Embracing the Complexity

In the labyrinthine realm of finance, options trading stands as an enigmatic domain, wielding the power to amplify both gains and risks. At the heart of this intricate world lies a constellation of metrics known as Greeks, each revealing a distinct facet of an option’s behavior and value. Understanding these Greeks is paramount to navigating the turbulence of options trading with precision and confidence.

Image: www.cheddarflow.com

Delta: The Anchor of Direction

Envisioned as the compass needle of options trading, Delta gauges the sensitivity of an option’s price to underlying price fluctuations. A positive Delta signifies that the option price will move in the same direction as the underlying asset, while a negative Delta indicates the inverse. This Greek serves as the foundation for understanding how options react to market dynamics.

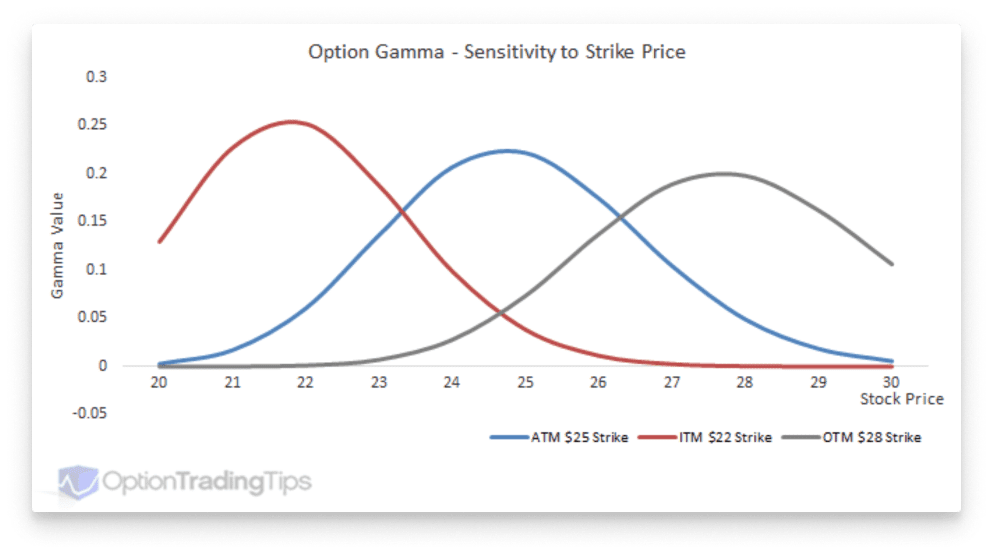

Gamma: The Catalyst for Acceleration

Gamma represents the rate of change in Delta, capturing the sensitivity of an option’s Delta to underlying price movements. A positive Gamma signifies that Delta will increase as the underlying price moves, while a negative Gamma indicates the opposite. Grasping Gamma empowers traders to anticipate and capitalize on price accelerations and decelerations.

Theta: The Timer of Value

In the realm of time, Theta embodies the unavoidable decay of an option’s value as it nears its expiration date. This Greek quantifies the daily rate at which an option loses value due to the dwindling time premium. Managing Theta effectively is crucial for optimizing returns and mitigating losses.

Image: www.avatrade.com

Vega: The Dance with Volatility

Vega measures the sensitivity of an option’s price to implied volatility, the market’s预期 of future price fluctuations. A positive Vega indicates that an option’s price will rise as implied volatility increases, and vice versa. Traders who capitalize on Vega can navigate the capricious winds of market volatility.

Rho: The Interest Rate Interplay

Rho quantifies the impact of interest rate changes on an option’s price. A positive Rho signifies that an option’s price will increase as interest rates rise, while a negative Rho indicates the opposite. Understanding Rho is essential for assessing the impact of monetary policy on option valuations.

