Options trading, a sophisticated financial strategy, conceals a secret weapon known as the Greeks. These metrics, named after the Greek alphabet, unveil the intricate dance between risk, reward, and time decay. Understanding the true nature of these Greeks is paramount to unlocking the mysteries of options trading and making informed decisions.

Image: www.youtube.com

Unveiling the Greeks: A Journey into Option Dynamics

In the realm of options trading, understanding the Greeks is not merely an academic pursuit; it is the key that unlocks the doors to precision and profitability. They provide a window into the soul of an option, revealing its sensitivity to changes in various factors such as the underlying asset’s price, volatility, time decay, and interest rates. Mastering the Greeks is akin to mastering the symphony of risk and return, allowing traders to craft strategies that dance to the rhythm of market movement.

Navigating the Greek Alphabet of Risk and Reward

The Greek alphabet serves as the alphabet for options traders, each letter representing a fundamental risk factor. Mastery of these letters unlocks the secrets to informed decision-making in the world of options trading.

Delta: The Great Predictor

Delta unveils how options prices shift in response to underlying asset price movements. It gauges the option’s directional sensitivity, a crucial factor for traders aiming to harness market momentum.

Image: www.cheddarflow.com

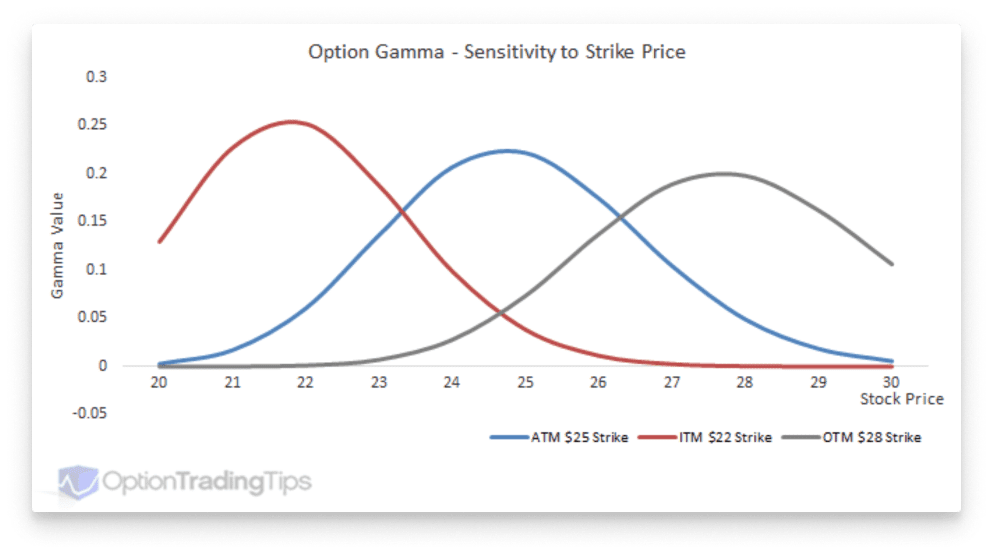

Gamma: The Volatility Catalyst

Gamma quantifies the rate at which Delta changes with respect to the underlying asset price. It serves as a gauge of how the option’s sensitivity to price changes evolves, a valuable tool for anticipating market volatility.

Theta: The Implacable Time Decay

Theta embodies the inexorable march of time, acting as a constant reminder of the value erosion options experience as they approach their expiration date. Understanding Theta allows traders to factor in the element of time decay, a force that shapes the very essence of options trading.

Vega: The Volatility Chameleon

Vega unravels the enigmatic relationship between options prices and volatility. It measures the amount by which an option’s price changes when implied volatility shifts, a crucial consideration for navigating the ever-changing ebb and flow of market sentiment.

Rho: The Interest Rate Dance

Rho unveils the subtle dance between options prices and interest rates. It reveals how options prices sway to the rhythm of interest rate fluctuations, a dance that can alter the calculus of trading decisions.

Harnessing the Power of the Greeks: Crafting Options Strategies

The true power of the Greeks lies not solely in their individual attributes, but in their collective wisdom. By weaving together the insights gleaned from each Greek, traders can craft options strategies that harness the dynamics of risk and reward.

Covered calls, for instance, seek to capture income through selling call options while minimizing risk by holding the underlying asset. Understanding the Greeks ensures that the chosen strike price and expiration align with the trader’s risk profile and market outlook.

Iron condors, on the other hand, embody the art of volatility trading. They leverage the power of multiple Greeks to create a strategy that profits from stable market conditions while limiting risk. Theta and Vega play central roles in this strategy, ensuring that time decay and volatility fluctuations are accounted for.

The Greeks In Options Trading

https://youtube.com/watch?v=KeyZOUAsTyw

Conclusion: The Greeks as a Guiding Light

The Greeks serve as a guiding light in the labyrinth of options trading. By deciphering their intricate language, traders gain the power to unravel the mysteries of option dynamics and make informed decisions. In the ever-evolving landscape of financial markets, the Greeks stand as an indispensable tool, empowering traders to navigate risk and reward with precision.