In the dynamic world of financial markets, options trading has emerged as a powerful tool for investors seeking profit potential and risk management. HSBC, a global leader in banking and finance, offers insightful options trading strategies to help investors navigate the complexities of this market.

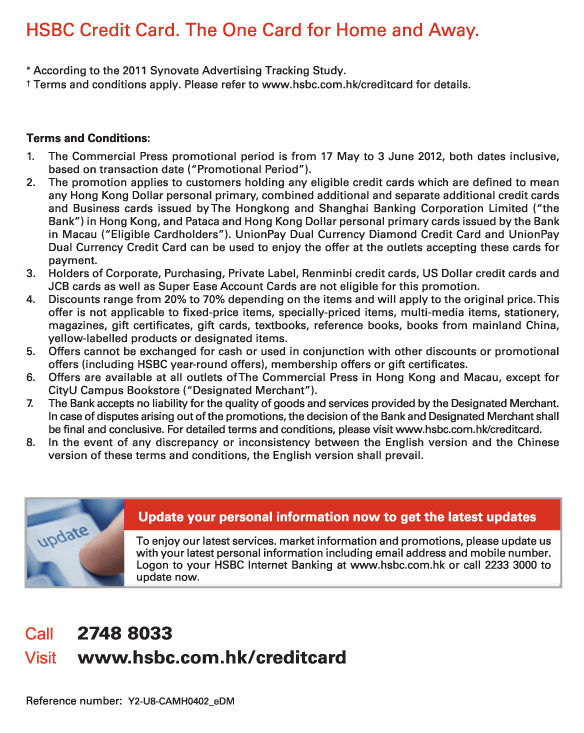

Image: etibavubanako.web.fc2.com

Unveiling HSBC’s Options Trading Strategies

HSBC’s options trading strategies are meticulously crafted to cater to the diverse needs of investors ranging from beginners to seasoned professionals. These strategies leverage expert research, market analysis, and sophisticated trading techniques to maximize returns while managing risk exposure effectively.

Understanding Options and Their Potential

Options are financial contracts that provide investors with the rights, but not the obligation, to buy or sell an underlying asset at a specified price on or before a specific date. Options trading involves speculating on the future price movements of assets, enabling investors to capitalize on potential price fluctuations without directly owning the underlying asset.

Strategy 1: Covered Call

Covered call strategy entails selling a call option while simultaneously holding an equivalent quantity of the underlying asset. This strategy is ideal for investors who are bullish on the underlying asset, seeking to gain income from option premiums while limiting potential downside risk.

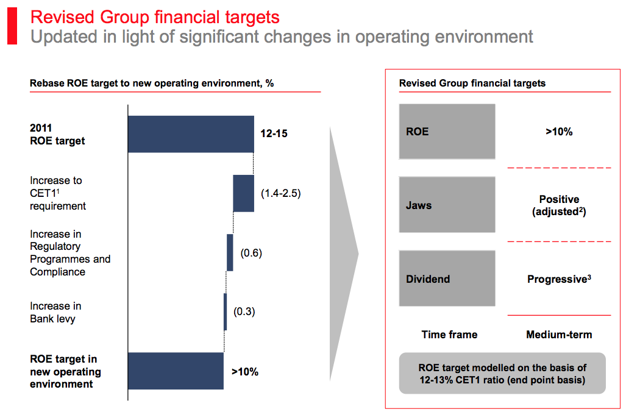

Image: seekingalpha.com

Strategy 2: Protective Put

A protective put strategy involves buying a put option while holding an equivalent quantity of the underlying asset. This strategy is suitable for investors who are bearish on the underlying asset, seeking downside protection in case of unfavourable price movements.

Strategy 3: Long Straddle

A long straddle strategy involves simultaneously buying both a call and a put option with the same strike price and expiration date. This strategy benefits from high volatility in either direction, enabling investors to capture significant profits when the market experiences substantial price fluctuations.

