Introduction

Image: www.slidebook.io

In the ever-evolving world of finance, options trading has emerged as a powerful tool for savvy investors seeking to enhance their portfolio’s potential. Options, financial instruments that confer the right but not the obligation to buy (call) or sell (put) an underlying asset at a specified price on or before a particular date, provide investors with a versatile range of strategies to mitigate risk, speculate on price movements, and generate income. HSBC, one of the world’s leading financial institutions, offers an array of option trading strategies to meet the diverse needs of investors.

This comprehensive guide will delve into the intricacies of HSBC option trading strategies, exploring the basics, identifying popular approaches, and providing practical examples to empower investors to harness the full potential of this dynamic investment vehicle.

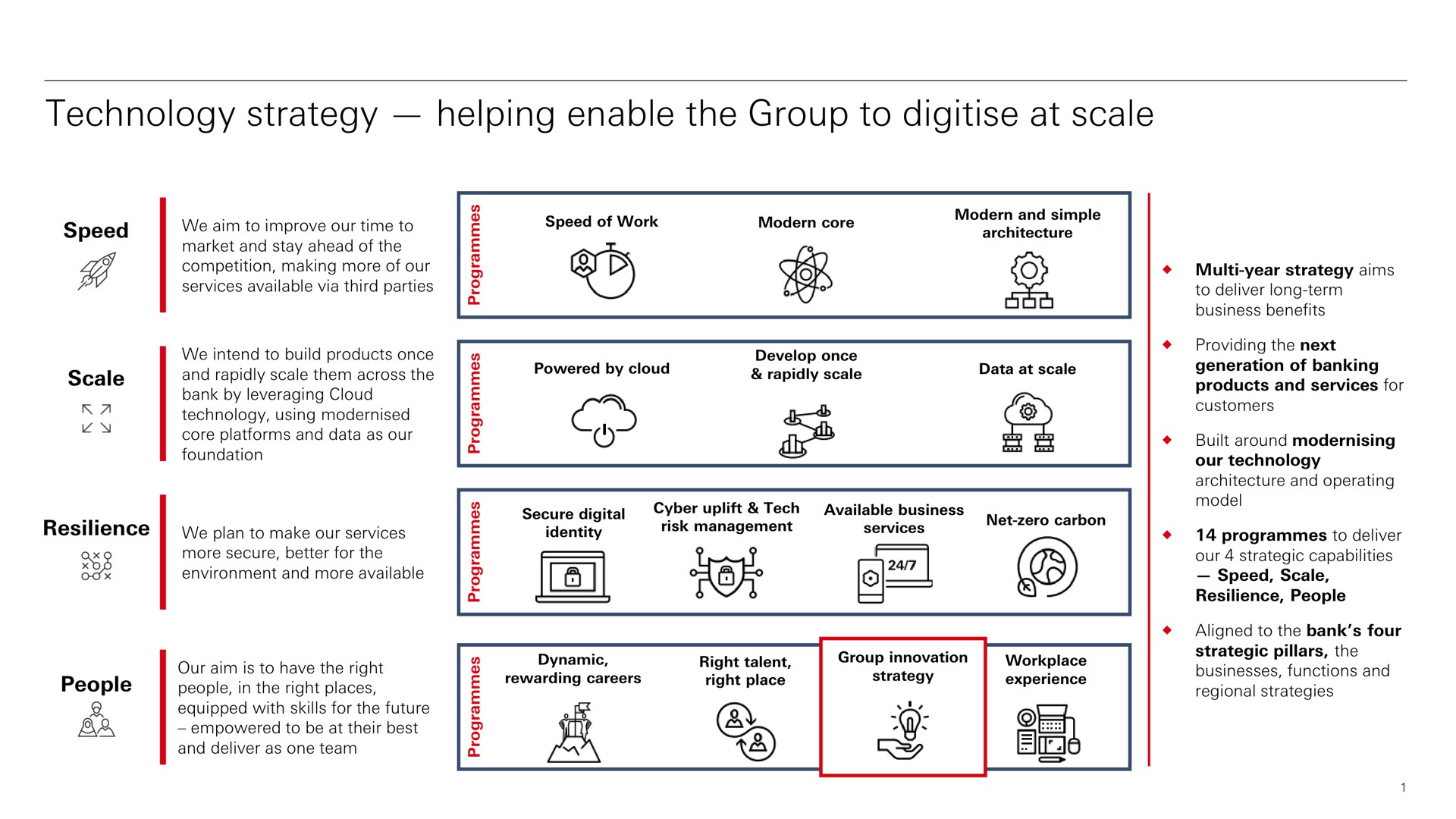

HSBC Option Trading: An Overview

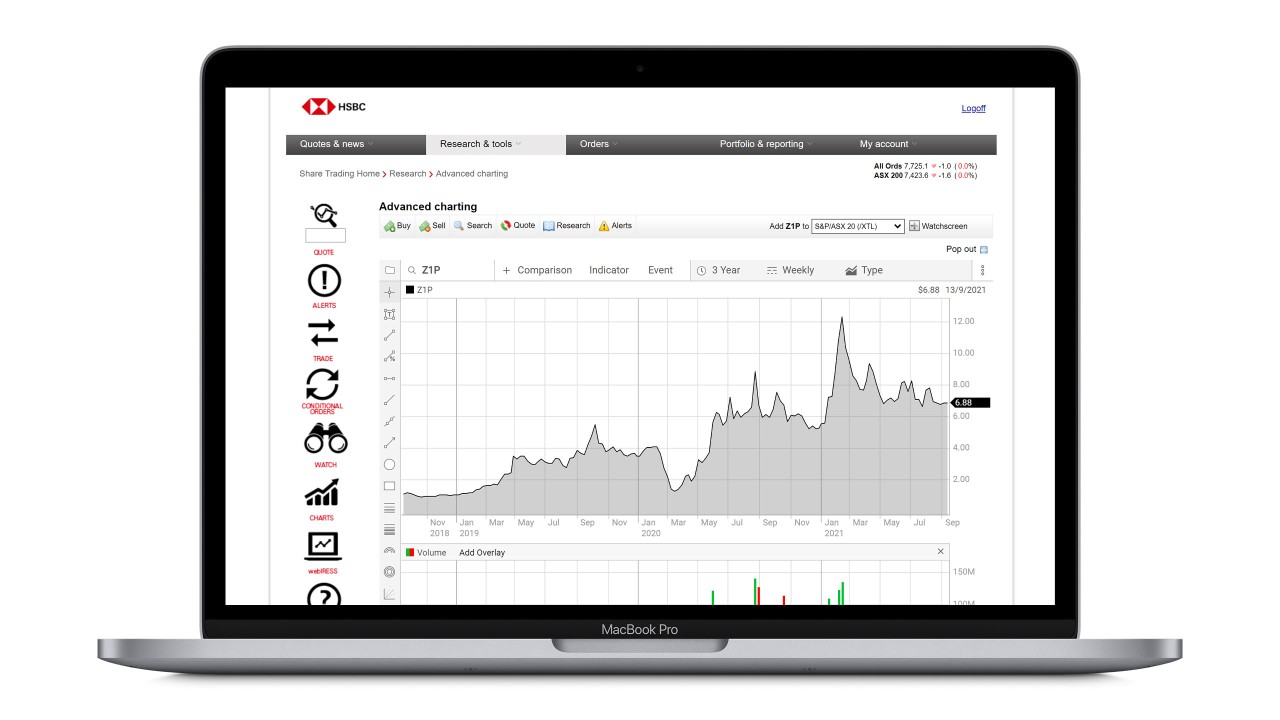

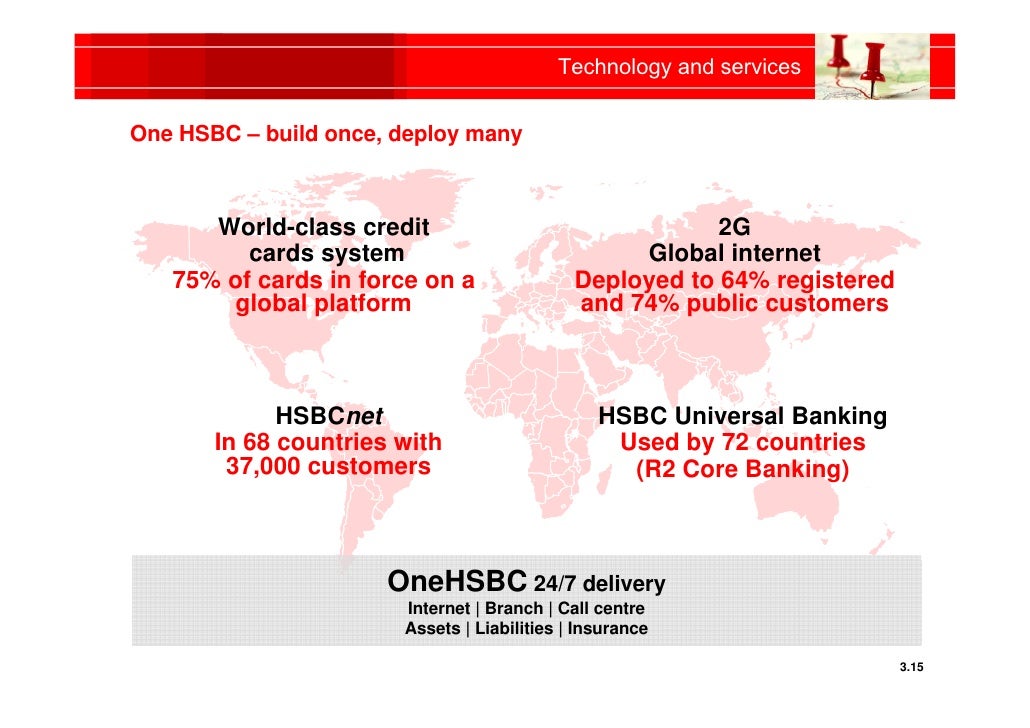

HSBC offers a robust platform for option trading, enabling investors to execute complex strategies with ease and efficiency. The bank provides access to global markets, a wide range of underlying assets including stocks, indices, currencies, and commodities, and tailored advice from experienced professionals. Whether an investor seeks to hedge against potential losses, speculate on market sentiment, or generate additional income, HSBC’s option trading services cater to a myriad of investment goals.

Popular Option Trading Strategies with HSBC

