In the ever-evolving world of finance, options trading emerges as a powerful tool for savvy investors seeking to enhance their portfolio returns. This comprehensive guide will delve into the intricate strategies of options trading, empowering you with the knowledge and insights to navigate this lucrative market with confidence.

Image: forex-strategies-revealed.com

What Are Options and Why Do They Matter?

Options represent financial contracts that grant the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price and time. These versatile instruments offer investors a diverse array of opportunities, from mitigating risk to potentially generating substantial profits. By harnessing the power of options, you can tailor your trading strategy to align with your unique financial goals.

The Fundamentals of Options Trading

Understanding the foundational concepts of options trading is the cornerstone of success. There are two primary types of options: calls and puts. A call option grants the buyer the right to purchase an underlying asset, while a put option gives the buyer the right to sell. Each option contract has four key characteristics:

- Underlying asset: The underlying asset can be a stock, bond, commodity, or even a currency.

- Strike price: This is the predetermined price at which the buyer can exercise their right to buy or sell.

- Expiration date: Options have a predetermined expiration date, after which they become worthless.

- Premium: This is the price paid by the buyer to the seller in exchange for the right granted by the option.

Strategies for Success in Options Trading

Options trading offers a wide range of strategies, each catering to specific market conditions and risk tolerances. Here are some popular and effective strategies:

- Bull Call Spread: This strategy is designed for bullish investors and involves buying a call option at a lower strike price and simultaneously selling a call option at a higher strike price.

- Bear Put Spread: Opposite to the bull call spread, this strategy is suited for bearish investors and involves selling a put option at a lower strike price and buying a put option at a higher strike price.

- Covered Call: This strategy is suitable for investors who own underlying shares and seek to generate additional income. It involves selling a call option against the shares they hold.

- Protective Put: This strategy is designed to protect potential losses on a stock position. It involves buying a put option at a strike price below the current market price of the stock.

Image: www.youtube.com

Expert Insights and Actionable Tips

To enhance your understanding and success in options trading, leverage the insights of seasoned experts in the field:

- “Options are not for everyone. Understand your risk tolerance and financial goals before venturing into this market.” – Warren Buffett

- “Don’t be afraid to seek professional advice from a reputable broker or financial advisor if you’re new to options trading.” – Mark Cuban

Here are some actionable tips to guide your options trading endeavors:

- Thoroughly research the underlying asset, market conditions, and potential risks before executing any trades.

- Consider your risk tolerance and trade accordingly. Avoid exposing yourself to excessive financial risk.

- Use protective strategies like stop-loss orders to manage potential losses.

- Constantly monitor your positions and adjust them as market conditions evolve.

- Stay informed about economic and market news that could impact your options trades.

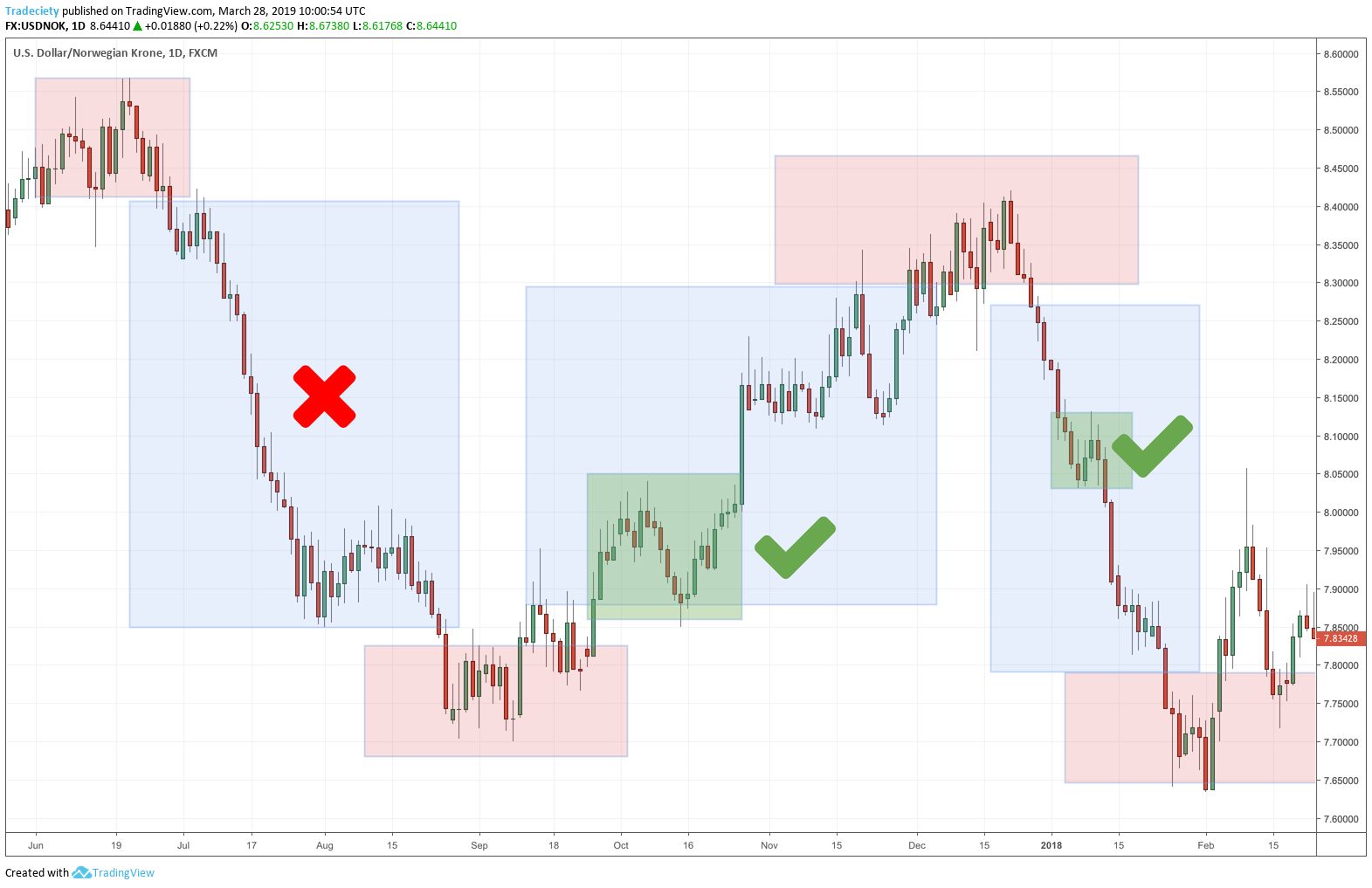

Stratigies For Trading Options

Image: tradeciety.com

Conclusion

Options trading offers a powerful and versatile toolkit for discerning investors seeking to maximize their portfolio returns. By mastering the strategies outlined in this guide, you can harness the opportunities and mitigate the risks associated with options trading. Remember to approach this market with knowledge, discipline, and a commitment to continuous learning. Invest wisely, and unlock the full potential of options trading.