Introduction

The allure of the financial markets has captured the imagination of individuals seeking to augment their wealth. Options trading, a sophisticated investment strategy, has emerged as a formidable tool for maximizing returns. As a beginner, the choice of trading on a cash account or a margin account may often pose a dilemma. This article will provide a thorough exploration of trading options on a cash account, equipping you with the knowledge and insights necessary to navigate the complexities of this financial landscape.

Image: businessfirstfamily.com

Delving into Cash Accounts

A cash account, as its name suggests, is a brokerage account that mandates the settlement of all trades on a same-day basis using available cash. This implies that you cannot borrow funds from your broker to facilitate trades, as is permissible in a margin account. While cash accounts may appear limiting initially, they offer unique advantages, particularly for novice traders.

Advantages of Cash Accounts

- Lower risk: Eliminating the ability to trade on margin significantly reduces the potential for substantial losses, as you can only trade with funds you have in your account.

- Discipline: Cash accounts enforce discipline by preventing overleveraging and uncontrolled risk-taking, which can often lead to financial ruin.

Understanding Options Trading

Options, unlike stocks or bonds, do not represent direct ownership in a company. Rather, they confer the right, but not the obligation, to buy or sell an underlying asset at a specified price and date. This flexibility makes options trading a versatile tool for various investment objectives, ranging from hedging against risk to speculating on price movements.

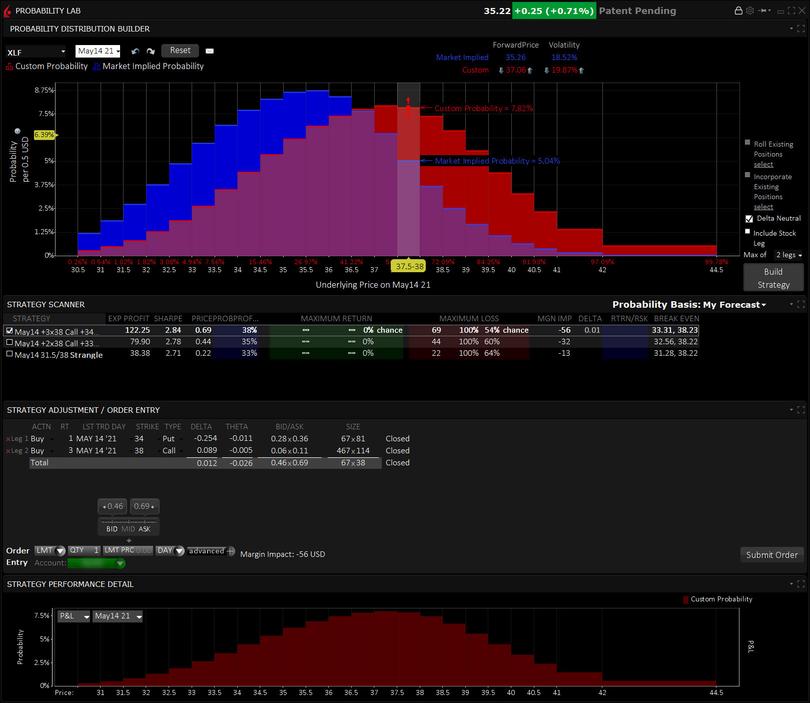

Image: www.interactivebrokers.com

Executing Options Trades on a Cash Account

Trading options on a cash account entails understanding several key aspects:

- Settlement: Option trades on a cash account must settle on the same day. This means that if you buy an option, you must have the funds in your account to cover the purchase price. Similarly, if you sell an option, you must have the underlying asset or the funds to cover the potential obligation to deliver.

- Exercise and assignment: If you hold an option until its expiration date, you have the right to exercise it. Exercising a call option obligates you to buy the underlying asset, while exercising a put option obligates you to sell it. If you do not wish to exercise the option, you can choose to let it expire worthless.

- Margin requirements: Cash accounts do not allow for margin trading. Therefore, you will not be subject to margin calls or maintenance margin requirements.

Tips and Expert Advice for Options Trading

Navigating the world of options trading requires a combination of knowledge, skill, and discipline. Here are a few tips to enhance your trading journey:

- Educate yourself: Acquire a thorough understanding of options trading concepts, including the different types of options, strategies, and risk management techniques.

- Start small: Begin with small trades and gradually increase your position size as you gain experience and confidence.

Frequently Asked Questions

- Q: What is the difference between a cash account and a margin account?

A: A cash account requires you to settle trades with available cash, while a margin account allows you to borrow funds from your broker to trade. - Q: Can I trade options on both cash and margin accounts?

A: Yes, you can trade options on either type of account, but different rules apply to each. - Q: Is options trading on a cash account less risky than on a margin account?

A: Yes, as you cannot borrow funds to trade, the potential for significant losses is reduced.

Trading Options On Cas Account

Image: alayneabrahams.com

Conclusion

Trading options on a cash account offers a prudent approach to investment, particularly for individuals seeking to mitigate risk and exercise financial discipline. By understanding the nuances and utilizing effective strategies, you can harness the potential of options trading to augment your investment returns.

Are you interested in delving into options trading on a cash account? Leave a comment below, and let’s continue the conversation!