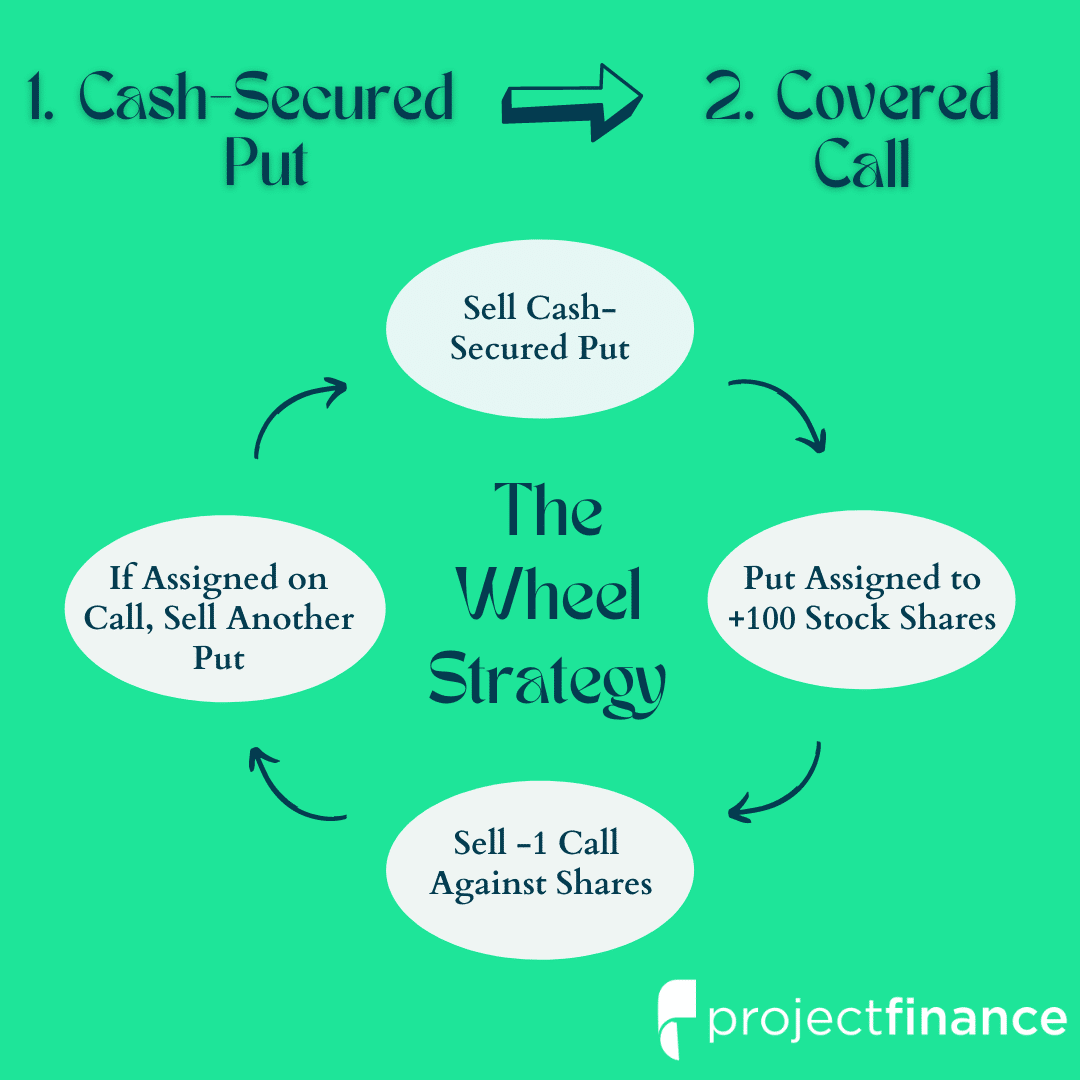

The wheel strategy is a versatile options trading strategy that can help you generate income, reduce risk, and potentially increase the value of your portfolio. It is a combination of selling covered calls and buying protective puts.

.png)

Image: www.coingecko.com

The strategy works by selling a covered call option on a stock that you own. If the stock price rises, you collect the premium from the call sale and keep the potential for further gains. If the stock price falls, you are protected by the put option, which you can exercise to sell your shares at a specified price.

The wheel strategy can be used on individual stocks, ETFs, or indexes. It is a relatively low-risk strategy that can be used by both experienced and novice traders. It is important to note that, like all options trading strategies, the wheel strategy can involve risk and requires a sound understanding of how options markets work and should be used with appropriate risk management techniques.

How to Implement the Wheel Strategy

To implement the wheel strategy, you will need to follow these steps:

- Sell a covered call option. A covered call is an option that gives the buyer the right to buy a stock at a specified price on or before a certain date. To sell a covered call, you must own at least 100 shares of the underlying stock. When you sell a call option, you will receive a premium.

- Buy a protective put option. A protective put option gives the buyer the right to sell a stock at a specified price on or before a certain date. To buy a protective put, you will pay some amount of premium. The premium you pay will typically be less than the premium you receive from selling the call option.

- Hold until expiration or take action. You can hold until the options expire or take action if certain conditions are reached. Typically, if the covered call is assigned early due to the underlying stock price appreciation, you can sell another covered call at a higher strike price to continue generating income. Alternatively, if the stock price falls and approaches your protective put, you can choose to exercise the put to sell your shares to limit potential losses.

Benefits of the Wheel Strategy

The wheel strategy offers several benefits, including:

- Generate income: Selling covered calls can generate income, regardless of whether the stock price moves up or down.

- Reduce risk: The protective put option provides downside protection, which can reduce the potential for losses.

- Increase portfolio growth: The wheel strategy can help you increase the value of your portfolio by buying undervalued assets and allowing them to appreciate in value.

- Tax benefits: Income generated from covered calls may be eligible for capital gains tax treatment, which can result in lower taxes.

Risks of the Wheel Strategy

While the wheel strategy can offer many benefits, it is important to be aware of the risks involved:

- Loss of capital: If the stock price falls significantly, you could lose money on the sale of the stock and the purchase of the protective put.

- Dilution of ownership: If you are consistently selling covered calls, you may end up reducing your ownership of the underlying stock over time.

- Complexity: The wheel strategy can be complex and requires a solid understanding of options markets. It should not be attempted by inexperienced traders.

Image: www.youtube.com

Wheel Strategy Options Trading

Image: www.projectfinance.com

Conclusion

The wheel strategy is a versatile options trading strategy that can help you generate income, reduce risk, and increase the value of your portfolio. However, it is important to be aware of the risks involved and to use appropriate risk management techniques. If you are new to options trading, it is important to consult with a financial advisor before implementing the wheel strategy.

We would like to emphasize that this article provides a general overview of the wheel strategy. It is not intended to be a complete or personalized investment guide. Always consult with a qualified financial professional to assess your investment goals and determine if the wheel strategy is a suitable strategy for you.