Introduction:

For those venturing into the intricate world of options trading, the concept of the strike price is paramount. Like a beacon guiding navigators through uncharted waters, the strike price provides a crucial reference point for navigating the complexities of this dynamic market. In this comprehensive article, we embark on a journey to enlighten investors on the enigmatic nature of the strike price, unlocking its significance and unraveling its impact on option trading strategies.

Image: www.youtube.com

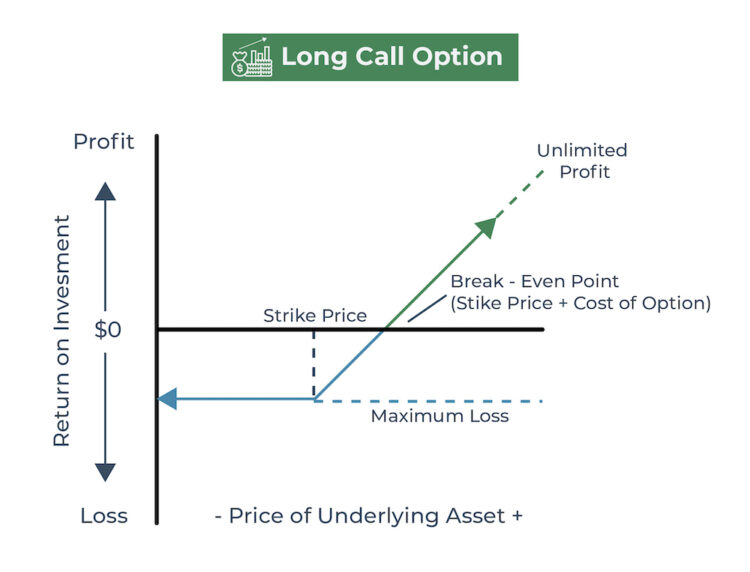

At the heart of options trading lies a fundamental principle: the ability to speculate on the future price movements of an underlying asset, such as a stock or commodity. Options contracts, the lifeblood of this thriving market, confer the right, not the obligation, to buy (in the case of call options) or sell (in the case of put options) the underlying asset at a predetermined price, known as the strike price, on or before a specific date known as the expiration date.

Defining the Strike Price:

The strike price acts as a pivotal threshold, serving as a benchmark against which the price movement of the underlying asset is measured. For call options, if the underlying asset price surpasses the strike price, the option has “intrinsic value,” representing the profit potential should the option be exercised immediately. Conversely, for put options, intrinsic value arises when the underlying asset price dips below the strike price.

As the expiration date approaches, time value, another critical component of option pricing, enters the equation. Time value reflects the remaining lifespan of the option contract, and its impact diminishes steadily until the expiration date, when it evaporates entirely. The interplay between intrinsic value and time value determines the overall value of an option contract.

Types of Strike Prices:

The world of option trading offers a vast array of strike prices to cater to diverse trading strategies. In-the-money (ITM) options boast an intrinsic value at the time of purchase, meaning the underlying asset price is already favorable for exercising the option. At-the-money (ATM) options have a strike price that aligns precisely with the current market price of the underlying asset, offering a delicate balance between intrinsic and time value.

Out-of-the-money (OTM) options, on the other hand, have strike prices that diverge significantly from the current market price, resulting in no intrinsic value at the outset. However, as the underlying asset price fluctuates, OTM options possess the potential to gain intrinsic value, albeit with a lower probability than ITM or ATM options.

Impact on Option Strategies:

The strike price exerts a profound influence on the potential profitability and risk profile of option trades. Traders must carefully consider the strike price in relation to their trading objectives, whether seeking immediate profit or speculating on future price movements.

For example, an ITM call option grants the holder the right to purchase the underlying asset at a price below the current market price, potentially leading to immediate profit if exercised promptly. Conversely, an OTM put option offers the right to sell the underlying asset at a price above the current market price, aiming for profit if the asset price declines before expiration.

Image: investinganswers.com

What Is Strike In Option Trading

Conclusion:

The strike price, a linchpin of option trading, empowers traders to navigate the intricate web of market fluctuations, providing a benchmark for assessing option value and devising effective trading strategies. Understanding its nuances is essential for maximizing the potential benefits while mitigating risks in this dynamic and rewarding realm of finance.