Introduction

Have you ever pondered the allure of financial markets yet hesitated due to the perceived complexities? Allow me to introduce you to the fascinating realm of no touch option trading, a strategy that empowers beginners to navigate the markets with ease and confidence.

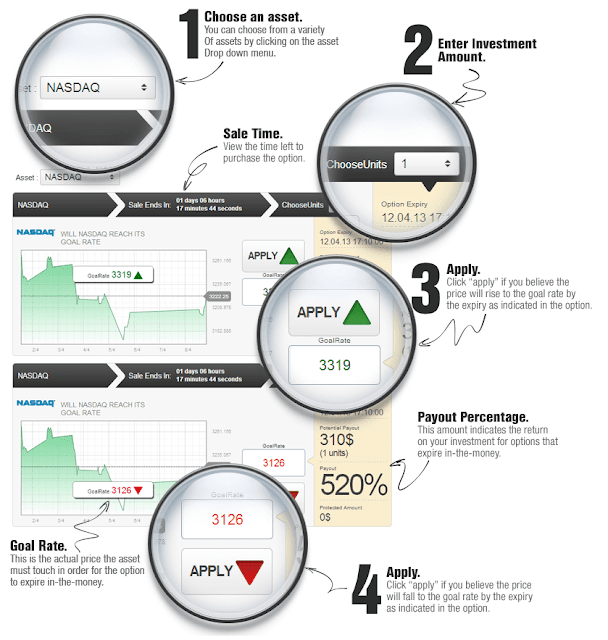

Image: payspacemagazine.com

Unveiling the world of options trading can be likened to embarking on an adventurous journey. Options, akin to blueprints, offer the potential to shape financial outcomes by granting the holder the right, not the obligation, to buy or sell an underlying asset at a predetermined price within a specified time frame. No touch options stand out as a unique breed, offering a simplified approach to this captivating domain.

No Touch Options: A Primer

Envision a financial tightrope walker, meticulously balancing on a taut cord strung between two towering pillars. No touch options embody this precarious equilibrium, with their value hinging upon the underlying asset’s price action remaining within predefined boundaries. Should the asset’s price venture outside these boundaries, the option’s value plummets to zero, akin to the tightrope walker losing their footing.

No touch options present a duality of flavors: *up-and-in* and *down-and-in*. Up-and-in options flourish when the underlying asset’s price ascends above a predefined ceiling, while down-and-in options bask in the glory of prices descending beneath a predetermined floor.

The Art of No Touch Option Trading

Mastering the art of no touch option trading requires a nimble mind and a keen eye for market nuances. Begin by establishing a solid foundation in options trading principles, understanding the mechanics of premiums and expiration dates. Armed with this essential knowledge, you can delve into the intricacies of no touch strategies.

Prudent selection of underlying assets is paramount. Seek assets with stable price histories and well-defined trading ranges. Embracing a meticulous approach to research and analysis will empower you to identify opportune trading scenarios. Patience, the hallmark of successful traders, is your indispensable ally. Remember, no touch options thrive on the underlying asset’s adherence to predetermined boundaries. Exercise patience, allowing time to unfold its magic.

Tips and Expert Insights

Emulating seasoned traders can accelerate your path to no touch option trading mastery. Consider employing expert guidance to refine your strategies and enhance your decision-making process. Seek out mentors, attend webinars, and delve into specialized literature to expand your knowledge horizons.

Embrace a proactive approach to risk management, meticulously assessing potential risks and implementing appropriate mitigation strategies. Employ stop-loss orders as your trusty companions, safeguarding your capital from unforeseen market gyrations.

Image: www.youtube.com

FAQs on No Touch Option Trading

Q: How do I determine the optimal strike price for a no touch option?

A: Careful analysis of the underlying asset’s historical price movements and volatility is essential for selecting an appropriate strike price.

Q: What factors should I consider when setting the boundaries for a no touch option?

A: Technical analysis, including support and resistance levels, can provide valuable insights when establishing boundaries.

Q: How does time decay affect no touch options?

A: Time is the inexorable foe of all options, eroding their value as expiration approaches. This effect is particularly pronounced in no touch options, emphasizing the importance of precise timing.

No Touch Option Trading

Image: www.forexof.com

Conclusion

No touch option trading unbolts the doors to financial empowerment for aspiring traders. By embracing the principles outlined in this guide and continuously honing your skills, you can navigate the markets with newfound confidence. Embrace the thrill of trading and forge your own path to financial success.

Are you ready to embark on this captivating journey into the realm of no touch option trading? Let your curiosity guide you as you delve deeper into the world of financial markets.