Imagine being able to make informed decisions about the financial markets, predicting price movements and managing risk like a seasoned trader. Greek options trading empowers you with this ability, unveiling a world of opportunities and insights that can transform your investment strategies.

Image: www.youtube.com

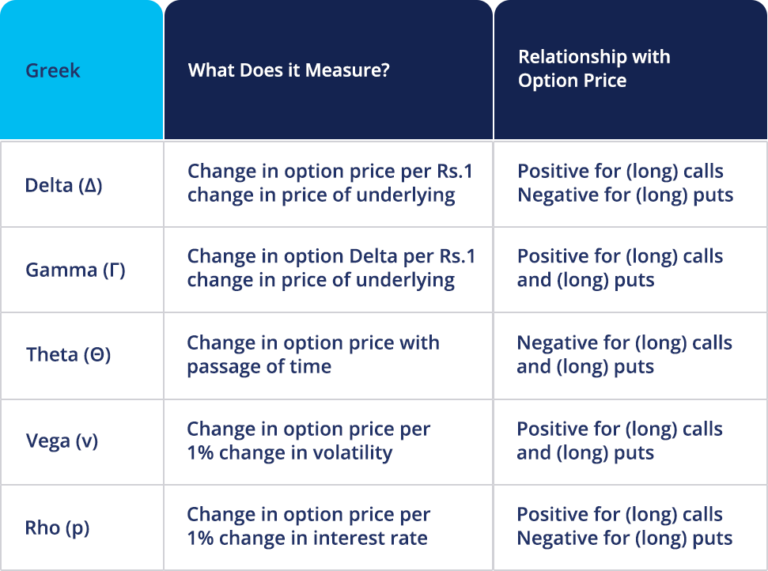

Greek options trading, simply put, is a technique used to measure and analyze the sensitivity of an option’s price to changes in underlying factors. Named after letters in the Greek alphabet – Delta, Gamma, Theta, Vega, and Rho – Greek parameters provide invaluable information about the dynamics of an option contract, allowing traders to make calculated decisions.

Delta: A Gauge of Price Sensitivity

Delta measures the rate of change in an option’s price for every $1 change in the underlying asset’s price. A delta of 0.5 indicates that the option’s price will increase by $0.50 for every $1 increase in the underlying asset’s price. Call options typically have positive deltas, while put options have negative deltas.

Gamma: A Key for Option Position Adjustments

Gamma measures the sensitivity of delta to changes in the underlying asset’s price. A positive gamma indicates that the delta of an option contract will increase as the underlying asset’s price moves in the direction favorable to the option. This knowledge is crucial for option traders who wish to adjust their positions or hedge their risks.

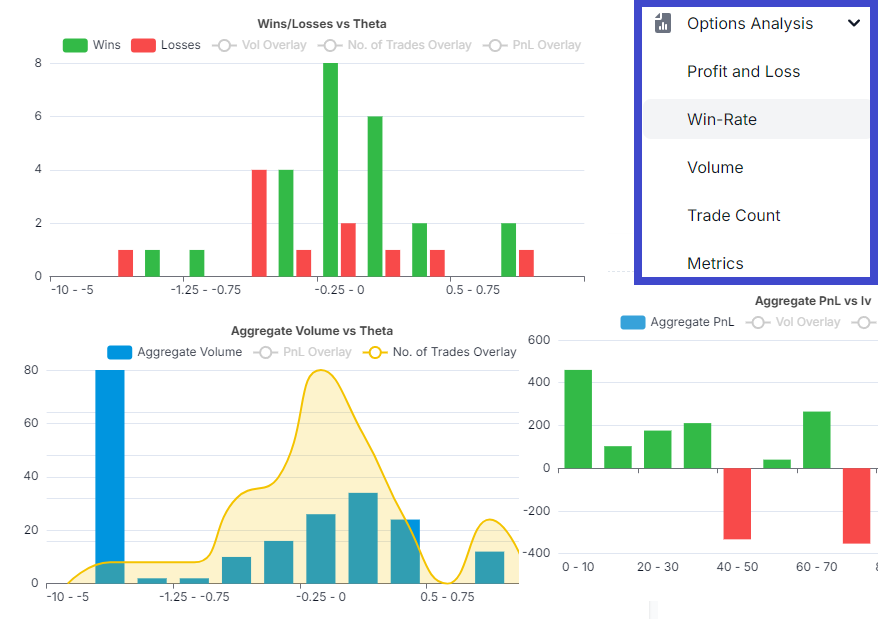

Theta: Time is Money, Measured by Theta

Theta measures the rate of decay in an option’s price as time passes. Time is a fundamental factor in options pricing, as the value of an option erodes as its expiration date approaches. Theta becomes more significant as the option nears its expiration date.

Image: www.tradesviz.com

Vega: Volatility, a Double-Edged Sword

Vega measures the sensitivity of an option’s price to changes in implied volatility. Implied volatility, in turn, reflects market expectations about the future volatility of the underlying asset. High vega can amplify option gains but also magnify losses, making it an instrument of both opportunity and risk.

Rho: Interest Rate and Option Value

Rho measures the sensitivity of an option’s price to changes in interest rates. Interest rate changes affect the cost of carrying an option position, influencing the option’s value. Rho is most relevant for long-term options or those with low strike prices.

The Power of Greek Options Trading

Equipping yourself with the knowledge of Greek options trading empowers you to dissect the nuances of option contracts. By using Greek parameters, you can:

- Assess the risk and reward potential of options strategies

- Identify optimal strike prices and expiration dates

- Hedge your portfolio against market fluctuations

- Develop sophisticated trading strategies

Greek Options Trading

Image: www.paytmmoney.com

Conclusion

Greek options trading is a powerful tool that unlocks the secrets of options pricing and risk management. Understanding and harnessing the power of Greeks empowers traders to make informed decisions, navigate market complexities, and maximize profit opportunities. Whether you’re a seasoned professional or a curious investor, Greek options trading can elevate your financial acumen and open up a world of possibilities in the financial markets. Explore further resources, consult experts, and practice using Greek parameters in real-life trading scenarios to become a master of the options domain.