Unveiling the Process of Closing Options Positions

As an active options trader, I know all too well the importance of closing positions in the options market. This closing process has two distinct methods: selling at close and selling to close. These two terms may appear similar, but their underlying actions are fundamentally different, and it’s crucial to understand the distinction. Today we will dive deep into the concept of “sell at close” and explore what it entails in the world of options trading.

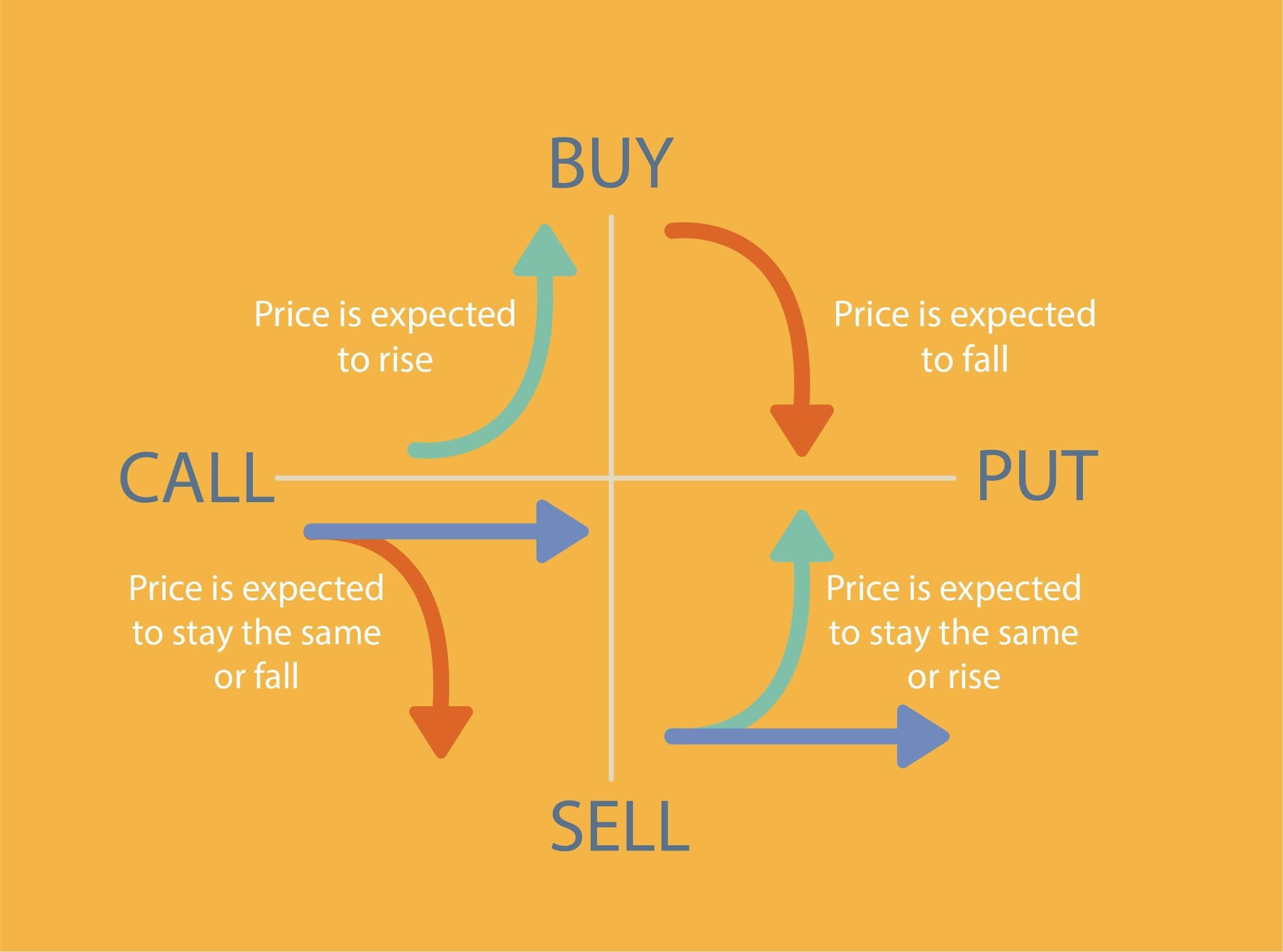

Image: www.markettradersdaily.com

Sell at Close: Defined

“Sell at close” is an order placed at the end of the trading day, with an execution time set for the day’s closing price. Unlike “sell to close,” which involves selling an existing option contract, “sell at close” initiates the creation and immediate sale of a new option contract, effectively establishing a short position in that underlying security.

The Mechanism of Sell at Close Orders

When you place a “sell at close” order, you are essentially selling an option contract that you do not currently own. This means that you are obligated to deliver the underlying security (in the case of a stock option) or the right to buy or sell the underlying security (in the case of an index or commodity option) to the buyer of the option if it is exercised.

Advantages and Disadvantages of Sell at Close Orders

Advantages:

- Sell at close allows you to establish a new option position at the closing price, which can be advantageous if you believe the price will move in a favorable direction.

- It can be used to create spread strategies, where multiple options contracts are bought and sold simultaneously.

Disadvantages:

- Since you are creating a new position, you are taking on additional risk compared to selling to close an existing position.

- Sell at close orders are subject to market volatility, and there is no guarantee that the closing price will be favorable.

Image: www.fool.com

Sell at Close vs. Sell to Close: Clarifying the Difference

The key difference between “sell at close” and “sell to close” lies in the initial position of the trader. “Sell at close” creates a new short position, while “sell to close” closes out an existing long or short position. This distinction is critical for risk management and accurately tracking gains or losses.

Clearing Up Common Misconceptions

One common misconception about “sell at close” is that it guarantees execution at the closing price. While it is likely that the order will be executed close to the closing price, it is not an absolute guarantee. Market conditions can influence the execution price, particularly in volatile markets.

Another misconception is that “sell at close” orders can only be used to close out existing positions. As explained earlier, this is incorrect.

Conclusion

Understanding the concept of “sell at close” is essential for success in options trading. By leveraging this order type strategically, traders can create new positions, adjust existing positions, and potentially profit from market movements. Remember, options trading carries risk, and it is always advisable to consult with a financial professional before making any trades.

Would you like to learn more about options trading? Share your questions in the comments below, and we’ll be happy to provide additional insights.

What Does Sell At Close In Options Trading Mean

Image: voxt.ru

Frequently Asked Questions (FAQs)

- Q: When should I use a “sell at close” order?

- A: Sell at close orders can be used to establish new option positions, create spread strategies, or adjust existing positions.

- Q: What is the difference between “sell at close” and “sell to close”?

- A: “Sell at close” creates a new short position, while “sell to close” closes out an existing long or short position.

- Q: Is there a guarantee that a “sell at close” order will be executed at the closing price?

- A: While it is likely that the order will be executed close to the closing price, there is no absolute guarantee.

- Q: Can I use “sell at close” orders only to close out existing positions?

- A: No, “sell at close” orders can also be used to create new positions.