Immerse yourself in the captivating world of options trading, where the potential for profit beckons. As you embark on this exciting journey, a crucial element that you must navigate is margin requirements. Understanding these requirements ensures optimal trading outcomes and safeguards your financial well-being.

Image: www.youtube.com

**What are Margin Requirements?**

In options trading, margin requirements represent the minimum amount of capital that you must maintain in your trading account to cover potential losses. These requirements serve as a safety net, ensuring that you have sufficient funds to meet any obligations arising from your trades.

Margin requirements vary depending on the type of option you trade (call or put), the option’s strike price, and the expiration date. Typically, higher-priced options with lower strike prices carry higher margin requirements.

**Understanding Margin Calls**

When your account balance falls below the required margin level, you may receive a margin call. This is a notification from your broker, requiring you to deposit additional funds to bring your account back into compliance. Failure to meet a margin call can result in forced liquidation of your positions, potentially leading to losses.

Regularly monitoring your account balance and understanding the margin requirements associated with your trades is essential to menghindari margin calls.

**Factors Influencing Margin Requirements**

Several factors can influence the margin requirements for option trades, including:

- Option Type: The type of option (call or put) can impact margin requirements.

- Strike Price: Higher-priced options typically have higher margin requirements.

- Expiration Date: Options with longer expiration dates often require higher margin requirements due to increased volatility.

- Volatility: High volatility in the underlying asset can lead to higher margin requirements.

Image: capital.com

**Tips for Managing Margin Requirements**

Effective margin management is vital for successful option trading. Consider the following tips:

- Choose options with appropriate margin requirements: Select options with margin requirements that align with your risk tolerance and account balance.

- Calculate and maintain margin cushion: Allow a buffer between your account balance and the margin requirements to avoid unexpected margin calls.

- Close positions early: If the underlying asset’s price moves unfavorably, consider closing your positions sớm than anticipated to manage margin requirements.

- Use limit orders: Limit orders can help you manage risk and prevent excessive losses, positively impacting margin requirements.

**FAQs on Margin Requirements**

- Q: What happens if I can’t meet a margin call?

A: Failure to meet a margin call will result in forced liquidation of your positions.

- Q: Can I trade without meeting margin requirements?

A: No, you must maintain the necessary margin in your account to trade options.

- Q: How are margin requirements calculated?

A: Margin requirements are typically a percentage of the option’s premium and vary based on the factors mentioned earlier.

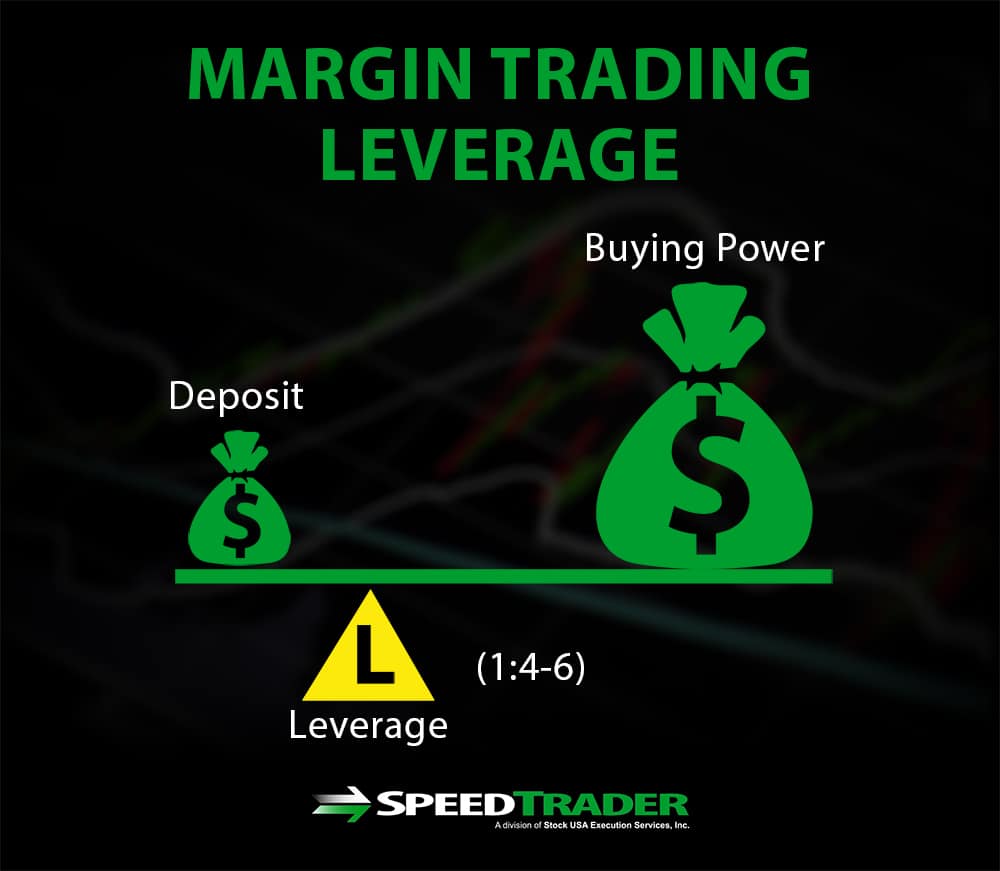

Margin Requirements For Option Trading Strategies

Image: speedtrader.com

**Conclusion**

Margin requirements are an indispensable aspect of option trading, ensuring that you have the capital to cover potential losses and fulfilling your trading obligations. By understanding these requirements and applying the tips provided, you can navigate the complexities of options trading confidently. If you’re new to options trading, it’s advisable to consult experienced traders or financial advisors for guidance.

Are you eager to delve deeper into understanding margin requirements for option trading strategies? Explore resources online or seek professional advice to enhance your trading prowess.