Introduction

Image: www.youtube.com

In the realm of financial markets, where time plays a pivotal role, the expiration date in option trading stands as a decisive marker. It marks the culmination of an options contract, a journey fraught with anticipation and the potential for significant gains or losses. But what exactly is an option trading expiration date, and how do you navigate this pivotal moment to maximize your investment outcomes? Embark on a comprehensive exploration to unravel the intricacies of this financial milestone.

Understanding the Option Trading Expiration Date

An option trading expiration date is the predetermined date on which an options contract ceases to exist and all rights and obligations associated with it expire. For call options, the right to acquire underlying assets expires on this date, while for put options, the obligation to sell the assets terminates. Comprehending the significance of this date is paramount for options traders, as it influences their trading strategy and the potential outcomes.

Navigating the Option Trading Expiration Date

Approaching the option trading expiration date requires a strategic mindset, meticulously weighing potential scenarios and taking proactive actions. Here’s how to navigate this crucial juncture effectively:

-

Understanding Intrinsic and Time Value: As the expiration date draws near, the intrinsic value of an option (the difference between the underlying asset’s current price and the strike price) becomes increasingly important. Additionally, the time value of an option, which reflects the potential for price fluctuations before expiration, diminishes over time.

-

Exercising Rights: If the intrinsic value of an option is positive at expiration, the holder has the right (but not the obligation) to exercise it. For call options, this means buying the underlying asset at the strike price, while for put options, it means selling the underlying asset.

-

Selling or Closing the Position: An alternative to exercising an option is to sell it or close the position in the options market before expiration. This strategy allows traders to secure profits, minimize losses, or adjust their trading position.

Expert Insights and Actionable Tips

Navigating the option trading expiration date with confidence requires valuable insights from experts in the field and practical tips to guide your decision-making:

- Plan Ahead: Determine your trading objectives and exit strategy well before the expiration date to avoid hasty decisions under pressure.

- Monitor Market Dynamics: Closely track the underlying asset’s price movements and market trends in the lead-up to expiration to make informed decisions.

- Consider Volatility: Understand the impact of volatility on option prices, especially as expiration approaches. Increased volatility can lead to significant price swings.

- Choose the Right Strategy: Whether it’s exercising, selling, or closing your position, select the strategy that aligns with your investment goals and risk tolerance.

Conclusion

The option trading expiration date serves as a pivotal moment in the lifecycle of an options contract, offering opportunities for both rewards and potential risks. By understanding the implications of this date, implementing strategic decision-making, and leveraging expert guidance, you can enhance your navigation of the financial markets and position yourself for success. Remember, the expiration date is not just an end but also a potential beginning for profitable trading endeavors.

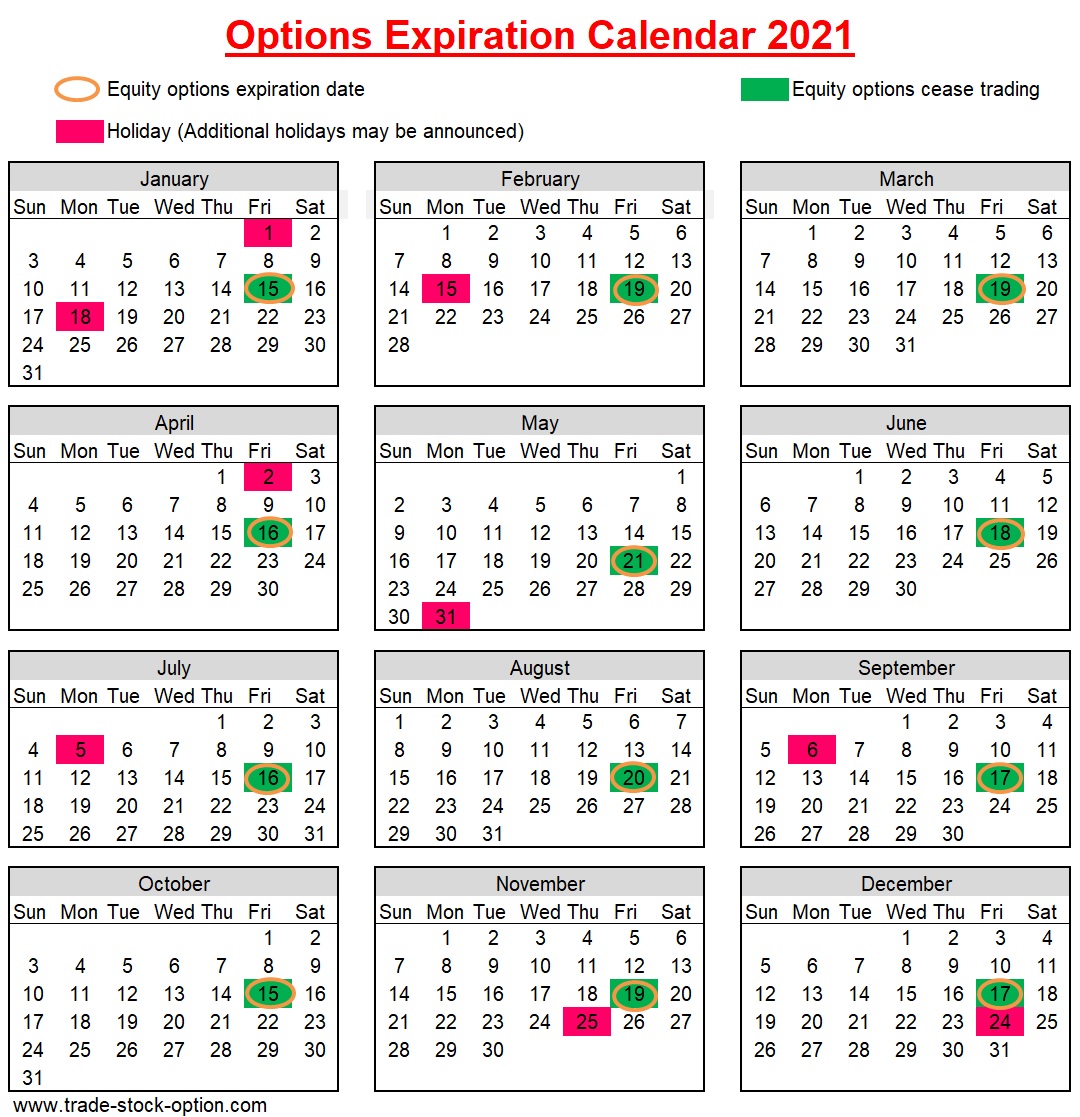

Image: www.trade-stock-option.com

Option Trading Expiration Date