HSBC offers a comprehensive suite of option trading strategies, each designed to address specific market conditions and investment objectives. Some of the most popular strategies include:

Covered Call Writing: This strategy involves selling (writing) a call option against an underlying asset that the investor already owns. The goal is to generate income from the premium received for selling the option while limiting the upside potential of the underlying asset.

Protective Put Buying: This strategy entails purchasing (buying) a put option against an underlying asset that the investor owns or intends to acquire. The put option provides protection against a decline in the asset’s price, thus limiting the potential downside risk.

Collar Strategy: This strategy combines covered call writing with protective put buying. By selling a call option at a higher strike price and simultaneously buying a put option at a lower strike price, investors can cap their potential profits and establish a defined range within which the underlying asset can fluctuate.

Straddle Strategy: This strategy involves simultaneously buying a call and a put option with the same underlying asset, strike price, and expiration date. Straddles are designed to profit from volatility in the underlying asset, as they gain value regardless of whether the market price rises or falls.

Strangle Strategy: Similar to a straddle, a strangle strategy involves buying a call and a put option with the same underlying asset and expiration date, but different strike prices. Unlike a straddle, the strike prices in a strangle are typically out-of-the-money, resulting in a lower premium cost but also a reduced potential for profit.

Practical Examples

To illustrate these strategies, consider the following examples:

Example 1: An investor owns 100 shares of Apple Inc. (AAPL) and is concerned about a potential decline in its price. The investor could employ a protective put buying strategy by purchasing a put option with an exercise price of $150 that expires in one month. If AAPL’s price falls below $150 before expiration, the put option will gain value, offsetting some of the losses incurred on the underlying shares.

Example 2: An investor believes that the volatility of the S&P 500 index (SPX) is likely to increase in the coming months. To capitalize on this, the investor could implement a straddle strategy by buying both a call and a put option with an underlying asset of SPX, the same expiration date, and a strike price at the current market level. If SPX’s volatility increases, the price of both options will rise, generating a profit for the investor.

Conclusion

HSBC option trading strategies empower investors with the tools to navigate the complexities of financial markets and pursue their investment objectives with confidence. By understanding the various strategies available and applying them judiciously, investors can enhance their portfolio’s potential, manage risk, and unlock new avenues for growth. HSBC, with its comprehensive platform and experienced professionals, stands as a trusted partner for investors seeking to harness the power of option trading strategies.

Image: www.hsbc.com.au

Hsbc Option Trading Strategies Pdf

Image: www.slideshare.net