Introduction

In the ever-evolving landscape of financial markets, astute investors seek strategies that offer both profit potential and tailored risk management. One such avenue is the realm of commodity options trading, a sophisticated approach that empowers traders with the ability to navigate the complexities of commodity markets. Understanding and implementing an effective commodity options trading strategy is paramount for capitalizing on market movements and safeguarding investments.

Image: www.schaeffersresearch.com

Delving into Commodity Options

Commodity options, unlike their equity counterparts, derive their value not from shares of companies but rather from underlying physical commodities such as oil, gold, or wheat. These contracts grant traders the right, but not the obligation, to buy (call option) or sell (put option) a specific quantity of a commodity at a predetermined price (strike price) on or before a specified date (expiration date). This flexibility provides traders with immense power to mitigate risk and enhance returns.

Unveiling the Mechanics

Exercising an option contract involves paying a premium to the contract seller in exchange for the underlying commodity at the strike price upon expiration. By understanding supply and demand dynamics, traders can leverage call options to capitalize on anticipated price increases or employ put options to hedge against potential price decreases. Conversely, selling options involves receiving a premium from the contract buyer while carrying the obligation to deliver the commodity if the option is exercised.

Strategic Considerations

Mastering a successful commodity options trading strategy requires careful consideration of several key factors. The selection of the underlying commodity is crucial, as each commodity exhibits unique supply and demand characteristics and price volatility. Furthermore, the strike price and expiration date must be meticulously chosen to align with market expectations. Additionally, understanding the pricing mechanisms behind options, such as Black-Scholes models, can aid in informed decision-making.

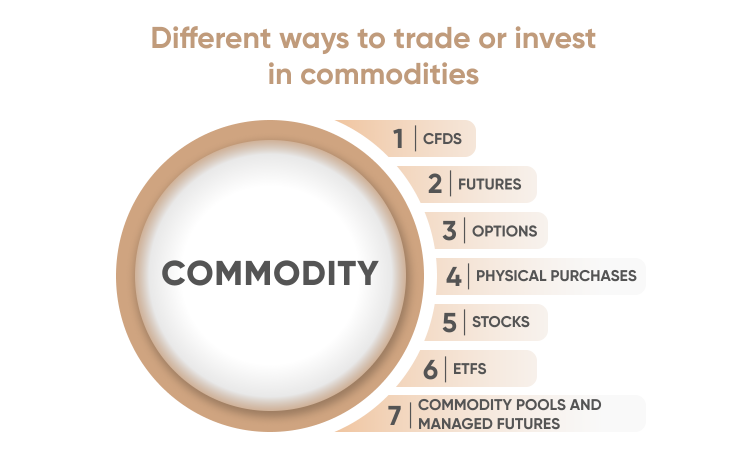

Image: capital.com

Risk Management Imperative

While commodity options trading holds the promise of substantial gains, it’s imperative to acknowledge and effectively manage the inherent risks associated with the strategy. Market volatility, geopolitical events, and macroeconomic factors can significantly impact commodity prices, potentially leading to losses if not properly managed. Implementing stop-loss orders, diversifying investments, and hedging against price fluctuations are prudent risk management practices.

Harnessing Technical Tools

In navigating the complexities of commodity options trading, technical analysis plays a vital role. By interpreting historical price charts and identifying patterns, traders can perceive market trends and formulate more informed trading decisions. Utilizing indicators such as moving averages, Bollinger Bands, and candlestick patterns can assist in gauging momentum, volatility, and support and resistance levels.

Real-World Applications

The versatility of commodity options extends beyond theoretical concepts, finding practical applications in a host of investment scenarios. Investors seeking income generation can opt for covered calls, while those wishing to hedge against downside risk may deploy protective puts. Fund managers aiming to enhance portfolio returns can incorporate commodity options into their asset allocation strategy.

Stay Updated and Informed

With the rapid evolution of financial markets, continuous education is paramount for thriving in the world of commodity options trading. Regularly accessing industry publications, attending webinars, and monitoring market news are effective means of staying abreast of the latest developments, trends, and analysis.

