In the fast-paced world of financial markets, understanding the importance of liquidity is paramount. It’s the lifeblood of trading, and for options traders, it’s essential to grasp the intricacies of liquidity to maximize their success.

Image: mailgate.kathrynireland.com

What is Liquidity?

Liquidity refers to the ease with which an asset can be bought or sold without significantly impacting its price. A liquid asset quickly converts into cash or another asset without loss of value, making it highly desirable for traders.

The Significance of Liquidity in Options Trading

For options traders, liquidity plays a crucial role in several key areas:

-

Execution: Liquidity ensures that traders can enter and exit trades swiftly and efficiently. Without it, they may struggle to find counterparties to buy or sell their options at their desired price.

-

Pricing: Liquid options markets reflect more accurate supply and demand dynamics. This leads to tighter spreads and fairer pricing, benefiting both buyers and sellers.

-

Risk Management: Liquidity mitigates risk by allowing traders to adjust their positions quickly in response to market movements. This is especially important in volatile markets where sudden price changes can occur.

-

Hedging: Liquid options provide effective hedging tools. Traders can use them to offset the risk of adverse market movements for underlying assets.

Key Factors Affecting Option Liquidity

-

Underlying Asset: The liquidity of the underlying asset (e.g., stocks, commodities, indices) directly impacts option liquidity. The more actively traded the underlying asset, the more liquid its options will be.

-

Strike Price: Options with strike prices close to the current market price of the underlying asset are generally more liquid than those further away.

-

Expiration Date: Options close to expiration tend to be less liquid than those with longer remaining maturities.

-

Volatility: High volatility in the underlying asset increases option liquidity, as traders seek to capitalize on price fluctuations.

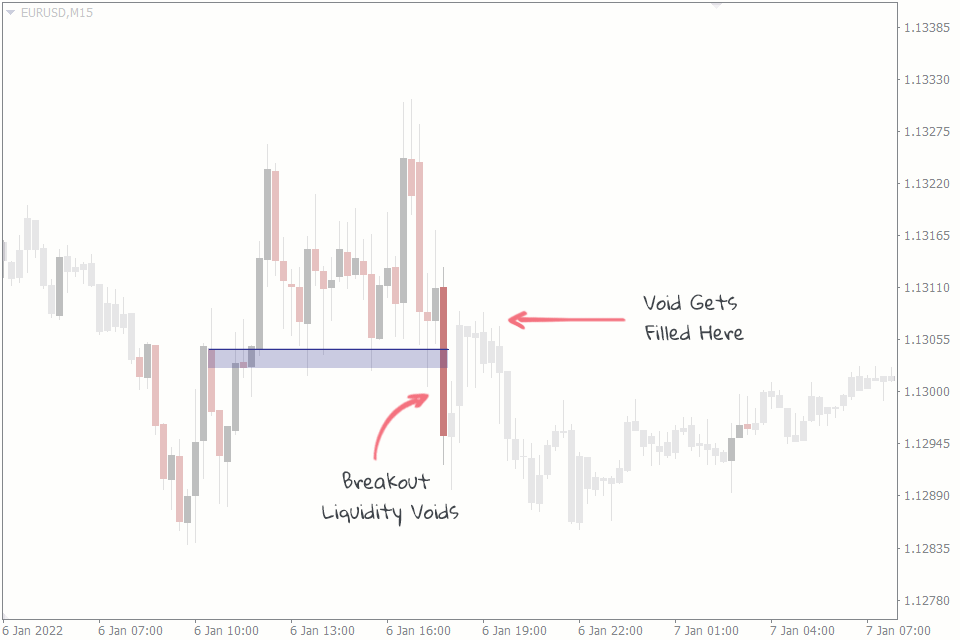

Image: fxssi.com

Strategies to Enhance Option Liquidity

-

Market Depth: Before placing a trade, traders should check the market depth, which indicates the number of orders waiting to be filled at different prices.

-

Order Types: Using limit orders rather than market orders can prevent traders from entering trades at unfavorable prices.

-

Trading During Peak Hours: Market liquidity tends to be higher during normal trading hours. Avoid trading outside these times when liquidity can be limited.

-

Professional Platforms: Trading on regulated exchanges or using reputable brokers with deep liquidity pools improves access to liquid options markets.

Liquidity Of Options Trading

Image: centerpointsecurities.com

Conclusion

Liquidity is an indispensable aspect of options trading. Understanding its significance empowers traders to make informed decisions and enhance their trading strategies. By considering the factors affecting option liquidity and adopting appropriate strategies, traders can maximize their execution efficiency, pricing accuracy, risk management, and hedging capabilities, ultimately leading to greater trading success. As the markets evolve, staying abreast of the latest liquidity trends and leveraging technology to access deeper liquidity pools will give traders a significant competitive advantage.