Are you ready to dive into the thrilling world of options trading? Allow us to unveil the secrets of one touch options trading strategies, a powerful tool for both seasoned traders and aspiring market enthusiasts.

Image: www.forexof.com

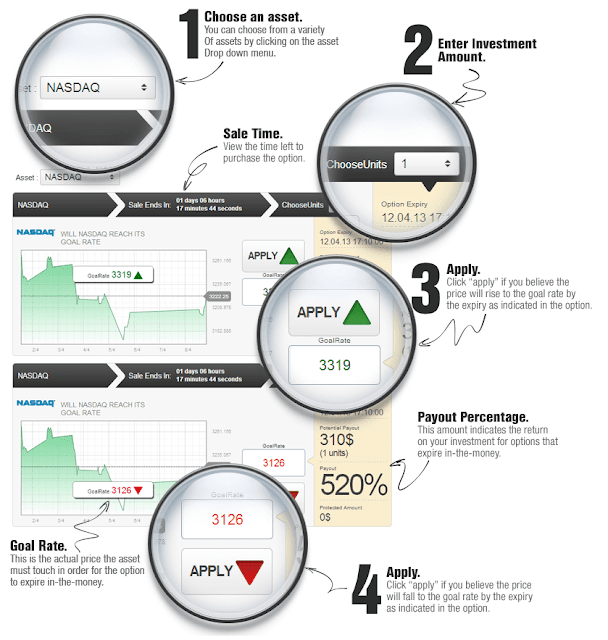

One touch options, also known as binary options, offer a unique way to capitalize on market movements. Unlike traditional options that provide the right but not the obligation to buy or sell an underlying asset, one touch options are binary in nature, meaning they pay out a fixed amount if the underlying asset touches a specified price level before the option expires. This characteristic makes them an attractive proposition for traders seeking high-probability, time-bounded trades.

Delving into the Mechanics

One touch options come in two flavors: call one touch and put one touch. Call one touch options pay out if the underlying asset climbs above a predetermined price (strike price) at any point before the expiration, while put one touch options reward traders if the underlying asset falls below the strike price.

The allure of one touch options lies in their simplicity and potential for substantial returns. However, it’s crucial to remember that they are all-or-nothing propositions, meaning either you collect the payout or lose the entire investment. To mitigate potential losses and increase your chances of success, a strategic approach is paramount.

Harnessing Advanced Strategies

The world of one touch options trading strategies is vast and complex, but certain approaches stand out for their effectiveness:

Horizontal One Touch: This strategy involves buying both a call and a put one touch option with the same strike price. If the underlying asset touches the strike price before the expiration, you profit regardless of the direction of the move.

Bull Call One Touch: For those who believe an uptrend is on the horizon, this strategy entails buying a call one touch option at or slightly above the current market price. Profit is made if the asset ascends to the strike price before the expiration.

Bear Put One Touch: Conversely, this strategy is suited for those expecting a downtrend. Buying a put one touch option at or slightly below the current market price can yield profit if the underlying asset retreats to the strike price before the expiration.

Navigating the Market Landscape

Before embarking on your one touch options trading journey, arm yourself with a thorough understanding of the market landscape:

Identify Key Price Levels: Determine the critical price levels that the underlying asset is likely to test. This analysis should consider technical indicators, market news, and economic data.

Assess Volatility: Volatility plays a significant role in one touch options pricing. Higher volatility typically translates into higher premiums but also increased risk.

Manage Risk: Options trading involves inherent risk, so it’s imperative to manage it effectively. Consider position sizing, stop-loss orders, and diversification strategies.

Image: www.scribd.com

One Touch Options Trading Strategies

Image: www.topratedforexbrokers.com

Unlocking the Potential

One touch options trading strategies offer a unique blend of potential profits and heightened risks. To reap the rewards while mitigating losses, embrace a balanced approach:

Start Cautiously: Begin with small trades to gain experience and refine your strategies. Gradually increase your investment as you develop confidence and expertise.

Embrace a Disciplined Approach: Stick to your trading plan and avoid emotional decision-making. Predefine your entry and exit points and adhere to them to maintain discipline.

Seek Continuous Learning: The financial landscape is ever-changing, so stay abreast of the latest market trends and emerging strategies. Educational resources, webinars, and market analysis platforms can be invaluable tools for your journey.

By grasping the intricacies of one touch options trading strategies and implementing them with precision, you can turn this powerful tool to your advantage. Embrace the thrill of the chase, capitalize on market fluctuations, and navigate the exhilarating realm of options trading.