Commodity Options Trading Strategy

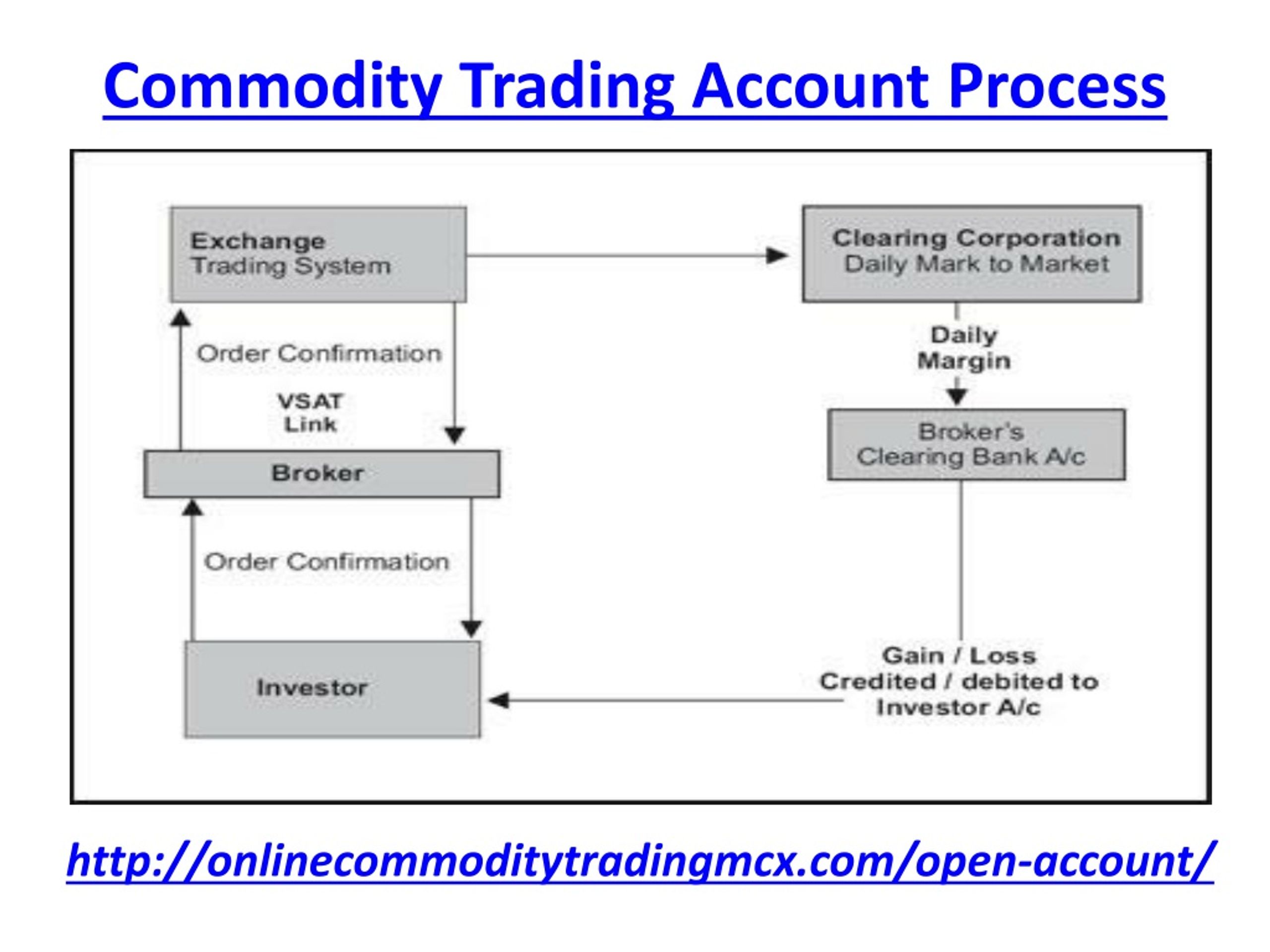

Image: www.slideserve.com

Conclusion

Embarking on commodity options trading empowers traders with an array of opportunities to profit from commodity price fluctuations while managing risk prudently. By comprehending the intricacies of this strategy, incorporating technical tools, and applying effective risk management techniques, traders can navigate the dynamic world of commodity markets with increased confidence and proficiency. Remember, as with any investment strategy, there are inherent risks involved, so thorough research and a deep understanding of the concepts are essential for successful execution.