In the bustling realm of financial markets, where fortunes are made and lost, lies a tantalizing yet complex world of futures option trading. Like a calculated dance, this intricate strategy holds the potential to amplify returns and navigate market uncertainties.

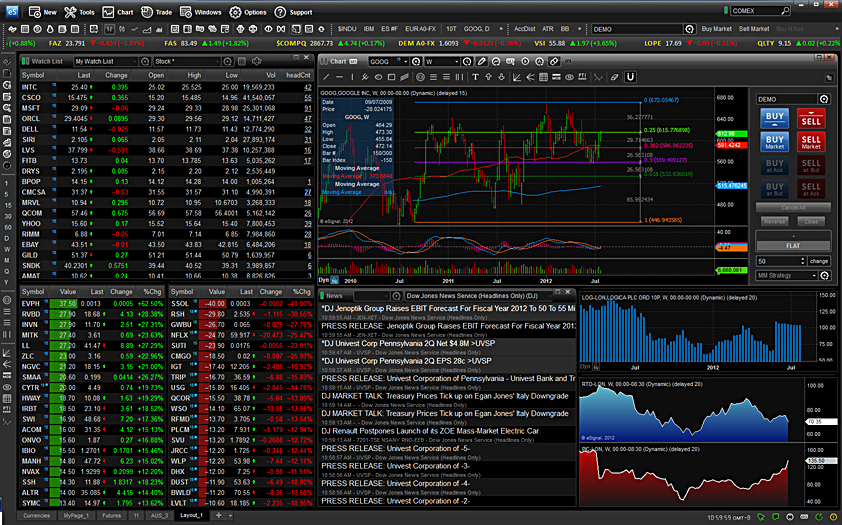

Image: dailytrademantra.com

Futures options grant the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on a specified date. This flexibility allows traders to speculate on future market conditions and hedge against potential losses.

The Anatomy of Futures Options

Futures options consist of two fundamental components: the **futures contract** and the **option contract**.

The futures contract represents an agreement to buy or sell an underlying asset at a specific price on a predetermined date. Futures contracts are standardized contracts traded on futures exchanges, such as the Chicago Mercantile Exchange (CME) or the Eurex.

The option contract provides the right to exercise the futures contract at a predetermined price. The buyer of an option has the option but not the obligation to exercise the contract, while the seller has the obligation to fulfill the contract if exercised.

Decoding the Mechanisms of Futures Option Trading

Futures option trading involves the buying and selling of options contracts. Traders can either purchase calls (the right to buy) or puts (the right to sell) options on the underlying futures contract.

Calls are purchased when traders anticipate that the price of the underlying asset will rise above the strike price (predetermined price). Puts, on the other hand, are purchased when traders expect the price to fall below the strike price.

Navigating the Ups and Downs of the Market

Futures option trading offers traders a versatile tool to navigate market fluctuations.

