Introduction

As an avid investor, I’ve been through countless market ups and downs. One defining moment in my investment journey was when I stumbled upon the world of options trading. The allure of potentially exponential returns was undeniable, but so were the potential risks. It led me to question whether options trading or a traditional cash account would be the best fit for my financial goals and risk tolerance.

Image: centerpointsecurities.com

Cash Account Only

A cash account is a brokerage account where you can buy and sell stocks, bonds, and other securities. Funds in a cash account must settle before you can use them to trade again. This means that you must have sufficient cash or hold enough settled funds in your account to cover the purchase price of any security you wish to buy.

Advantages of a Cash Account

– Lower risk compared to margin accounts

– No interest charges or margin calls

– Suitable for conservative investors and those new to investing

Disadvantages of a Cash Account

– Limited opportunities for leverage

– Potential for missed trading opportunities due to settlement delays

Options Trading

Options trading involves the buying and selling of options contracts. An option contract gives you the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specific price on or before a certain date. Options trading can provide potential for higher returns but also carries significant risks.

Advantages of Options Trading

– Potential for high returns

– Hedging strategies to manage risk

– Leverage and increased buying power

Disadvantages of Options Trading

– High risk of losing capital

– Complex strategies, requiring advanced understanding

– Expiration dates and time decay factors

Making the Decision

The choice between options trading and a cash account depends on various factors, including your investment goals, risk tolerance, and level of financial knowledge. If you’re new to investing or have a low risk tolerance, a cash account is advisable. On the other hand, if you’re seeking higher potential returns and are comfortable with the associated risks, options trading might be a suitable option.

Image: sharetrading.westpac.com.au

Tips and Expert Advice

- If you decide to trade options, educate yourself thoroughly before placing any trades.

- Start with small and paper trades before risking real capital.

- Understand the risks and potential rewards of options trading before getting involved.

- Consider seeking guidance from a financial advisor or experienced mentor.

- Manage your risk by diversifying your portfolio and using stop-loss orders.

FAQ

Q: Is options trading suitable for beginners?

A: Options trading involves complex strategies and can be highly risky, making it unsuitable for beginners. It’s recommended to gain experience and knowledge before engaging in options trading.

Q: Can I make a lot of money with options trading?

A: While options trading has the potential for high returns, it also carries significant risks. The outcome of an options trade depends on various factors, including market conditions, volatility, and the skill of the trader.

Options Trading Or Cash Account Only

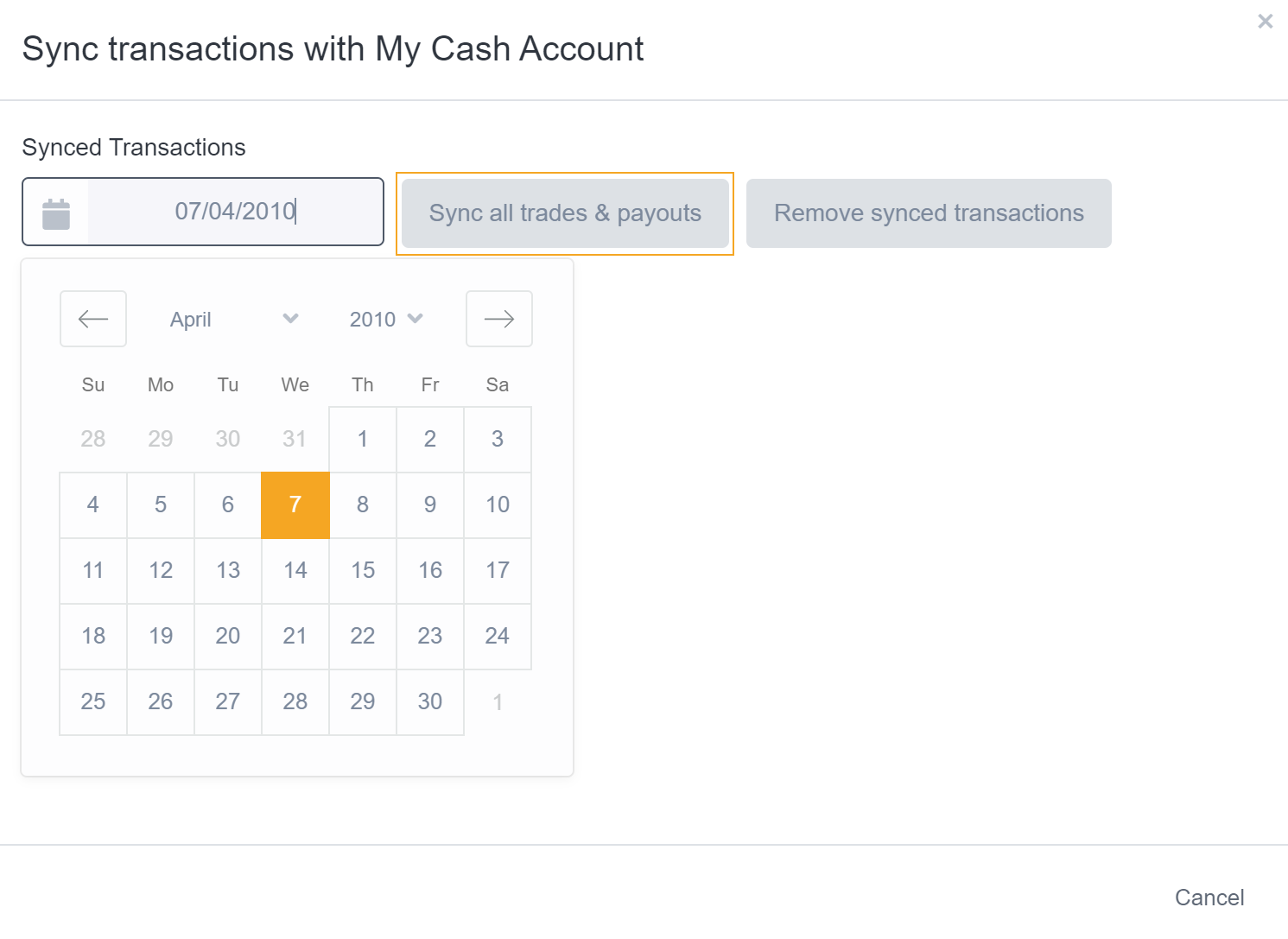

Image: www.sharesight.com

Conclusion

The decision between options trading or a cash account only is a personal one that depends on your individual circumstances. By understanding the pros and cons, as well as your own investment goals and risk tolerance, you can make an informed decision that aligns with your financial objectives.

Would you like to learn more about options trading and cash accounts? Join our upcoming webinar where industry professionals will delve deeper into these topics, providing insights and strategies to help you make informed investment decisions. Register now!