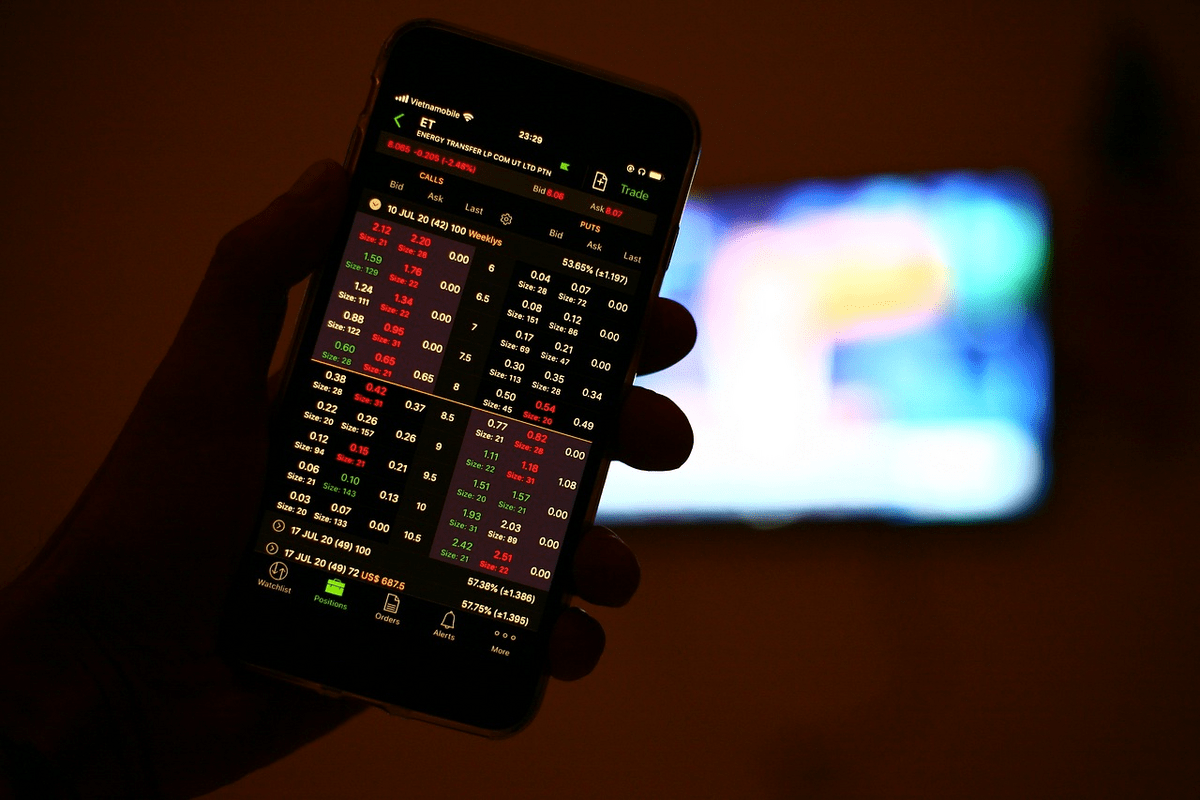

Imagine a scenario you’ve been eyeing a particular stock all day, but the market closes before you can make a move. You’re left wondering, “Can I still trade the stock after hours?” The answer is a resounding yes, thanks to the wonders of options after-hours trading.

Image: www.wallstreetzen.com

Exploring the World of After-Hours Trading

Options after-hours trading, also known as extended-hours trading, offers traders the flexibility to execute trades beyond the regular market hours of 9:30 am to 4 pm EST. This extended trading session typically runs from 4 pm to 8 pm EST, providing traders with an additional four hours to make or adjust trades.

After-hours trading can be a valuable tool for investors looking to capitalize on news events or market movements that occur after the traditional market close. It also allows traders to react to earnings reports or other market-moving events that happen outside of regular trading hours.

The Mechanics of Options After-Hours Trading

When trading options after hours, it’s essential to understand the mechanics involved. After-hours trading is conducted on a separate market called the “after-hours market.” This market has its own set of rules and regulations, distinct from the regular market.

In the after-hours market, trading volume is typically lower compared to regular trading hours. This can lead to wider bid-ask spreads, potentially resulting in higher transaction costs. Additionally, fewer market participants are active during after-hours trading, which may impact the liquidity of certain options contracts.

Benefits and Considerations

Options after-hours trading offers several advantages:

- Extended Trading Hours: The extended trading hours allow traders to react to market events that occur outside of regular trading hours.

- Flexibility: Traders have more flexibility to manage their trades and adjust their positions as needed.

- Market Insights: After-hours trading provides insights into market sentiment and potential price movements for the following trading day.

However, it’s crucial to consider some disadvantages before engaging in after-hours trading:

- Lower Liquidity: The lower trading volume during after-hours trading can result in wider bid-ask spreads and potential execution delays.

- Increased Risk: Less market activity can lead to increased price volatility, potentially amplifying losses.

- Market Closure: After-hours trading ends at 8 pm EST, which means any open positions will be subject to overnight risk until the market reopens the following day.

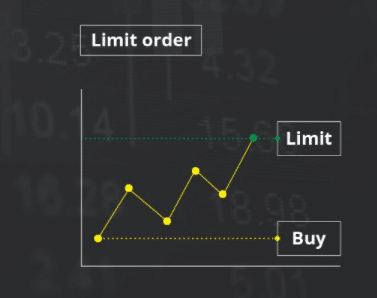

Image: investgrail.com

Tips for Success in Options After-Hours Trading

To achieve success in options after-hours trading, follow these expert tips:

- Educate Yourself: Thoroughly understand options trading strategies and risk management techniques.

- Practice in a Simulated Environment: Test your strategies in a simulated trading environment before risking real capital.

- Monitor News and Market Events: Stay informed about market news and events that may impact after-hours trading.

- Be Patient and Disciplined: Exercise patience and stick to your trading plan, even during volatile market conditions.

- Consider Trading Options with High Liquidity: Focus on options contracts with high liquidity to minimize slippage and execution risks.

By adhering to these tips, traders can mitigate risks and increase their chances of success in options after-hours trading.

Frequently Asked Questions

Q: What are the trading hours for options after-hours trading?

A: Options after-hours trading typically runs from 4 pm to 8 pm EST.

Q: Can I trade all options contracts after hours?

A: No, not all options contracts are available for after-hours trading. Only certain actively traded options contracts with sufficient liquidity are eligible.

Q: Are there additional fees associated with options after-hours trading?

A: Yes, some brokers may charge additional fees for after-hours trading. These fees vary depending on the brokerage firm.

Options After Hours Trading

Image: squareoff.in

Conclusion

Options after-hours trading offers traders the opportunity to extend their trading day and capitalize on market events beyond regular trading hours. By understanding the mechanics, considering the benefits and drawbacks, and following expert tips, traders can navigate the after-hours market effectively. So, ask yourself: Are you ready to explore the exciting world of options after-hours trading?