In the fast-paced world of financial markets, currency options trading offers immense potential for both savvy investors and speculative traders. Understanding the intricate nuances of currency options trading hours is paramount to maximizing success in this dynamic arena. This in-depth guide will delve into the ins and outs of currency options trading hours, providing you with the knowledge and insights necessary to navigate this complex landscape with confidence.

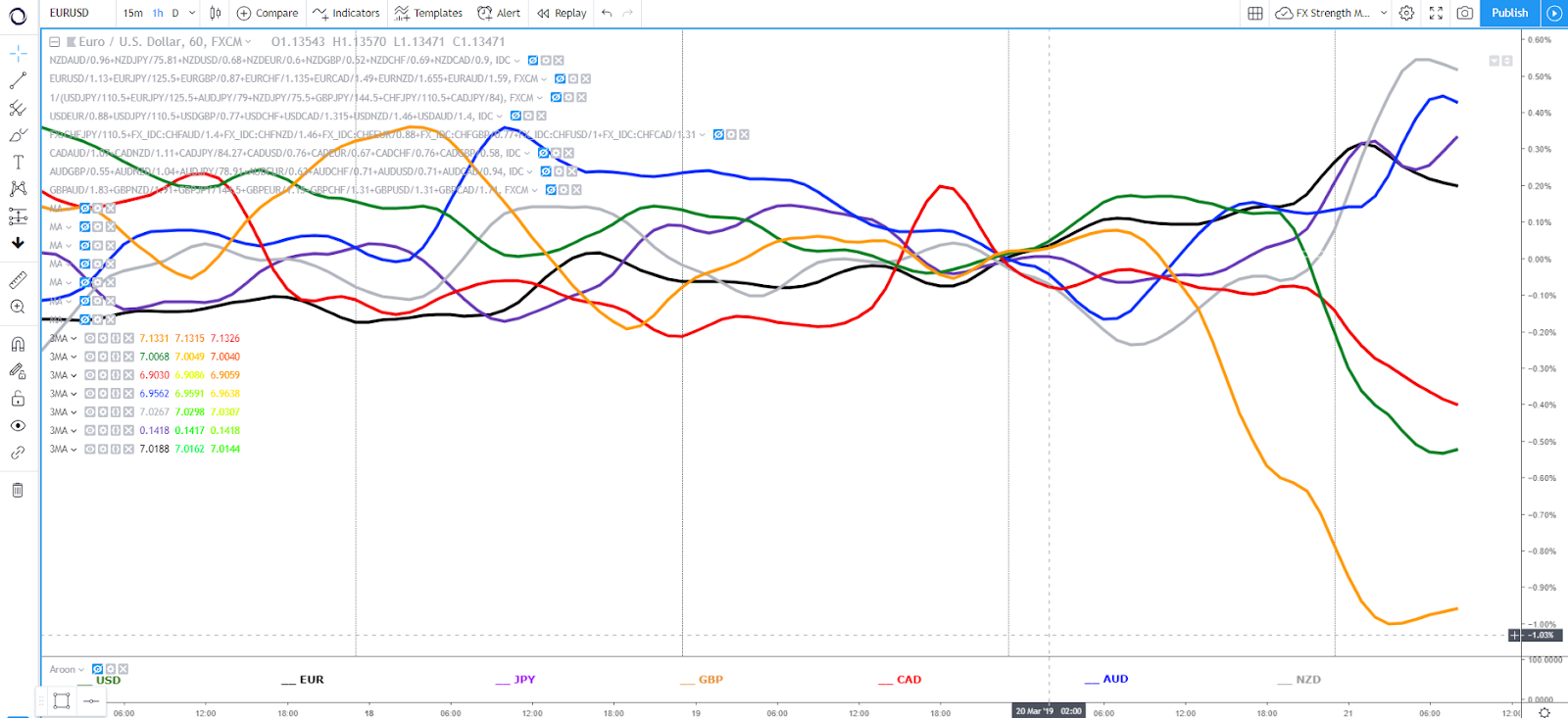

Image: liquidityfinder.com

Currency options are financial derivatives that grant the holder the right, but not the obligation, to buy or sell an underlying currency at a specified price on or before a particular date. These versatile instruments offer investors flexibility, risk management, and the potential for substantial gains. However, it is crucial to be aware of the specific trading hours during which currency options can be bought and sold to optimize your trading strategies.

The Global Landscape of Currency Options Trading Hours

Currency options trading hours vary across different time zones and financial centers around the world. The most significant trading hub for currency options is London, where the Intercontinental Exchange (ICE) Futures Europe operates the largest currency options exchange globally. Trading hours in London typically run from 8:00 am to 4:00 pm GMT (Greenwich Mean Time).

Other major financial centers also offer currency options trading during specific hours. In New York, the CME Group operates the Chicago Mercantile Exchange (CME), which hosts currency options trading from 7:20 am to 1:00 pm EST (Eastern Standard Time). In Tokyo, the Tokyo Financial Exchange (TFX) facilitates currency options trading from 7:00 am to 3:00 pm JST (Japan Standard Time).

Understanding the Trading Cycle

Currency options trading hours are divided into three distinct phases: the open, the middle, and the close. During the open, which typically lasts for the first hour of trading, volatility is often elevated as market participants establish their positions for the day. The middle of the trading session is generally a period of lower volatility, but significant news or economic events can trigger sudden price movements.

The close of trading is often characterized by a surge in activity as traders adjust their positions before the market closes. This can lead to increased volatility and potential trading opportunities. It is important to note that the trading cycle can vary depending on the currency pair being traded and the specific market conditions.

Factors Influencing Currency Options Trading Hours

Several factors can influence currency options trading hours, including:

- Economic news and events: Major economic announcements, such as interest rate decisions or GDP reports, can significantly impact currency prices and trading activity. These events often occur during specific times of the day, which can affect currency options trading hours.

- Market liquidity: Currency options trading is most liquid during the open and close of trading hours. This is because more market participants are active during these times, leading to tighter spreads and more trading opportunities.

- Trading platform: Different trading platforms may have their own specific currency options trading hours. It is essential to check the trading hours of your preferred platform before executing any trades.

Image: nihoyuyipe.web.fc2.com

Expert Insights and Practical Tips

To enhance your understanding of currency options trading hours, it is essential to seek insights from experienced traders and follow these practical tips:

- Plan your trades: Before jumping into the market, take the time to study the economic calendar and identify potential events that could impact currency prices. Plan your trading strategies accordingly to capitalize on potential opportunities.

- Monitor market volatility: Pay close attention to market volatility levels throughout the trading session. Increased volatility can lead to wider spreads and more risk, so it is important to adjust your trading strategies accordingly.

- Consider hedging strategies: Hedging strategies can help mitigate risk and lock in profits in volatile market conditions. Explore different hedging techniques, such as spread trades or option combinations, to protect your positions.

Currency Options Trading Hours

Image: tradeproacademy.com

Conclusion

By understanding currency options trading hours and incorporating expert insights into your trading strategies, you can unlock the full potential of this dynamic financial market. Remember, successful trading requires a combination of knowledge, skill, and a keen eye for opportunities. Embrace the complexities of currency options trading hours as a path to enhanced trading outcomes and empower yourself with the tools necessary to navigate the financial markets with confidence.