Introduction

The vibrant financial hub of Singapore has witnessed a growing interest in options trading, as traders seek to expand their investment horizons and potentially enhance their returns. Options trading involves buying or selling contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on a specific date. With its structured regulatory environment and access to a wide range of markets, Singapore has become a prime destination for options traders.

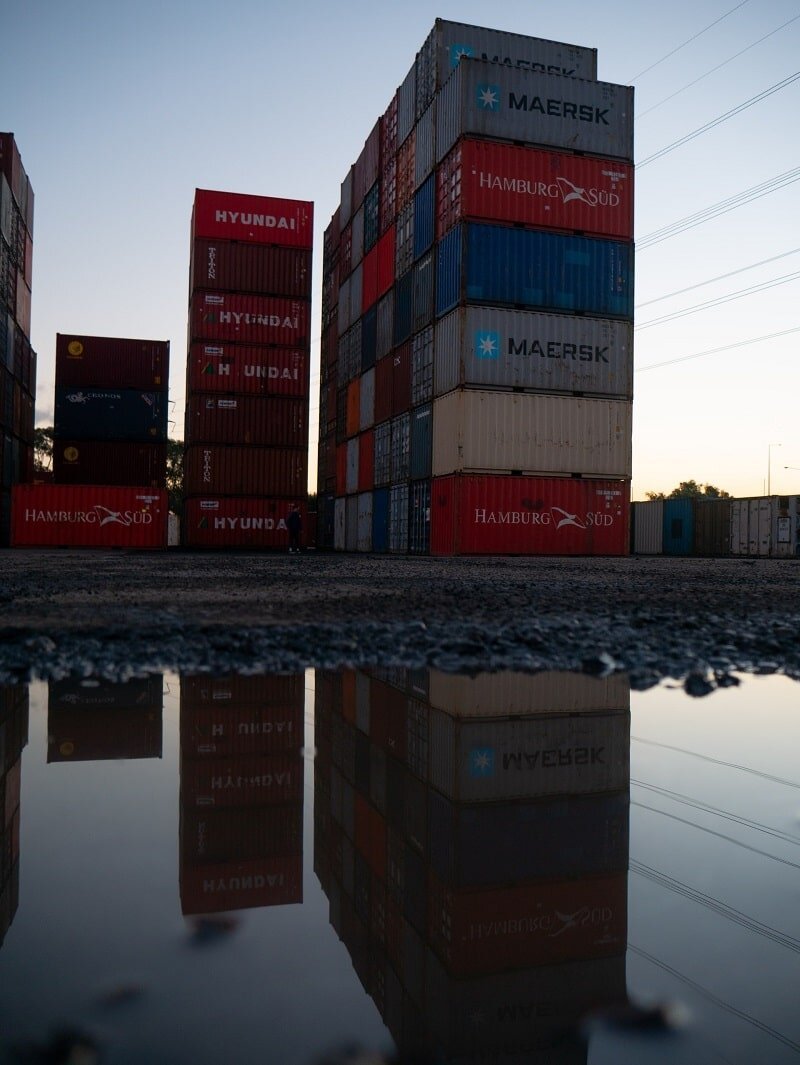

Image: www.trading-impossible.com

Navigating the complexities of options trading necessitates partnering with a reliable and established broker that provides a user-friendly platform, educational resources, and competitive trading conditions. This article delves into the landscape of options brokers in Singapore, outlining their essential services, offerings, and key differentiators to assist traders in making informed choices.

Understanding Options Brokers: A Guiding Hand for Traders

Options brokers serve as intermediaries between traders and the options exchanges, facilitating the execution of options contracts. They offer a range of services, including:

- Order Placement and Execution: Brokers provide a trading platform that enables traders to place and manage their options orders, which are then routed to the relevant exchanges for execution.

- Real-Time Market Data: Brokers supply real-time market data, including prices, quotes, and historical data, which empowers traders to make informed decisions.

- Educational Resources: Many brokers offer educational materials, webinars, and training sessions to help traders understand options strategies and enhance their trading skills.

- Customer Support: Brokers provide customer support via phone, email, or live chat to assist traders with queries, technical issues, or account management.

Choosing the Right Broker: Factors to Consider

Selecting the optimal options broker in Singapore hinges on several key factors:

- Regulation and Credibility: Verify that the broker is duly licensed and regulated by the Monetary Authority of Singapore (MAS), attesting to their adherence to industry standards and ethical practices.

- Trading Platform: Assess the user-friendliness, functionality, and charting capabilities of the broker’s trading platform to ensure alignment with your trading style and preferences.

- Product Offerings: Determine the range of options products available, including the underlying assets, expiration dates, and contract sizes, to cater to your trading needs.

- Fees and Commissions: Carefully examine the broker’s fee structure, including commissions, spreads, and other charges, to avoid hidden costs that can erode your profits.

- Research and Analysis: Evaluate the broker’s research and analysis tools, such as technical indicators, charting software, and proprietary research reports, to enhance your decision-making process.

Image: www.pilotoasia.com

Options Trading Singapore Broker

Image: www.berotak.com

Top Options Brokers in Singapore: Unveiling the Leaders

Singapore is home to a plethora of reputable options brokers, each offering unique strengths and cater