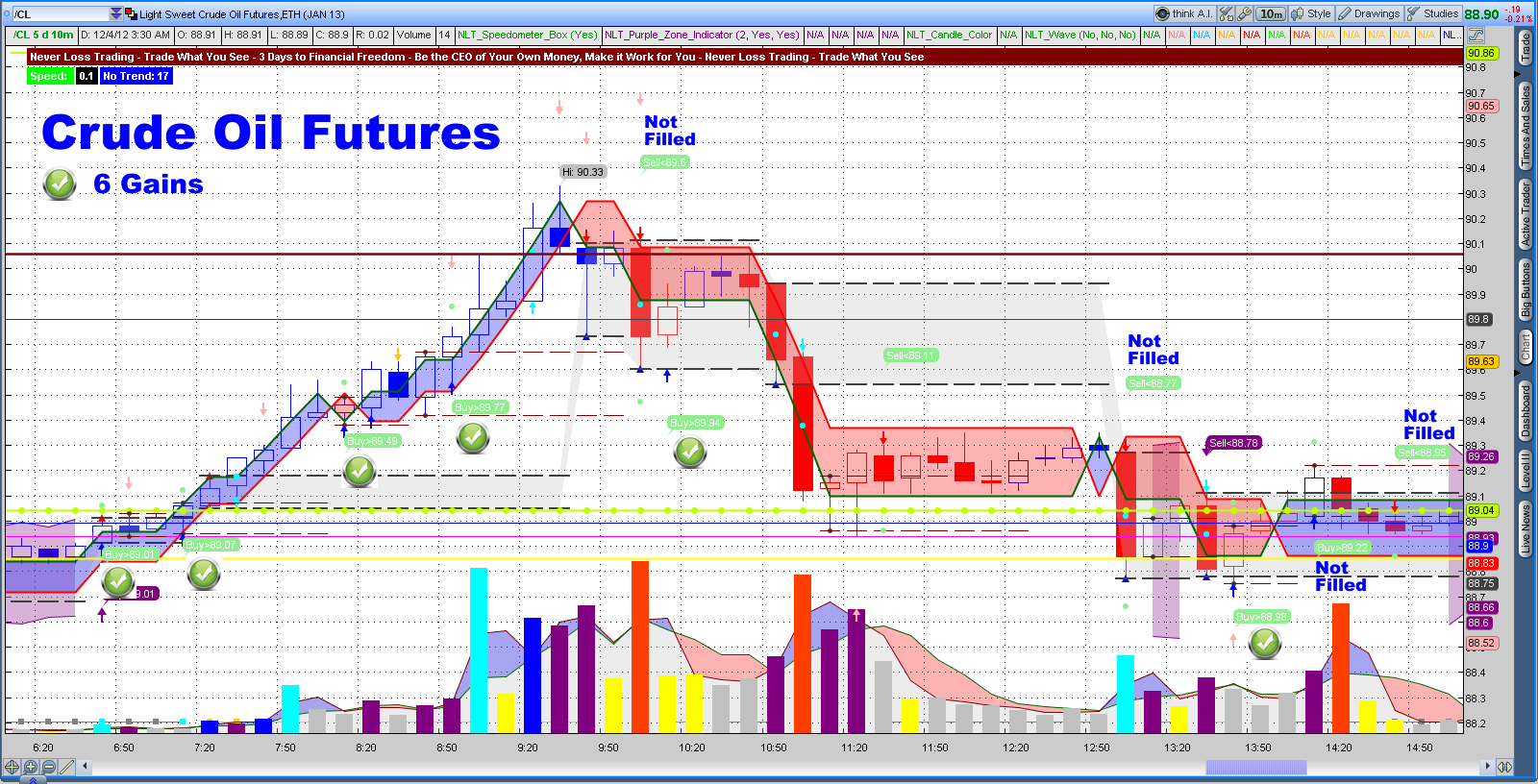

- Bullish Strategies: Call options can be used to capitalize on rising prices. When the underlying asset’s price rises, the call option’s value increases.

- Bearish Strategies: Put options can be employed to profit from falling prices. As the underlying asset’s price declines, the value of the put option rises.

- Hedging Strategies: Options can be used to hedge against potential losses in the underlying asset. By selling an option contract, traders can reduce their exposure to price fluctuations.

However, it’s important to note that futures options trading involves significant risk and requires a thorough understanding of market dynamics and complex trading strategies.

Image: niyudideh.web.fc2.com

Expert Insights: Unraveling the Nuances

To delve into the intricacies of futures option trading, expert guidance is invaluable.

- Master Market Analysis: Analyze market trends, economic data, and industry news to make informed trading decisions.

- Choose the Right Tools: Utilize technical indicators, charting tools, and position-sizing calculators to optimize your trading strategy.

- Manage Risk Effectively: Limit your exposure by using stop-loss orders, monitoring market volatility, and diversifying your portfolio.

- Embrace Education: Continuously educate yourself about futures option trading strategies, risk management techniques, and market developments.

Equipping yourself with these expert insights can significantly enhance your understanding and improve your chances of success in the dynamic world of futures options.

FAQs: Addressing Common Queries

Q: What are the key benefits of futures option trading?

A: Futures option trading offers potential for enhanced returns, flexibility in speculating on future market conditions, and opportunities for hedging against risk.

Q: What are some of the risks associated with futures option trading?

A: Options trading involves significant risk, including the possibility of losing the premium paid for the contract and substantial losses if the underlying asset’s price moves unexpectedly.

Q: How do I get started with futures option trading?

A: Begin by educating yourself, understanding the basics of futures and options contracts, practicing with a demo account, and seeking guidance from experienced traders or reputable sources.

Furtures Option Trading

Image: seboxinero.web.fc2.com

Conclusion: Igniting Your Interest

Navigating the complexities of futures option trading can be a transformative experience for those seeking mastery in the financial realm.

By embracing expert insights, continuously expanding your knowledge, and managing risk effectively, you can unlock the potential for enhanced returns and ride the waves of market fluctuations with confidence.

Are you ready to step into the world of futures option trading and embark on a journey of financial growth and discovery?