Introduction

In the fast-paced world of financial markets, option trading has emerged as a sophisticated investment strategy that offers both potential rewards and risks. Navigating this intricate landscape requires a set of guiding principles to enhance your chances of success. This article presents the golden rules of option trading, a comprehensive framework that will empower you to make informed decisions and maximize your returns.

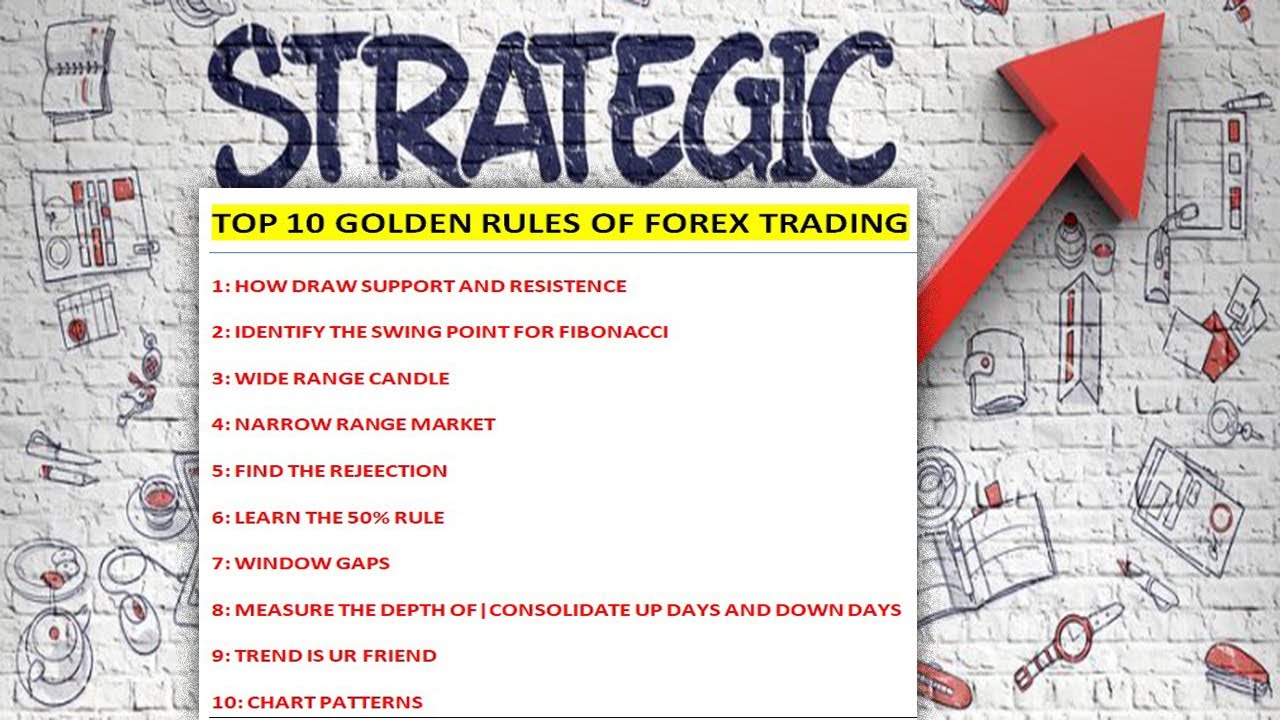

Image: www.youtube.com

The Essence of Options

An option is a financial instrument that grants the holder the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specified price (strike price) on or before a given date (expiration date). This inherent flexibility provides traders with the ability to profit from price fluctuations in the underlying asset without owning it directly. Options trading offers investors the potential for substantial gains, but understanding the underlying principles and adhering to sound strategies is crucial for managing risk and achieving success.

Rule 1: Begin with a Solid Foundation

Before venturing into option trading, it is essential to establish a solid foundation in the basics. Grasp the nuances of options contracts, including their types, exercise styles, and Greeks. Acquire knowledge of market mechanics, such as supply and demand dynamics and volatility analysis. By developing a comprehensive understanding, you will be better equipped to navigate the complexities of option trading.

Rule 2: Define Your Strategy Thoroughly

Option trading encompasses a wide range of strategies, each with its own unique risk and reward profile. Define a clear strategy that aligns with your investment goals and risk tolerance. Whether it’s income generation, capital appreciation, or hedging against market volatility, choose a strategy that complements your financial objectives.

Rule 3: Manage Risk Prudently

Risk management is paramount in option trading. Identify and assess potential risks associated with each trade. Familiarize yourself with the concept of delta and other Greeks, which measure the sensitivity of options to underlying asset price changes. Employ stop-loss orders to limit potential losses and protect your capital.

Image: unitedstatestroopers.blogspot.com

Rule 4: Consider the Time Value of Options

Time is an intrinsic factor in option pricing. As an option approaches its expiration date, its value decays due to the diminishing probability of profitability. Understand the concept of time decay and incorporate it into your trading decisions.

Rule 5: Leverage Market Volatility

Option traders often seek to capitalize on market volatility, which can amplify potential gains but also increase risk. Employ strategies that benefit from price fluctuations, such as selling options during periods of high volatility and buying options when volatility is low. Monitor implied volatility (IV) closely to gauge market expectations and adjust your trading strategies accordingly.

Rule 6: Monitor the Underlying Asset

Success in option trading hinges on a thorough understanding of the underlying asset. Track its price movements, volatility, and relevant news events that may impact its value. Stay informed about industry trends, company earnings, and economic factors that can influence the asset’s performance.

Rule 7: Exercise Options Wisely

Exercising an option means physically buying or selling the underlying asset at the strike price. Carefully consider the implications of exercise, such as potential profit or loss, tax consequences, and the impact on your overall trading strategy. Make informed decisions based on your analysis and market conditions.

Rule 8: Never Stop Learning

Option trading is a dynamic field that constantly evolves. Stay abreast of the latest market trends, trading techniques, and regulatory changes. Attend industry seminars, read books and articles, and engage with experienced traders. Continuous learning enhances your adaptability and helps you stay ahead of the curve.

Golden Rules Of Option Trading

Conclusion

Embracing the golden rules of option trading equips you with the knowledge and strategies necessary to navigate this complex financial landscape. By adhering to these principles, you can improve your decision-making, manage risk, and increase your chances of achieving success in the world of option trading. Remember, consistent learning, disciplined risk management, and a thorough understanding of the market are the keys to unlocking the potential of this powerful investment tool.