Introduction:

Image: www.projectfinance.com

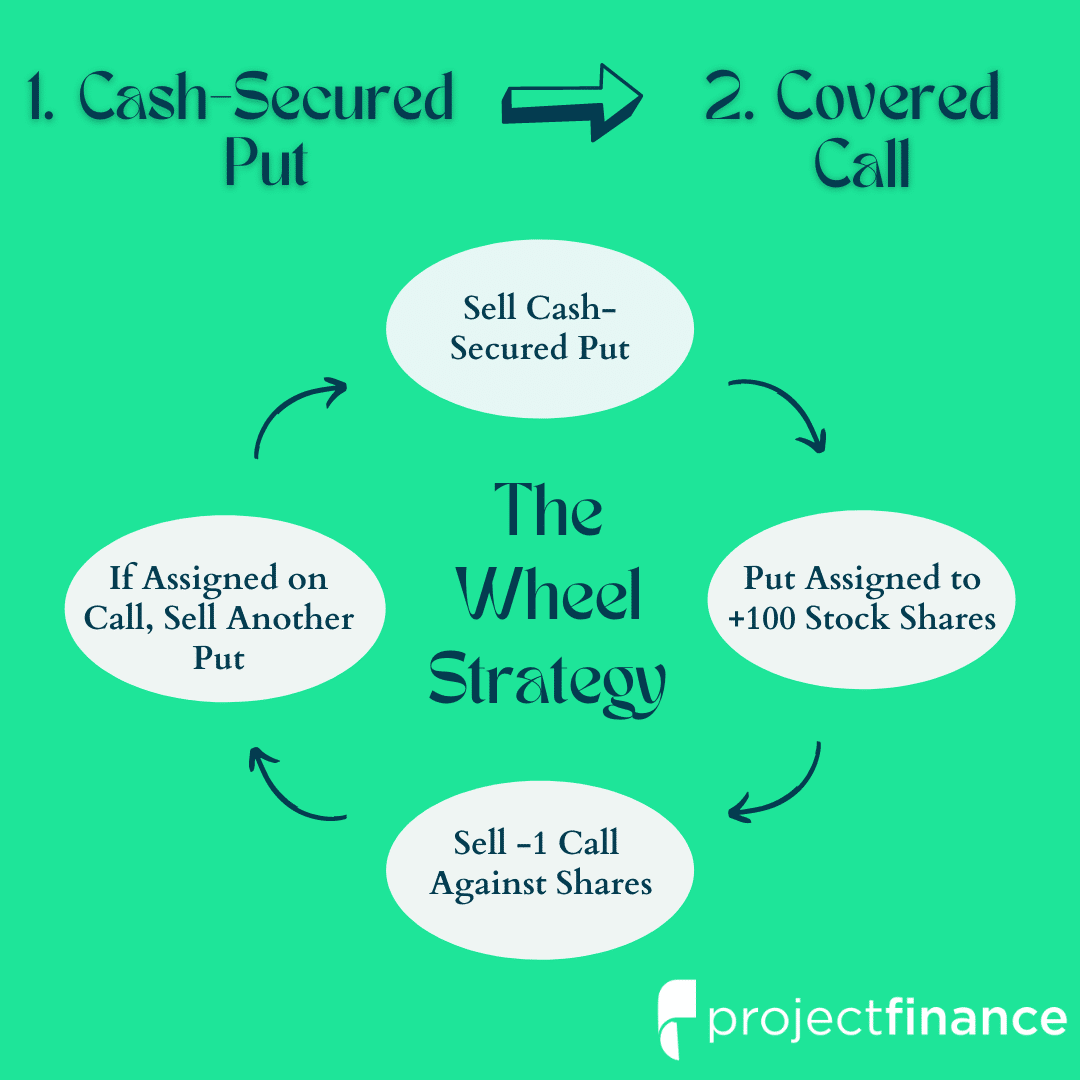

Imagine yourself driving down the road of financial markets, seeking a steady and potentially lucrative path. The Wheel Strategy emerges as a beacon, guiding you towards a systematic approach to options trading that offers a multifaceted blend of income generation and risk management. This comprehensive guide will delve into the intricacies of The Wheel Strategy, empowering you to harness its potential and navigate the market with confidence.

Understanding The Wheel Strategy:

The Wheel Strategy is a versatile options trading approach that revolves around the simultaneous sale and purchase of options contracts. At its core, the strategy involves selling a covered call while simultaneously buying a protective put option. This intricate balancing act provides income generation through the covered call sale and establishes a safety net with the put purchase.

Foundations of The Wheel Strategy:

-

Selling Covered Calls: Selling a covered call involves granting another trader the option to purchase your underlying asset at a pre-determined price within a specified time frame. This strategy generates income by collecting premiums from the buyer of the call option.

-

Buying Protective Puts: Simultaneously, you purchase a put option to protect against potential price declines in the underlying asset. A put option gives you the right, but not the obligation, to sell the asset at a pre-determined price within a specified time frame.

Execution of The Wheel Strategy:

a. Selection of Underlying Asset: Identify an underlying asset with high liquidity and stable price movements. This minimizes volatility risks and enhances the strategy’s effectiveness.

b. Covered Call Strike Price: Set the covered call’s strike price above the current market price, capturing potential upside while managing risk.

c. Put Option Strike Price: Determine the put option’s strike price to protect against significant price declines. This typically involves setting it below the current market price.

d. Managing Positions: Continuously monitor market conditions and adjust positions accordingly. This may involve rolling over options contracts or adjusting strike prices as the market evolves.

Benefits of The Wheel Strategy:

-

Income Generation: Selling covered calls provides a steady stream of income through premiums. This income can supplement or replace other revenue sources.

-

Risk Management: The protective put option limits potential losses in the event of unfavorable market movements. This risk mitigation feature provides peace of mind and preserves capital.

-

Long-Term Returns: The Wheel Strategy aims to generate consistent returns over time by benefiting from both rising and falling markets.

Expert Insights and Actionable Tips:

“The Wheel Strategy is a versatile tool that can provide steady income and protect against downside risks. However, it requires discipline and careful execution,” advises seasoned options trader, Michael Malone.

“Focus on undervalued assets with strong fundamentals. This will enhance your chances of success in the long run,” adds expert trader, Sarah Johnson.

Conclusion:

The Wheel Strategy presents a comprehensive options trading approach that combines income generation and risk management. By equipping yourself with the knowledge and insights outlined in this guide, you can confidently navigate the market and harness the potential of this powerful strategy. Remember, successful options trading requires patience, discipline, and a clear understanding of market dynamics. Embrace the journey, learn from experienced traders, and unlock the financial freedom The Wheel Strategy can offer.

Image: www.youtube.com

Wheel Strategy For Options Trading

Image: www.rockwelltrading.com