Navigating the world of options trading can be exhilarating and profitable, but understanding the concept of sideways market trading is crucial for success. When the market moves sideways instead of exhibiting sharp or consistent upward or downward trends, opportunities arise for adept traders. This article will delve into options trading sideways, providing a comprehensive guide to help you master this strategy in the financial markets.

/GettyImages-113212885-59d654fe519de200102b67e0.jpg)

Image: useconomy.about.com

Understanding Sideways Options Trading

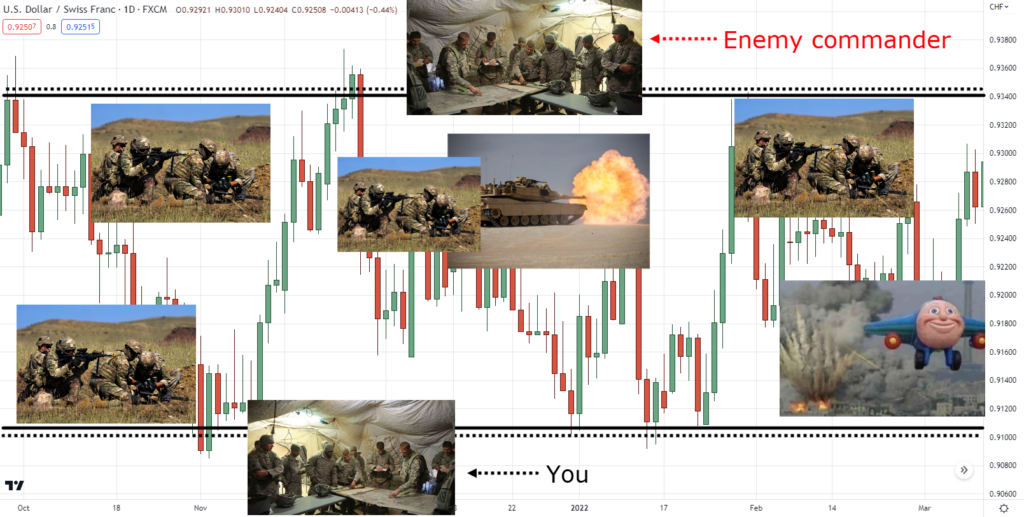

Options trading sideways entails profiting from market fluctuations within a limited range. It involves identifying stocks or indices whose prices remain relatively stable within a defined price channel. Traders utilize various strategies to capitalize on these sideways movements, employing sophisticated options trading techniques to generate income. These strategies typically involve buying and selling call and put options to capture premiums and take advantage of the market’s stability.

Advantages and Disadvantages of Sideways Trading

Engaging in sideways options trading offers several advantages. It allows traders to profit from market stability, often with lower risk than trend-following approaches. Moreover, sideways trading can provide consistent returns even in volatile markets, making it a preferred strategy for risk-averse investors.

However, it’s essential to acknowledge the potential drawbacks associated with sideways trading. Trading ranges can break out unexpectedly, leading to losses or missed opportunities. Additionally, capturing significant profits may require patience and discipline as market fluctuations can be gradual, and sideways trends can persist for extended periods.

Expert Insights and Actionable Tips

“When trading sideways,” advises financial analyst Emily Carter, “it’s crucial to select underlying assets that exhibit well-defined price channels.” She stresses the importance of identifying the support and resistance levels within which the price action is contained. “Understanding these boundaries allows traders to make more informed decisions while employing options strategies.”

Another expert, options trader Mark Rodriguez, emphasizes the significance of position sizing and risk management. “Trading sideways can be a slow and steady process,” he explains. “Traders should manage their risk by allocating a reasonable portion of their portfolio to each trade.” He recommends using trailing stop-loss orders to safeguard profits and limit potential losses if the market breaks out of the trading range.

Image: www.tradingwithrayner.com

Options Trading Sideways

Image: therobusttrader.com

Conclusion

Options trading sideways offers a compelling strategy for traders seeking consistent returns in a range-bound market. By leveraging the concepts and techniques outlined in this comprehensive guide, you can navigate sideways market conditions with greater confidence and maximize your profit potential. Remember to embrace a disciplined approach, manage your risk, and seek expert insights to enhance your trading strategies. Embrace the opportunities presented by sideways markets and unlock the rewards of successful options trading.