Introduction

In the fast-paced world of investing, finding a reliable and consistent income stream can be a daunting task. Enter the wheel option trading strategy, a proven method employed by seasoned traders to steadily generate cash flow while managing risk. This comprehensive guide will delve into the intricacies of the wheel option strategy, providing you with the knowledge and tools to harness its potential.

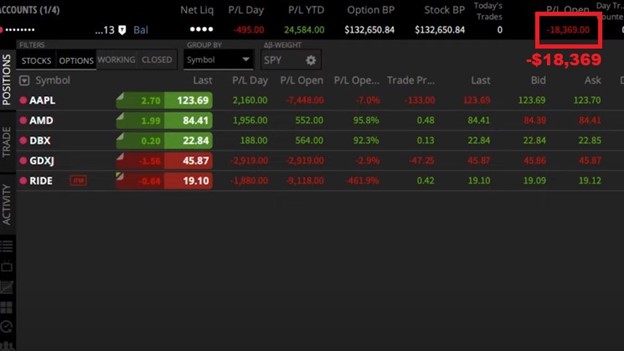

Image: www.moneyshow.com

What is the Wheel Option Trading Strategy?

The wheel option trading strategy is a multifaceted approach that involves selling covered calls on stocks you own while simultaneously selling cash-secured puts on the same underlying security. By combining these two strategies, you create a dynamic system that seeks to capture premium income in all market conditions.

How the Strategy Works

At the core of the wheel strategy is the concept of covered calls and cash-secured puts. When you sell a covered call, you grant someone else the right to buy your shares at a specified price (the strike price) by a certain date (the expiration date). In exchange for this right, you receive a premium. Cash-secured puts also work similarly, with the main difference being that you are obligated to buy the stock at the strike price if it falls below that level.

Benefits of the Wheel Strategy

The wheel strategy offers several compelling benefits:

- Generates Cash Flow: By selling covered calls, you can pocket premium income even when the stock price remains stagnant or moves sideways.

- Manages Risk: The cash-secured put component ensures you are only obligated to buy the stock at a price you are comfortable with.

- Downswing Protection: In bear markets, the put options provide a safety net by potentially buying your stock at a higher price than the current market value.

- Flexibility: The wheel strategy can be adjusted to suit different market conditions and risk tolerances.

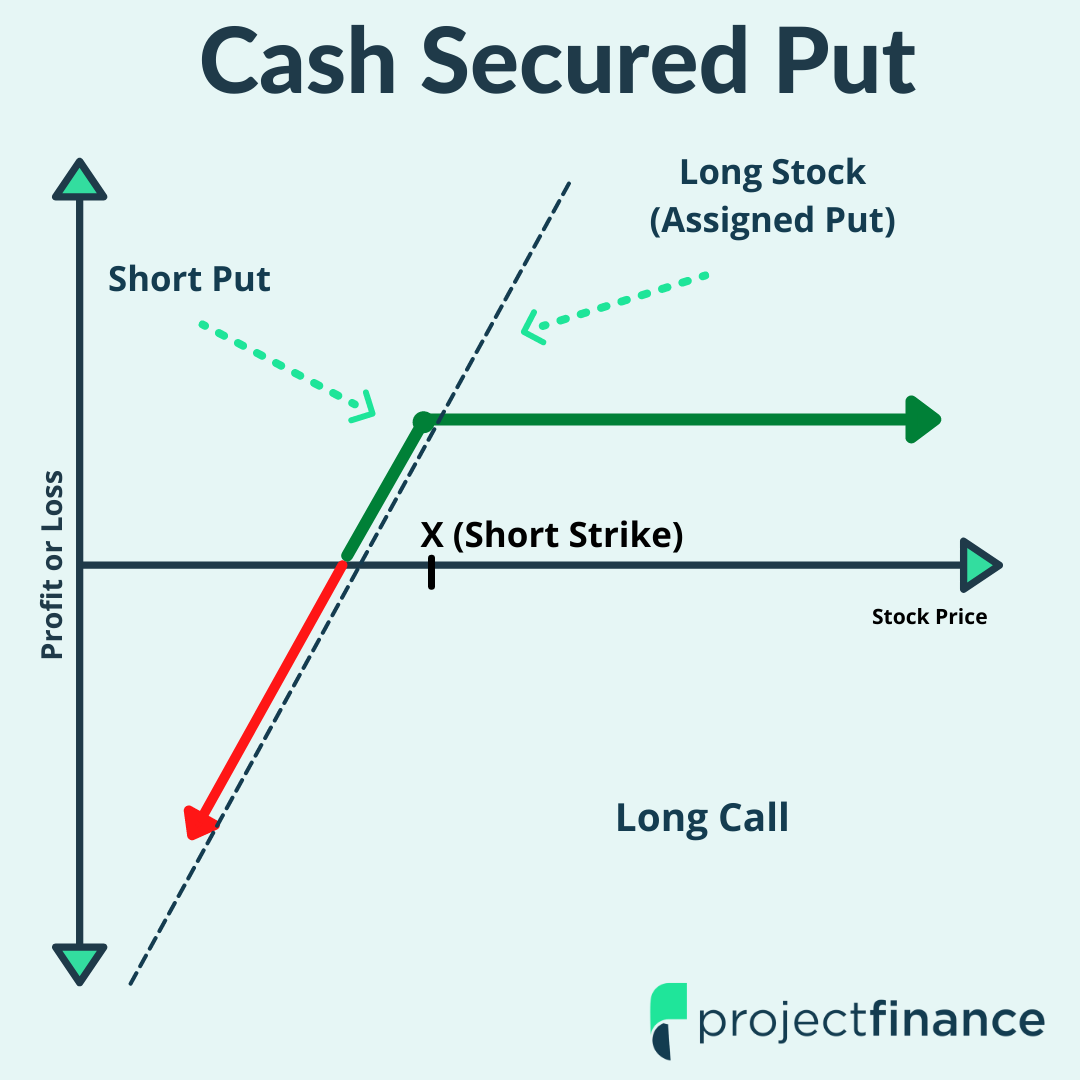

Image: investcrown.com

Expert Insights

Acclaimed options trader Nial Fuller emphasizes the importance of managing risk when implementing the wheel strategy. He advises traders to “only sell options on stocks they would be happy to own, even if the option expires worthless.”

James Cordier, founder of Option Pit, stresses the significance of patience and discipline. He counsels, “The wheel is a marathon, not a sprint. Stick with it through market ups and downs to reap the long-term benefits.”

Actionable Tips

- Start small by choosing a liquid stock with a tight bid-ask spread.

- Select strikes and expirations that align with your time horizon and risk tolerance.

- Roll your options out and up or down as necessary to maximize premium income.

- Monitor your positions closely and adjust adjustments if market conditions change.

Wheel Option Trading Strategy

Image: www.projectfinance.com

Conclusion

The wheel option trading strategy is a valuable tool for generating consistent income in the stock market. By combining covered calls and cash-secured puts, you can create a dynamic system that mitigates risk while enhancing your potential returns. Remember to approach this strategy with a disciplined mindset, manage risk prudently, and be patient in your pursuit of financial success. With the right knowledge and execution, the wheel strategy can empower you to unlock the potential of the options market and achieve your financial goals.