

Image: epsilonoptions.com

Gamma Scalping:

Gamma scalping capitalizes on the relationship between Gamma and Delta, exploiting short-term price movements to generate profits.

Vega Trading:

Vega trading involves profiting from fluctuations in implied volatility, typically by buying options with positive Vega when volatility is expected to rise and selling them when volatility is expected to fall.

Theta Decay:

Theta decay can be employed to profit from the time value erosion of options, particularly in the case of deep out-of-the-money options.

What Are The Greeks In Option Trading

Conclusion

The Greeks stand as indispensable tools in the arsenal of option traders, providing a comprehensive understanding of an option’s characteristics and risks. By deciphering the intricacies of Delta, Gamma, Vega, Theta, and Rho, traders gain the ability to navigate the complex world of option trading with greater precision and confidence. Embracing the knowledge of the Greeks empowers traders to unlock the full potential of options, whether for hedging, speculation, or income generation. In the ever-evolving financial landscape, the Greeks remain a timeless guide, illuminating the path towards successful option trading.