Have you ever wondered what the flurry of activity in the options market signals, or what insights can be gleaned from the sheer volume of contracts traded? Understanding options trading volume goes beyond just numbers on a screen; it’s a window into the minds of market participants, revealing their expectations, strategies, and potential future price movements.

Image: www.nyse.com

Options trading volume, simply put, represents the number of contracts bought and sold for a particular underlying asset within a specific timeframe. It’s a powerful data point that can be used to gauge market sentiment, identify potential trends, and even predict future price movements. This article will delve deep into the world of options trading volume, exploring its significance, its various applications, and how you can leverage this data to enhance your trading decisions.

Unveiling the Significance of Options Trading Volume

The Language of Market Sentiment

One of the most valuable aspects of options trading volume is its ability to gauge market sentiment. High volume often implies a strong conviction among traders, whether bullish or bearish. For instance, a surge in call options volume suggests a belief that the underlying asset’s price will rise, while a spike in put options volume indicates a bearish sentiment. This information can be invaluable for traders looking to align their positions with the prevailing market sentiment.

Identifying Emerging Trends and Patterns

Options trading volume can also illuminate emerging trends and patterns in the market. Observing periods of consistent high volume in specific options contracts can be a sign of a developing trend. Conversely, a sudden drop in volume might indicate a potential shift in sentiment or a weakening trend.

Image: www.optiontradingtips.com

Estimating Potential Volatility

Options contracts derive their value from the underlying asset’s volatility. High options trading volume often accompanies periods of elevated volatility, as traders seek to capitalize on price fluctuations. By closely monitoring volume shifts, traders can get a sense of the potential for price fluctuations in the future.

Exploring Options Trading Volume in Action

The Case of Earnings Announcements

Earnings announcements are often accompanied by significant spikes in options trading volume. This is because traders anticipate the potential for large price swings, particularly if the company’s earnings deviate from expectations. Analyzing the volume of call and put options surrounding an earnings announcement can provide valuable insights into the market’s expectations for the company’s performance.

Volatility and the VIX Index

The VIX index, a popular gauge of market volatility, is closely correlated with options trading volume. When the VIX rises, indicating heightened volatility, options trading activity tends to increase as traders seek to hedge their positions or profit from price swings. This correlation can be a useful tool for understanding the relationship between volatility and options trading volume.

Options Volume and Insider Trading

Options trading volume can sometimes be a leading indicator of insider trading activity. Unusual spikes in volume for specific options contracts, particularly close to a company announcement, could signal insider knowledge of an upcoming event. While not conclusive evidence, this information can be a starting point for further investigation.

Navigating the Nuances of Options Trading Volume

Open Interest and Volume

While options trading volume is important, it’s crucial to consider open interest alongside it. Open interest represents the total number of outstanding contracts for a particular options contract. High open interest coupled with high volume suggests a strong conviction in the market, while low open interest with high volume might indicate short-term speculation.

The Challenge of Interpreting Volume

Interpreting options trading volume is not always straightforward. Market participants can employ various strategies, and volume data alone doesn’t provide the complete picture. Analyzing volume in conjunction with other indicators, such as price action, sentiment data, and news events, is key to gaining a comprehensive understanding of the market.

Technological Advancements and Data Accessibility

The availability of sophisticated trading platforms and real-time data feeds has made it easier for traders to access and analyze options trading volume. This increased accessibility has democratized access to this valuable information, empowering individual investors to make more informed trading decisions.

Options Trading Volume: A Powerful Tool for Informed Trading

Options trading volume is a powerful tool for navigating the dynamic world of options trading. By understanding its significance, exploring its diverse applications, and mastering the nuances of its interpretation, traders can gain a significant edge in the market. By combining insights from volume data with other indicators and sound trading strategies, traders can potentially improve their decision-making, navigate market sentiment, and identify opportunities for profitable trades.

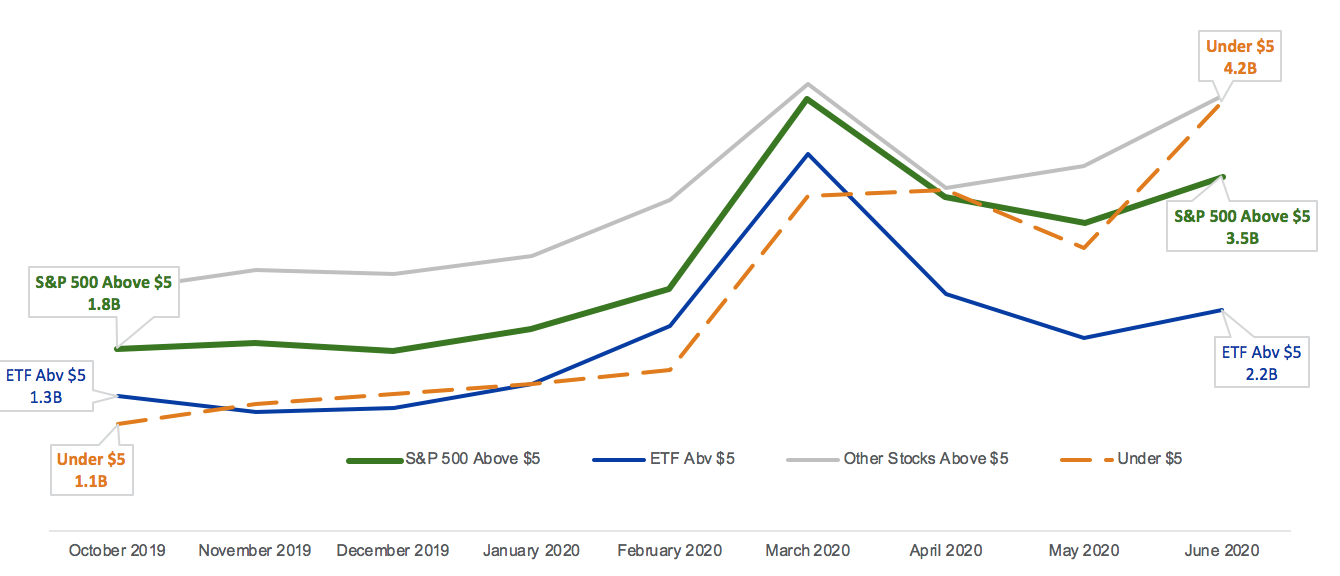

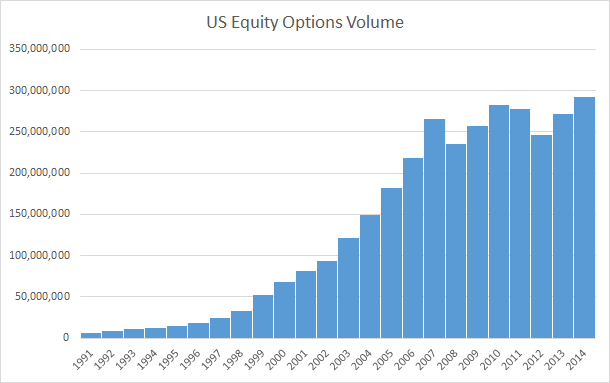

Options Trading Volume Statistics

Call to Action:

Now that you’ve delved into the world of options trading volume, we encourage you to continue exploring this fascinating aspect of the market. Share your thoughts and experiences in the comments below! The more we delve into this topic, the more valuable insights and strategies we can uncover together.