In the fast-paced and dynamic world of options trading, liquidity serves as the very foundation upon which successful transactions are built. Simply put, liquidity refers to the ability to buy or sell an option contract in a timely manner, at a fair price and without any adverse impact on its market value. It’s the lifeblood that ensures a smooth and efficient trading process.

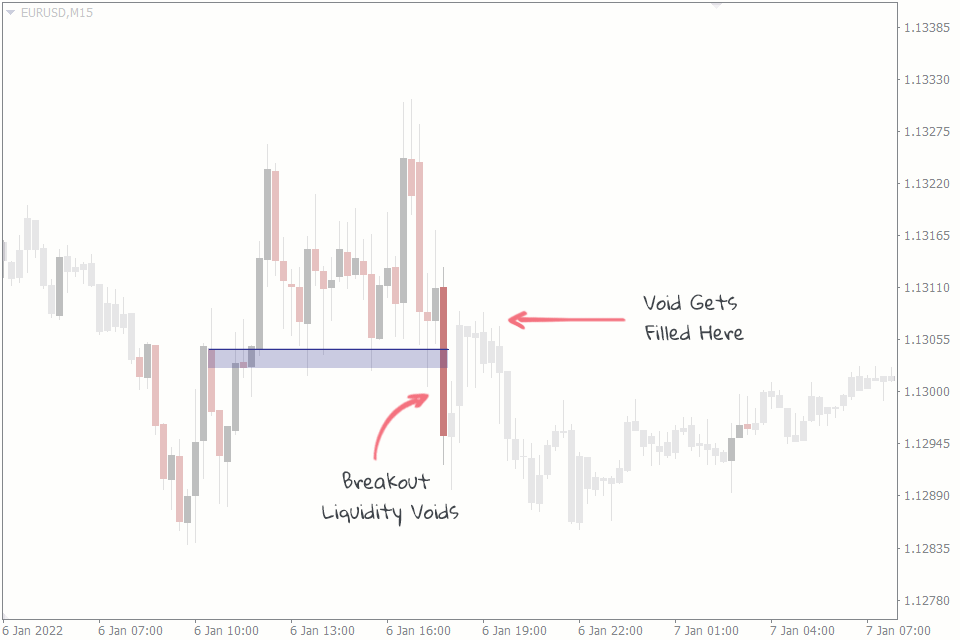

Image: www.youtube.com

Liquidity Explained: An in-Depth Examination

Let’s delve deeper into the intricacies of liquidity in options trading, dissecting its myriad facets and profound implications. At its core, liquidity is determined by two critical factors: market depth and market breadth. Market depth gauges the number of outstanding contracts available for trading at different price levels, indicating the potential volume that can be absorbed by the market without significant price fluctuations. Market breadth, on the other hand, measures the diversity of market participants, encompassing both buyers and sellers, who actively trade within the options market. A market characterized by ample depth and breadth exhibits robust liquidity, enabling traders to execute their strategies seamlessly and efficiently.

Liquidity and Premium Pricing: A Direct Correlation

The liquidity of an option contract directly influences its premium pricing. Options with higher liquidity, characterized by substantial market depth and breadth, typically command lower premiums than their less liquid counterparts. This is attributed to the reduced risk associated with trading highly liquid options. As liquidity increases, the likelihood of finding a counterparty to execute a trade in a timely manner enhances, mitigating the potential for substantial price slippage or execution delays.

Liquidity Assessment: A Critical Step in Trading Strategy

Evaluating the liquidity of an option contract prior to execution is paramount for astute options traders. Several parameters serve as valuable indicators of liquidity:

- Option Volume: High trading volume suggests a deep market, facilitating the execution of large orders without undue market impact.

- Open Interest: Substantial open interest signifies a broad market participation, enhancing liquidity and indicating a sustained level of trading activity.

- Bid-Ask Spread: A narrow bid-ask spread reflects ample market depth, minimizing the price differential between buy and sell orders.

- Historical Volatility: Options with historically high volatility tend to exhibit lower liquidity, as rapid price movements can deter market participants and limit trading activity.

Image: fxssi.com

Liquidity and Options Trading Success: A Winning Combination

Mastering the art of assessing and leveraging liquidity empowers options traders to optimize their trading strategies, mitigating risks and maximizing returns. By prioritizing highly liquid options, traders can execute trades with confidence, minimizing the potential for adverse price movements and ensuring prompt order fulfillment. Moreover, liquidity enhances traders’ flexibility, allowing them to adjust positions swiftly in response to changing market conditions.

Options Trading Meaning Of Liquidity

Image: brokerevaluation.com

Conclusion: Liquidity – A Cornerstone of Options Trading Proficiency

In the realm of options trading, liquidity reigns supreme as a pivotal factor in realizing profitable outcomes. Its importance cannot be overstated, and traders who master the art of identifying and leveraging liquid options gain a significant edge over their peers. By meticulously assessing liquidity metrics and incorporating liquidity considerations into their trading strategies, traders can navigate the often-choppy waters of the options market with greater confidence and enhanced profitability.