Staying Informed: Latest Trends and Developments

The options trading landscape is constantly evolving, with new strategies and techniques emerging to meet changing market conditions. By staying abreast of these developments, investors can refine their strategies and enhance their trading decisions.

Monitoring Market News and Insights

Tracking market news and insights provides invaluable information about economic trends, geopolitical events, corporate announcements, and other factors affecting asset prices. Real-time monitoring of news sources, financial media, and expert commentaries can assist investors in making informed decisions for their options trading strategies.

Leveraging Forums and Social Media

Engaging with online forums and social media platforms dedicated to options trading offers access to a wealth of insights, experiences, and discussions. These platforms foster interactions with experienced traders, providing valuable knowledge and actionable tips that can improve trading strategies.

Tips and Expert Advice from Experienced Traders

Drawing upon the wisdom of experienced traders, here are some invaluable tips to enhance your options trading strategies:

Tip 1: Define Clear Strategy Objectives

Establish明确的战略目标, outlining your desired profit targets, risk tolerance, and investment horizon. A well-defined strategy ensures that your trading decisions are aligned with your overall investment goals and risk appetite.

Tip 2: Manage Risk Prudently

Risk Management is paramount in options trading to mitigate potential losses and preserve capital. Employing stop-loss orders, diversification techniques, and monitoring position size can help you control risk effectively.

FAQs on HSBC Options Trading Strategies

Q: Who can benefit from HSBC’s options trading strategies?

A: HSBC’s options trading strategies are tailored to a wide range of investors, including retail traders, institutional investors, and professional fund managers seeking to enhance their returns and manage risks.

Q: What resources are available to learn more about options trading?

A: HSBC provides comprehensive resources, including educational materials, webinars, and access to experienced professionals, to help investors gain insights and improve their options trading skills.

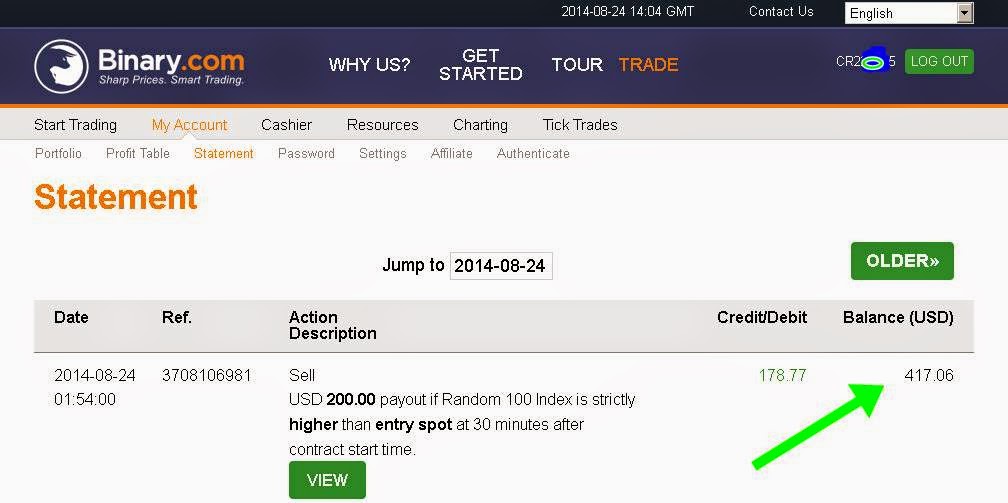

Hsbc Options Trading Strategies Pdf

Image: kulyfyyepi.web.fc2.com

Conclusion

HSBC options trading strategies offer a sophisticated and comprehensive approach to navigating the complexities of options trading. By embracing these strategies, investors can unlock the potential for enhanced returns while managing risk effectively. Embark on your options trading journey today and empower yourself with the knowledge and insights provided by HSBC.

Are you ready to explore the lucrative world of options trading? Partner with HSBC and harness the power of expert strategies to elevate your trading journey!