Introduction

Understanding the dynamics of the stock market can be a formidable task, but with the right knowledge and strategies, it is possible to not only survive but thrive in this fast-paced environment. One such strategy, particularly in the Indian context, is Nifty options trading. To empower aspiring and seasoned traders alike, this article delves into the complexities of this technique, offering a comprehensive guide to Nifty options trading strategies in an easy-to-understand manner.

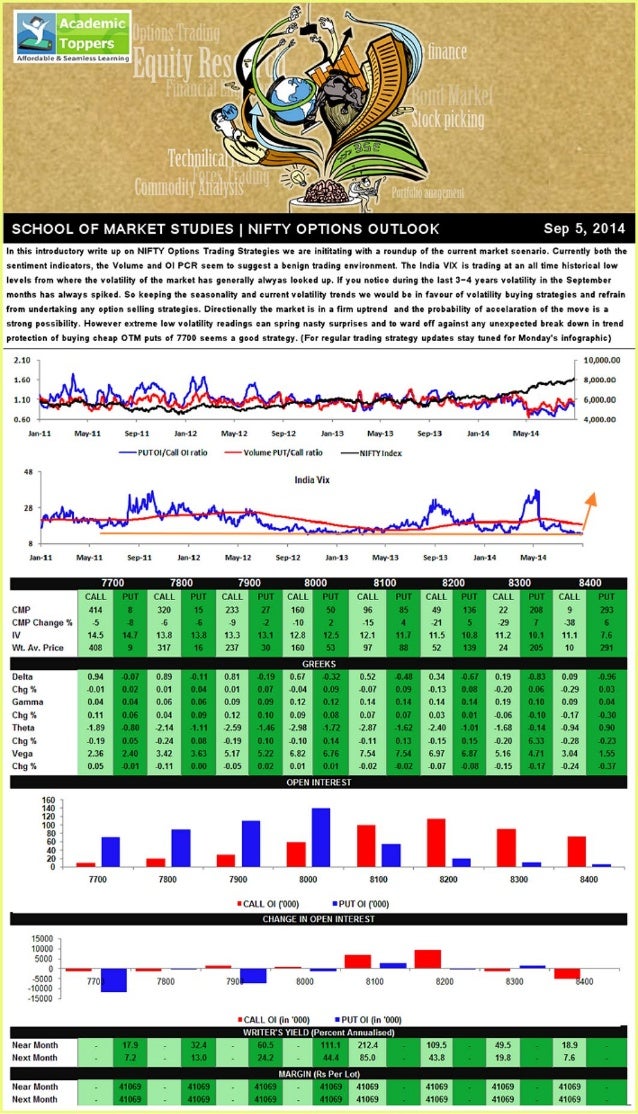

Image: www.slideshare.net

Understanding Nifty Options

Nifty options are financial contracts that grant the buyer the right but not the obligation to buy or sell the underlying asset, the Nifty 50 index, at a predetermined price on a specific date. This flexibility allows traders to take various positions in the market, from speculating on price movements to hedging against potential risks.

Benefits of Nifty Option Trading

Nifty option trading offers a multitude of benefits to traders, including:

- Leverage: Traders can control a significant number of Nifty shares with a relatively small investment, maximizing their potential returns.

- Flexibility: Options provide traders with the right to exercise their contracts at a predetermined price, giving them the flexibility to adjust their positions as the market fluctuates.

- Income Generation: Options can be used to generate income through strategies like option writing, where traders sell options to other market participants.

- Risk Management: Options can serve as a hedging tool, allowing traders to protect their portfolio from adverse price movements in the underlying asset.

Types of Nifty Option Strategies

Traders have access to a wide range of Nifty options strategies, each with its unique risk and reward profile. Some of the most common strategies include:

- Covered Call: Involves selling a call option while owning the underlying shares, limiting potential gains but providing extra income.

- Cash-Secured Put: Similar to a covered call, but involves selling a put option while holding cash equal to the underlying value.

- Naked Option Selling: Selling an option without owning the underlying asset, exposing the trader to unlimited losses.

- Long Call: Buying a call option to benefit from price increases in the underlying asset.

- Long Put: Buying a put option to benefit from price decreases in the underlying asset.

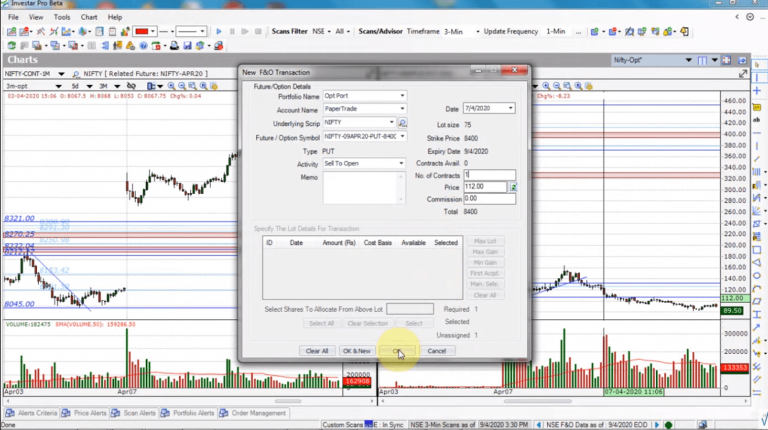

Image: investarindia.com

How to Choose the Right Nifty Option Strategy

Selecting the appropriate Nifty option strategy depends on factors such as market conditions, risk tolerance, and investment goals. Here are a few considerations to guide your decision:

- Time Decay: Options lose value over time, and traders need to consider the time frame for which they plan to hold their positions.

- Volatility: Higher volatility leads to higher option premiums and increased potential for gains and losses.

- Market Sentiment: Understanding market sentiment can help traders anticipate price movements and choose strategies that align with their expectations.

Advanced Nifty Option Trading Techniques

Beyond basic strategies, there are advanced techniques that can enhance the profitability and complexity of Nifty option trading. These include:

- Straddle and Strangle: Creating a portfolio of options with the same expiration but different strike prices to benefit from significant price movements in either direction.

- Butterfly Spreads: A more complex strategy that involves buying and selling options at different strike prices, creating a bell-shaped profit profile.

- Iron Condor: A multi-leg strategy designed to profit from limited price movements while reducing risk compared to simple option selling.

Nifty Option Trading Strategies Pdf

Image: www.quora.com

Conclusion

Nifty option trading strategies offer a powerful tool for traders to harness the potential of the Indian stock market. By understanding the basics of options, selecting the appropriate strategies, and navigating the complexities of advanced techniques, traders can increase their chances of success in this dynamic environment. However, it is crucial to remember that options trading carries inherent risks, and traders should always conduct thorough research and exercise prudent risk management practices.