Imagine this: you’re ready to make a trade, but there’s no one to take the other side. You’re stuck with an asset you can’t sell. Welcome to the world of illiquidity, a nightmare for traders.

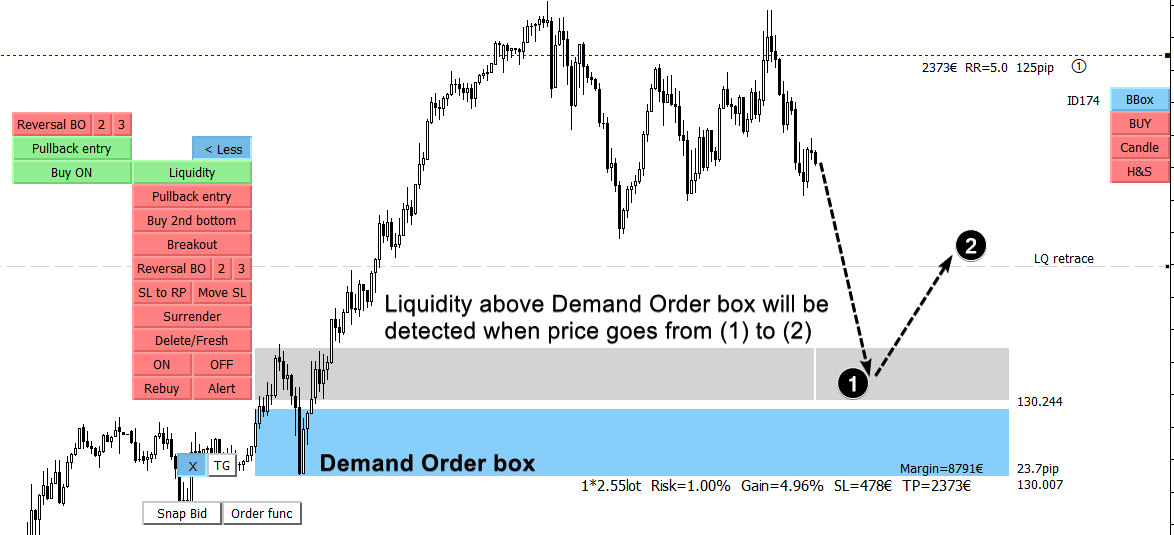

Image: www.mql5.com

In option trading, liquidity is everything. It’s the lifeblood that ensures smooth transactions, allowing you to buy and sell options quickly and efficiently.

What is Liquidity?

Liquidity measures how easily an asset can be bought or sold without significantly affecting its price. In option trading, liquidity refers to the ease with which you can buy or sell an option contract while minimizing slippage and price impact.

Importance of Liquidity

Liquidity brings numerous benefits to option traders:

- Efficient Execution: Highliquidity allows orders to be executed quickly and at a fair price, reducing execution costs and slippage.

- Reduced Risk: Liquidity provides traders with the ability to enter and exit positions quickly, minimizing the risk of adverse price movements.

- Improved Returns: Liquidity facilitates competitive pricing, ensuring traders get the best possible prices on their trades, which can lead to improved returns.

Understanding Liquidity in Options

Liquidity in options trading is primarily determined by three factors:

Image: seventrading.net

1. Market Depth

Market depth refers to the number of orders waiting to execute at different price levels. High market depth indicates a healthy level of liquidity, allowing traders to execute large orders without substantial price impact.

2. Order Flow

Order flow refers to the volume and direction of new orders entering the market. Balanced order flow, where the number of buyers and sellers is roughly equal, contributes to liquidity by facilitating smooth price action.

3. Volatility

Volatility measures the extent of price fluctuations in the underlying asset. High volatility often leads to increased liquidity, as traders are more likely to participate in a market with potential for significant returns.

Latest Trends and Developments

Recent trends and developments are shaping liquidity in options trading:

1. High-Frequency Trading

High-frequency trading (HFT) algorithms have significantly improved liquidity by providing near-instantaneous trade execution and contributing to balanced order flow.

2. Electronic Trading Platforms

Electronic trading platforms have revolutionized option trading, providing centralized marketplaces where traders can access vast liquidity pools and execute orders efficiently.

3. Volatility Management Products

Volatility management products, such as volatility ETFs and derivatives, have gained popularity, allowing traders to manage volatility risk and improve liquidity even in volatile markets.

Expert Tips and Advice

To navigate the liquidity landscape in option trading, consider the following tips and expert advice:

1. Choose Liquid Markets

Focus on trading options with high volume and open interest, as these markets offer greater liquidity. This will reduce the likelihood of execution delays and slippage.

2. Manage Order Size

When placing orders in less liquid markets, it’s crucial to manage the order size carefully. Break large orders into smaller ones to avoid impacting the market price significantly.

3. Use Limit Orders

Limit orders allow traders to specify a specific price at which they want to buy or sell an option. This can help protect against the risk of executing at an unfavorable price due to low liquidity.

Frequently Asked Questions

- Q: Why is liquidity important in option trading?

- Q: What factors affect liquidity in option trading?

- Q: How can I improve my liquidity in option trading?

A: Liquidity ensures efficient trade execution, reduces risk, and improves returns.

A: Market depth, order flow, and volatility significantly influence liquidity.

A: Choose liquid markets, manage order size, use limit orders, and understand the latest trends and developments.

What Is Liquidity In Option Trading

Conclusion

Liquidity is the cornerstone of successful option trading. By understanding liquidity concepts, incorporating expert tips, and staying abreast of industry trends, traders can navigate the liquidity landscape effectively and enhance their trading performance.

Call to Action: Are you interested in delving deeper into the intricacies of option trading? Explore our additional resources and engage with our community to expand your knowledge and maximize your trading potential.