Navigating the Complexities of Golden Trading Options

In the realm of financial trading, the allure of golden trading options beckons investors seeking lucrative returns. However, navigating these complex instruments requires a deep understanding of their intricacies and risks. This comprehensive review empowers you with the knowledge and insights to make informed decisions about golden trading options.

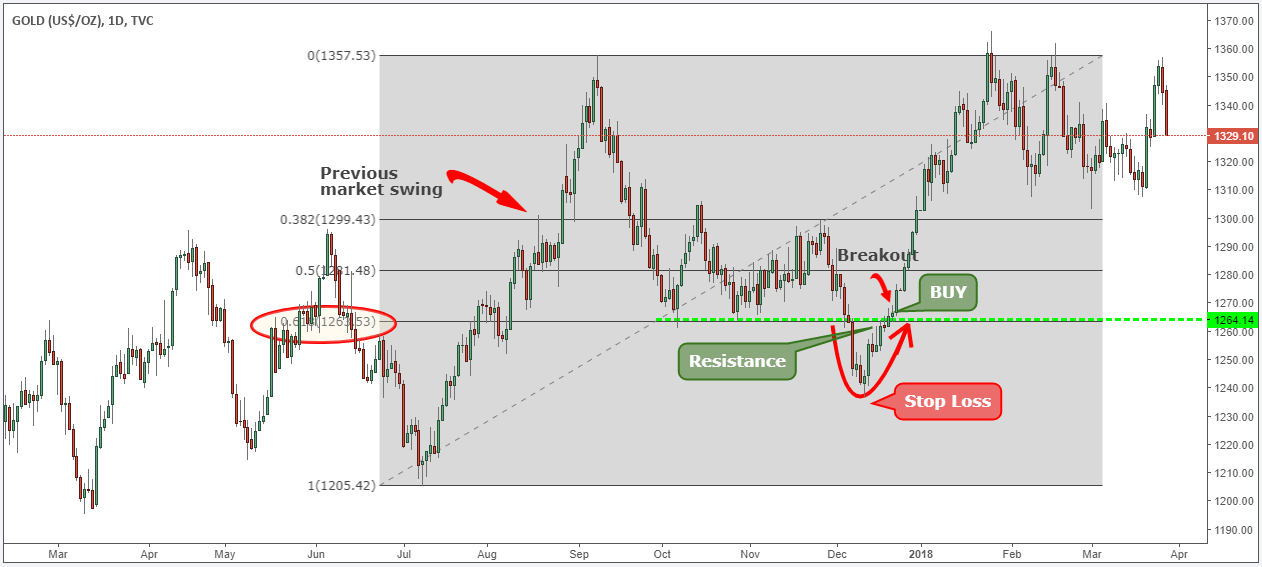

Image: foxtradeland.com

Unveiling the Essence of Golden Trading Options

Golden trading options stand out as a type of financial contract granting the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined “strike price” on a specific expiration date. These contracts are traded on various financial exchanges, offering investors the flexibility to hedge against market fluctuations or speculate on future price movements.

History and Evolution of Golden Trading Options

The concept of trading options can be traced back to the 19th century, with the first documented option contract executed in 1848. Golden trading options, specifically, emerged as a popular trading instrument in the early 20th century. Over time, they have evolved into a sophisticated tool widely employed by financial institutions, professional traders, and savvy investors alike.

Fundamental Concepts Underlying Golden Trading Options

Understanding the core concepts behind golden trading options is paramount for successful participation in this market. These include the “call option,” which entitles the holder to buy the underlying asset at the strike price, and the “put option,” which allows the holder to sell the underlying asset at the strike price. The “strike price” represents the price at which the option can be exercised, while the “expiration date” signifies the last day the option can be executed.

Image: tradingstrategyguides.com

Advantages and Applications of Golden Trading Options

Golden trading options offer numerous advantages, including the ability to hedge against risk, speculate on price movements, and generate potential income through option premiums. These contracts find wide application in portfolio management, risk mitigation, and income generation strategies.

Real-World Use Cases of Golden Trading Options

Understanding the practical applications of golden trading options enhances their value. Let’s explore a few scenarios:

- A financial institution holding a large quantity of stocks can utilize a put option to protect against potential market downturns.

- An investor expecting a rise in the price of a particular stock can buy a call option to capitalize on the potential gain.

- A trader looking to generate income without owning the underlying asset can engage in option trading by buying and selling call or put options.

Expert Insights on Golden Trading Options

Insights from industry experts are invaluable. Here’s what two financial experts say about golden trading options:

“Golden trading options provide investors with flexibility and numerous strategic possibilities. However, understanding their dynamics and managing risk effectively is crucial.” – Maria Hernandez, Financial Advisor

“Options trading has evolved into a sophisticated field, and golden trading options remain a valuable tool when utilized with discipline and a solid understanding of the market.” – Dr. Peter Marshall, Economics Professor

Actionable Tips for Successful Golden Trading Options

To enhance your golden trading options success, consider these actionable tips:

- Begin with a thorough understanding of the underlying concepts.

- Conduct thorough research on market trends and potential risks.

- Exercise realistic expectations and define clear trading strategies.

- Monitor your positions regularly and manage risk prudently.

Golden Trading Option Review

Image: golden-trading-option-strategy.en.softonic.com

Conclusion: Unlocking the Potential of Golden Trading Options

Golden trading options present a powerful tool for investors and traders seeking to navigate market complexities and pursue financial goals. However, a deep understanding of their dynamics, coupled with calculated risk management, is essential to unlock their full potential. By embracing the insights presented in this comprehensive review, you empower yourself to confidently participate in the golden trading options market and drive your financial success.