Welcome to my comprehensive guide on the Wheel Options Trading Strategy. In this post, we’ll embark on a deep dive into this lucrative approach, uncovering its benefits, mechanics, and how to maximize its potential. Join me as we uncover the secrets of harnessing market inefficiencies to generate consistent returns.

Image: www.rockwelltrading.com

Understanding the Concept of Wheel Options Trading

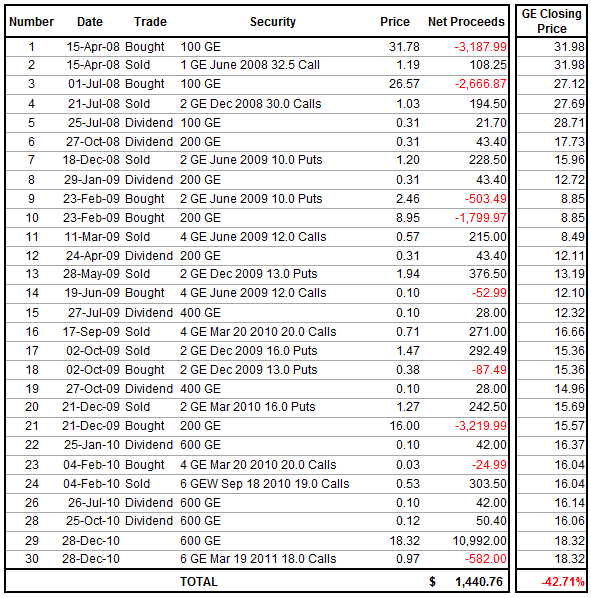

The Wheel Options Trading Strategy is a neutral to slightly bullish strategy involving simultaneously selling a cash-secured put option and a covered call option. The put option gives the buyer the right to sell a stock at a specified price (strike price) within a predefined timeframe (expiration date). Meanwhile, the covered call option grants the buyer the right to buy the stock at a strike price higher than the current market price.

The key behind the Wheel Strategy lies in profiting from time decay and the volatility of the underlying stock. By selling options at a higher strike price, traders gain premiums that compensate for potential losses if the option is exercised. This strategy is ideal for traders seeking to generate income from stocks they own or are willing to purchase in anticipation of price increases.

Benefits of the Wheel Options Trading Strategy

- Regular Income Generation: The sale of options premiums provides regular income, regardless of the direction of the underlying stock’s movement.

- Downside Protection: The sale of put options offers protection against potential downturns in the stock price, reducing losses.

- Capital Appreciation Potential: If the stock price rises, the covered call option will be exercised, resulting in capital gains.

How to Implement the Wheel Options Trading Strategy

To implement the Wheel Strategy, follow these steps:

- Identify the Right Stock: Choose a stock with moderate volatility, high liquidity, and a strong underlying trend.

- Sell a Cash-Secured Put Option: Sell a put option at a strike price below the current market price and collect the premium.

- Sell a Covered Call Option: Once you own the stock from exercising the put option or have purchased it outright, sell a covered call option at a strike price higher than the current market price.

- Manage the Positions: Monitor the performance of the options regularly and adjust the strategy as needed, including rolling options or adjusting strike prices.

Image: marketxls.com

Tips and Expert Advice for Successful Wheel Trading

- Thoroughly Understand the Strategy: Master the mechanics and risks involved before placing any trades.

- Choose Stocks Wisely: Select stocks with characteristics suited to the Wheel Strategy, such as high liquidity and volatility.

- Manage Risk: Limit your risk by trading within your means, using stop-loss orders, and diversifying your portfolio.

- Be Patient: The Wheel Strategy is not a get-rich-quick scheme. Consistency and patience are key for long-term success.

- Learn from Others: Seek guidance from experienced traders, attend workshops, and read books to enhance your knowledge and skills.

FAQs on Wheel Options Trading Strategy

- Q: What is the role of time decay in the Wheel Strategy?

A: Time decay reduces the value of options as they approach expiration, benefiting traders who sell options. - Q: When should I use the Wheel Strategy?

A: The strategy is suitable for traders comfortable with market neutrality and willing to hold shares for extended periods. - Q: What are the risks involved in Wheel Trading?

A: Like other options strategies, the Wheel Strategy carries risks, including the potential for losses if the underlying stock’s price moves sharply against your position.

Wheel Options Trading Strategy Review

Image: optionstradingiq.com

Conclusion

The Wheel Options Trading Strategy is a powerful tool for income generation, downside protection, and potential capital appreciation. By understanding its mechanics, benefits, and risks, traders can harness the strategy’s potential to enhance their trading performance. Remember, success in options trading requires a combination of knowledge, discipline, and patience. Embrace the challenges and reap the rewards of this rewarding strategy.

Are you intrigued by the potential of the Wheel Options Trading Strategy? Share your thoughts and questions below, and let’s start a discussion!