Understanding the Dance of the Financial Markets

In the vibrant tapestry of financial markets, stocks and options weave an intricate dance, where trading volume data unveils a hidden dialogue. Understanding this interrelation is akin to wielding a maestro’s baton, allowing traders to navigate the complexities and seize opportunities in this dynamic realm. Delving into the interplay of stock and options market trading volume, we embark on a journey to unravel the secrets and harness its power.

Image: www.axi.group

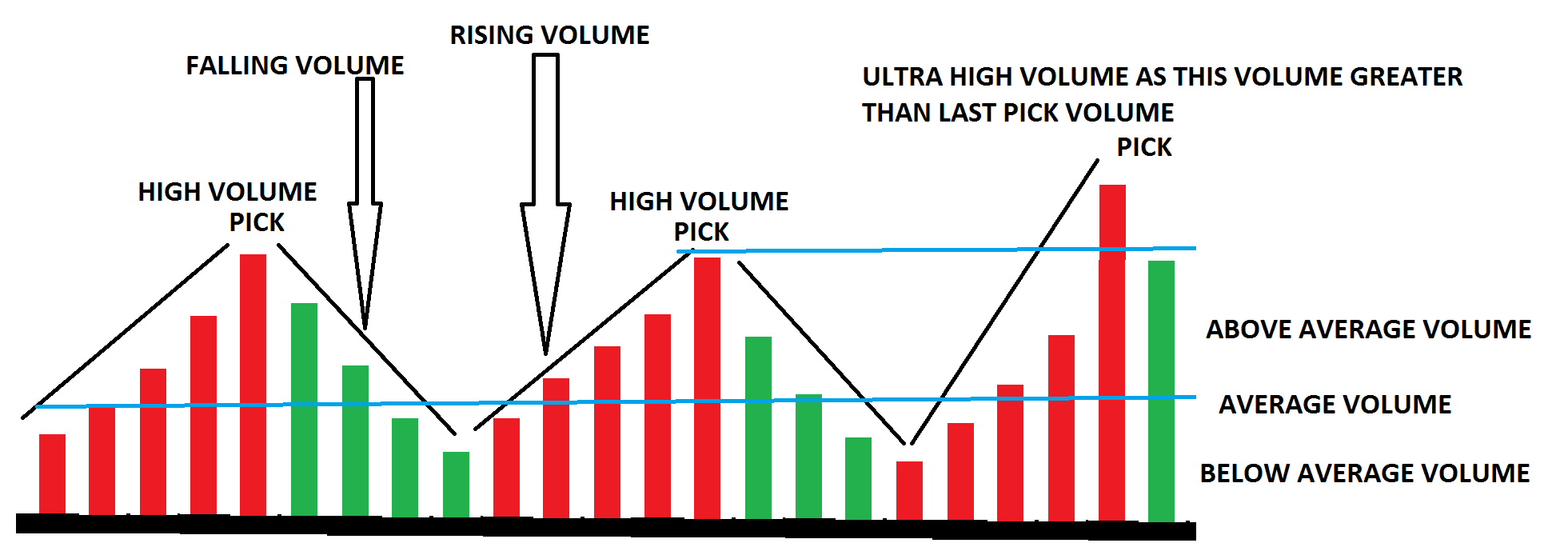

Volume as the Pulse of Market Sentiment

Trading volume, the lifeblood of markets, pulsates with the collective actions of investors. Each transaction, whether a stock purchase or an options contract, reflects a sentiment, a desire, or a decision made by market participants. By studying volume patterns, traders can decipher the underlying emotions and intentions that shape market movements.

Stock Volume: A Mirror of Market Momentum

Stock volume reflects the intensity of buying and selling activity, providing insights into the underlying momentum. High volume during uptrends signifies a surge in buying pressure, driving prices higher. Conversely, elevated volume during downtrends signals increased selling, amplifying the decline. Volumenomics, a coveted skill in technical analysis, empowers traders to identify market reversals and potential price breakouts.

Options Volume: A Delineator of Sentiment

Options volume, on the other hand, offers a nuanced understanding of market sentiment. Traders use options as tools to manage risk and speculate on future price movements. The volume of options traded on a particular strike price reveals the market’s expectations for the underlying stock. Whether traders buy or sell options speaks volumes about their optimism or pessimism.

Image: soakploaty.blogspot.com

The Interrelation: A Symphony of Signals

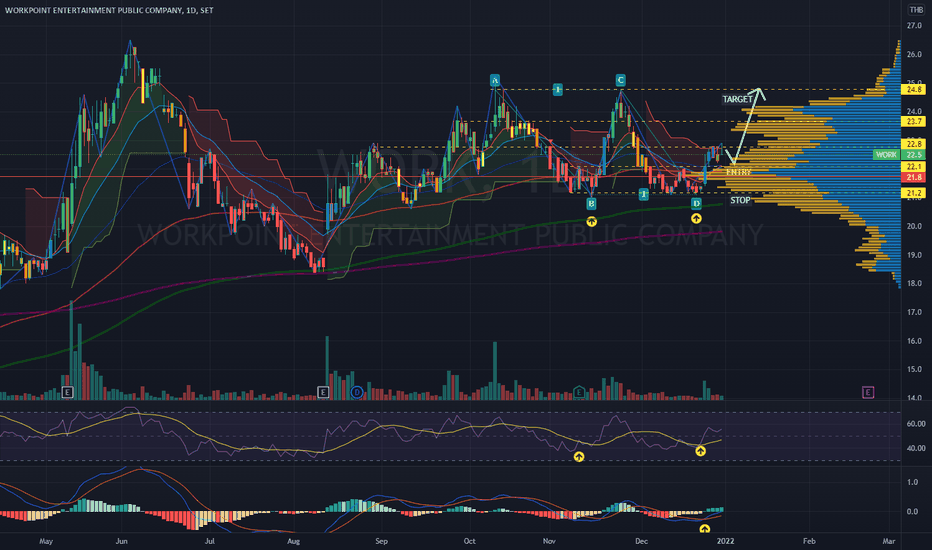

The true power lies in understanding how stock and options volume data interact. When stock volume and options volume align, it’s a sign of strong conviction among investors. High stock volume with elevated call option volume indicates bullishness, while substantial volume in put options alongside declining stock volume suggests bearish expectations. However, when stock volume and options volume diverge, it unveils an undercurrent of uncertainty or a potential shift in market sentiment.

Practical Applications for Traders

This interrelationship offers traders an edge in making informed trading decisions. For instance, when stock volume spikes while options volume remains steady, it could indicate a temporary dip that traders can use as a buying opportunity. Conversely, if stock volume declines sharply with increasing options volume, caution is warranted, as it may signal an impending reversal.

The Interrelation Of Stock And Options Market Trading Volume Data

Image: ar.inspiredpencil.com

Conclusion: Unlocking Market Insights

The interplay of stock and options market trading volume data is a treasure trove of market insights for traders. By deciphering the language of volume, investors can gain a deeper understanding of market sentiment, identify potential turning points, and make strategic trading decisions. Embracing this knowledge is like mastering an instrument in the financial symphony, empowering traders to navigate the markets’ ebb and flow with precision and finesse.