The realm of financial markets is a never-ending dance of numbers, where the ebb and flow of money dictate the rise and fall of fortunes. Among the many fascinating aspects of this intricate symphony of capital is the concept of options trading, a realm where traders and investors seek to predict and profit from market movements. One crucial aspect of options trading is volume, which signifies the number of contracts bought and sold within a specific time frame. In this multifaceted article, we will embark on a deep dive into the significance of options trading volume by exchange, shedding light on its impact on market dynamics and exploring strategies to leverage this valuable information.

Image: mybroadband.co.za

Options Trading Volume by Exchange: A Fundamental Indicator

Options contracts, by their very nature, bestow upon their holders the right but not the obligation to buy (in the case of call options) or sell (in the case of put options) underlying assets at a predetermined price on or before a specified date. The total number of these contracts traded within a given timeframe constitutes the options trading volume. This volume plays a pivotal role in discerning market sentiment and gauging the strength of a particular trend. Moreover, it serves as an indispensable tool in evaluating the liquidity of an options market, indicating the ease with which contracts can be bought or sold.

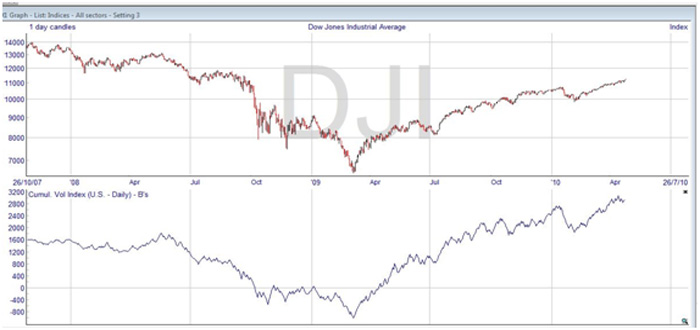

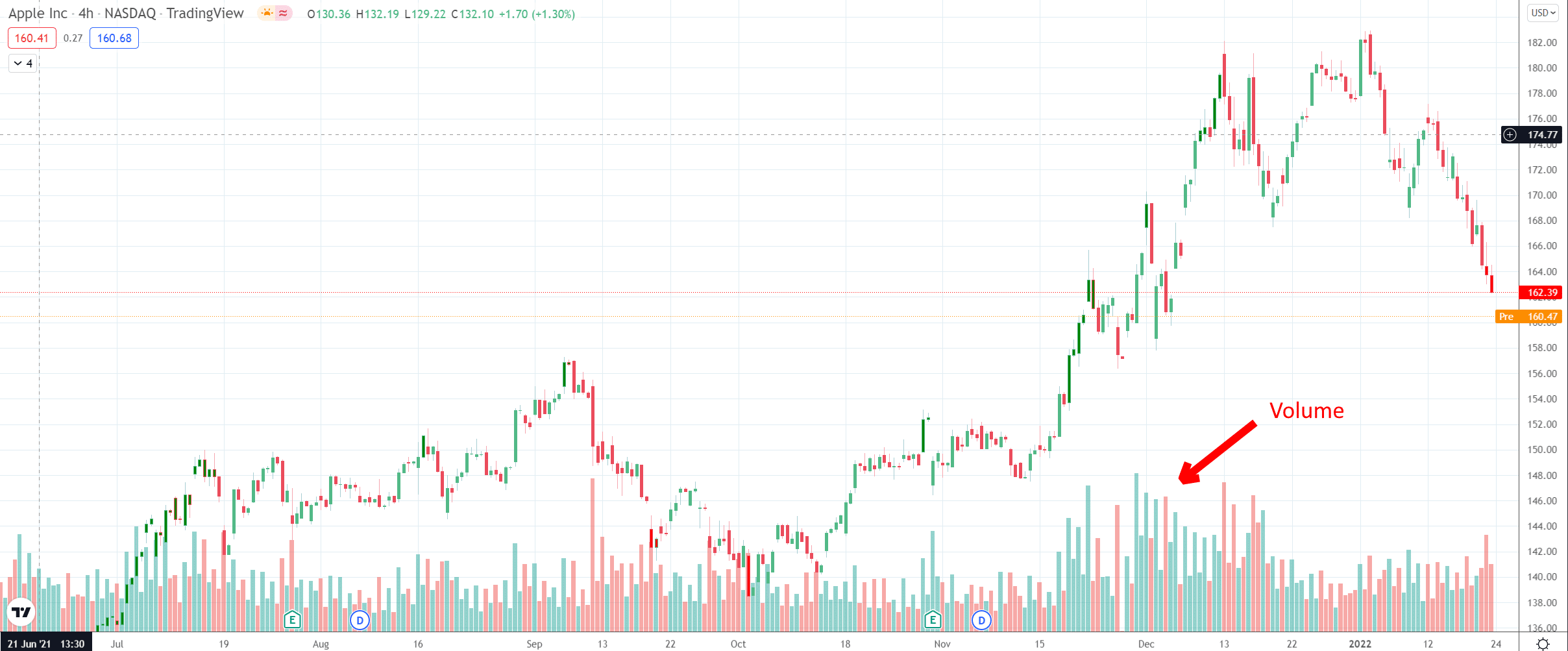

Volume is particularly significant when conducting technical analysis, the art of using historical price data to forecast future market behavior. Traders often analyze volume in conjunction with price action to validate and refine their trading decisions. For instance, a surge in volume accompanying a breakout from a trading range typically suggests that the move is more likely to continue, as it signifies the participation of a larger number of market participants. Conversely, a notable increase in volume during a period of consolidation or sideways movement may signal that a trend reversal is imminent and warrants cautious consideration.

Understanding Exchange-Specific Volume Dynamics

While the aggregate options trading volume provides valuable insights, it is equally important to examine volume data on an exchange-specific basis. Different exchanges often exhibit unique characteristics and attract diverse sets of traders, resulting in disparities in trading volume and market behavior.

Exchanges that cater to retail traders, such as TD Ameritrade or Robinhood, tend to have higher volumes in smaller, speculative contracts. This is because retail traders often engage in short-term trading strategies and may prioritize factors such as liquidity and ease of entry over long-term fundamentals.

On the other hand, exchanges like the Chicago Board Options Exchange (CBOE) and the International Securities Exchange (ISE) witness substantial volumes in larger, more complex contracts. These exchanges are favored by institutional investors and professional traders, who typically employ sophisticated trading strategies and focus on long-term market dynamics.