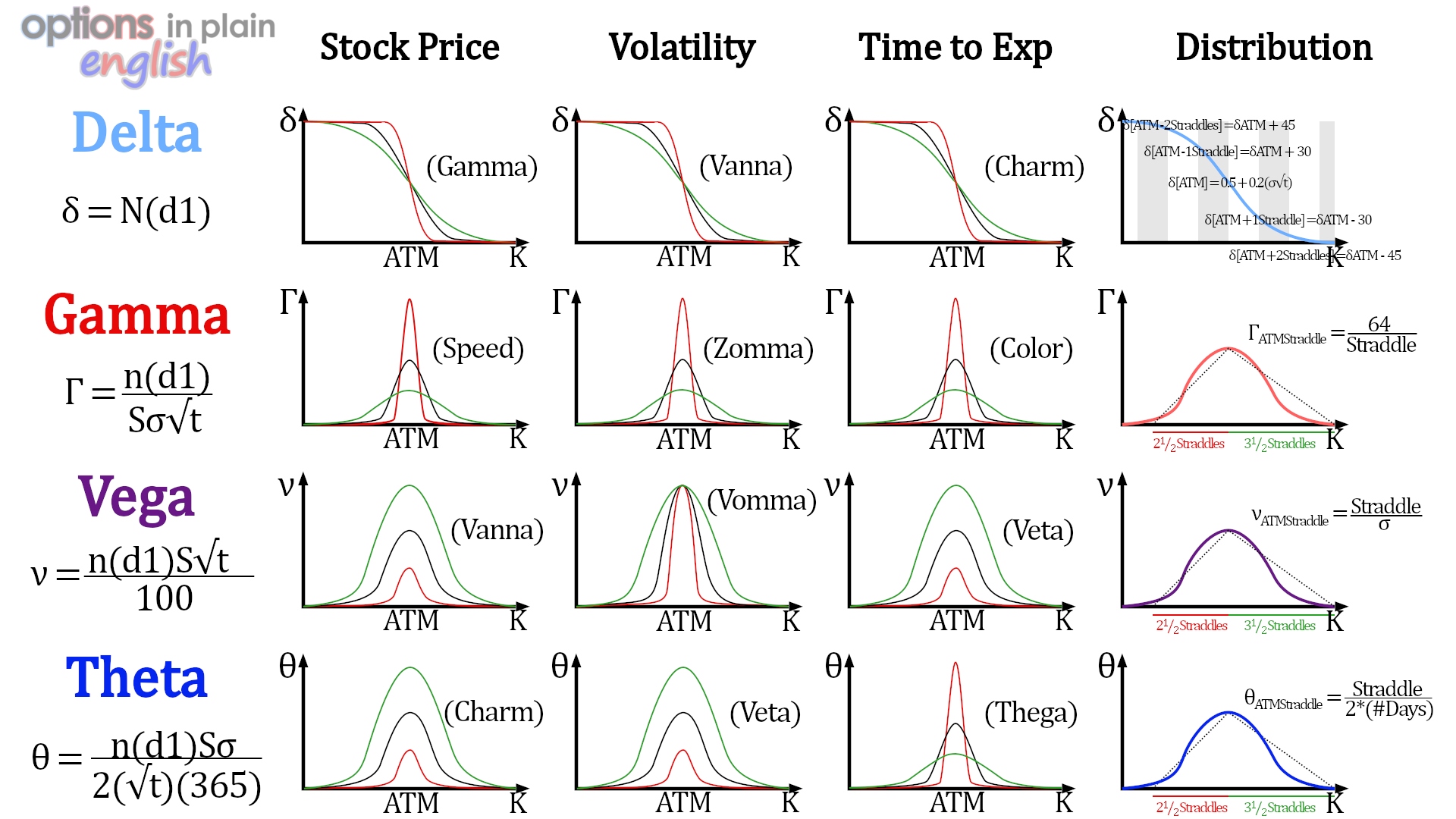

Beyond the Basics: Exploring Advanced Greeks

The realm of Greeks extends beyond these core metrics, encompassing a tapestry of advanced concepts that provide a granular understanding of option behavior. Kappa, Lambda, and Charm delve into the intricacies of Black-Scholes models, revealing the effects of dividend payments, risk-free rates, and price kurtosis on option pricing.

Practical Applications: Mastering the Greeks

Equipped with this arsenal of Greeks, traders can ascend the pinnacle of options trading prowess. By deftly weaving these metrics into their strategies, they can:

-

Fine-tune their hedging strategies by understanding how Greeks influence option sensitivities.

-

Enhance their risk management by quantifying and monitoring potential price movements.

-

Optimize their trading decisions by leveraging Greeks to anticipate and capitalize on market shifts.

What Is A Greek In Options Trading

Image: optionsinplainenglish.com

Embracing the Greek Advantage

Unveiling the enigma of Greeks in options trading unlocks a realm of possibilities and empowers traders with unparalleled precision. By harnessing the power of these multifaceted metrics, traders can conquer the complexities of this enigmatic domain and emerge as masters of the options market.