Identifying exchanges with the highest volume for specific underlying assets can provide valuable insights. For example, if you intend to trade options on Apple stock, examining volume data from exchanges where Apple options are actively traded, like CBOE or NASDAQ, will provide a clearer picture of market sentiment and liquidity.

Unveiling the Impact of Volume on Option Premiums

Option premiums, the price paid to purchase an options contract, are directly influenced by trading volume. As volume increases, so does liquidity and, consequently, the bid-ask spread (the difference between the highest price a buyer is willing to pay and the lowest price a seller is willing to accept) tends to narrow. This is because a larger number of participants in the market leads to more efficient pricing and reduced transaction costs.

For instance, if the daily trading volume of a specific options contract is typically 5,000 contracts but suddenly spikes to 20,000 contracts, the bid-ask spread may narrow from 0.20 to 0.15. This reduction in the spread signifies increased liquidity and facilitates more favorable entry and exit points for traders.

Image: www.financial-spread-betting.com

Options Trading Volume By Exchange

Image: www.publicfinanceinternational.org

Leveraging Volume Data for Strategic Options Trading

Astutely utilizing options trading volume by exchange can significantly enhance trading strategies and improve decision-making. Here are several actionable tips:

-

Identify High-Volume Exchanges: Focus on exchanges that consistently exhibit substantial volume in the options you intend to trade. This will ensure optimal liquidity and minimize execution risks.

-

Scrutinize Volume Trends: Analyze volume changes over time to gauge market sentiment and potential shifts in trend. A sustained increase in volume may suggest a breakout or reversal is underway, while declining volume could indicate a period of consolidation or trend exhaustion.

-

Correlate Volume with Price Action: Combine volume analysis with price action to refine trading decisions. For example, a breakout accompanied by escalating volume has a higher probability of success than a breakout with dwindling volume.

-

Assess Volume Profiles: Construct volume profiles by plotting volume at different price levels. This technique can reveal areas of support and resistance, as well as potential points of trend reversal.

-

Consider Open Interest: In conjunction with volume, monitor open interest, which represents the number of outstanding contracts. High open interest in combination with high volume indicates strong institutional participation and reinforces trend continuation.

In conclusion, options trading volume by exchange is a multifaceted indicator that unveils valuable market dynamics and provides crucial insights for successful trading decisions. By comprehending the intricacies of volume analysis, traders can navigate the ever-shifting landscape