Introduction

Are you ready to unlock the secrets of the options trading world? Join us on an extraordinary journey as we delve into the fascinating realm of Ichimoku Cloud trading. This innovative approach will equip you with the knowledge and techniques to navigate the complexities of options markets with precision and confidence.

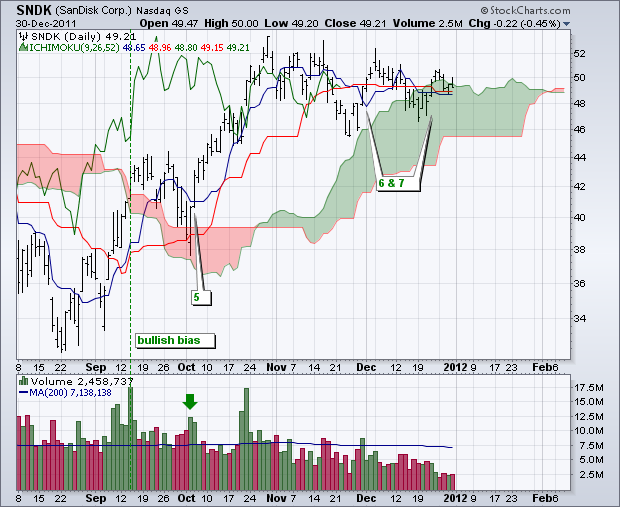

Image: microexcel.ae

In this comprehensive guide, we’ll unravel the essence of Ichimoku Cloud trading, empowering you to make informed decisions that drive successful outcomes. Get ready to delve into the world of options trading, where the Ichimoku Cloud becomes your trusted companion, guiding you towards informed investments and financial triumph.

Understanding the Ichimoku Cloud: A Visual Representation of Market Trends

The Ichimoku Cloud is a cutting-edge technical analysis tool that harnesses multiple time frames to provide a comprehensive snapshot of market behavior. At its core lies the idea of identifying trend direction, momentum, and support and resistance levels – all essential elements for effective options trading.

The Ichimoku Cloud is composed of five primary components, each meticulously designed to capture different aspects of the market. These components intertwine to form a visual representation that simplifies market interpretation and empowers traders to make strategic decisions.

-

Tenkan-sen (Conversion Line): This line represents the average of the highest high and lowest low prices over the past nine periods. It acts as a dynamic support or resistance level, providing insights into potential market reversals.

-

Kijun-sen (Base Line): This line represents the average of the highest high and lowest low prices over the past 26 periods. It serves as a more robust support or resistance level, guiding traders in identifying potential trend changes.

-

Senkou Span A (Leading Span A): This line is derived by plotting the average of the Tenkan-sen and Kijun-sen, shifted forward by 26 periods. It provides an indication of the potential future trend direction.

-

Senkou Span B (Leading Span B): This line represents the average of the highest high and lowest low prices over the past 52 periods, also shifted forward by 26 periods. It provides confirmatory signals and helps identify potential reversal zones.

-

Chikou Span (Lagging Span): This line represents the closing price of the current period, plotted 26 periods behind. It serves as a visual representation of the momentum and direction of the current trend.

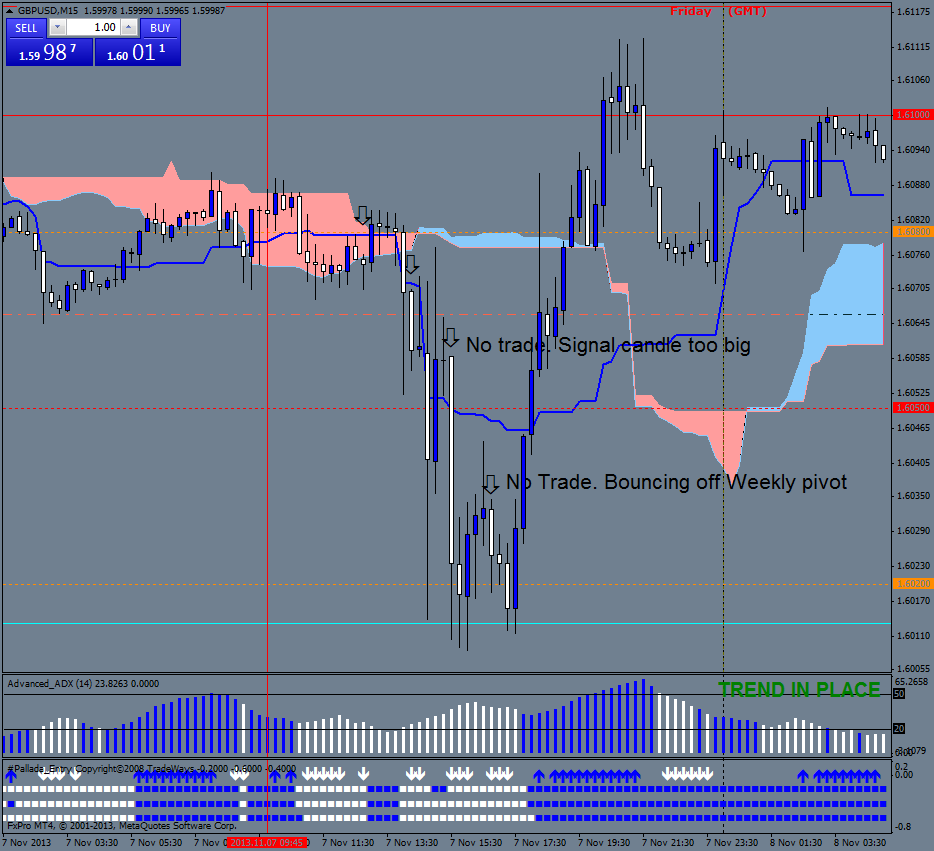

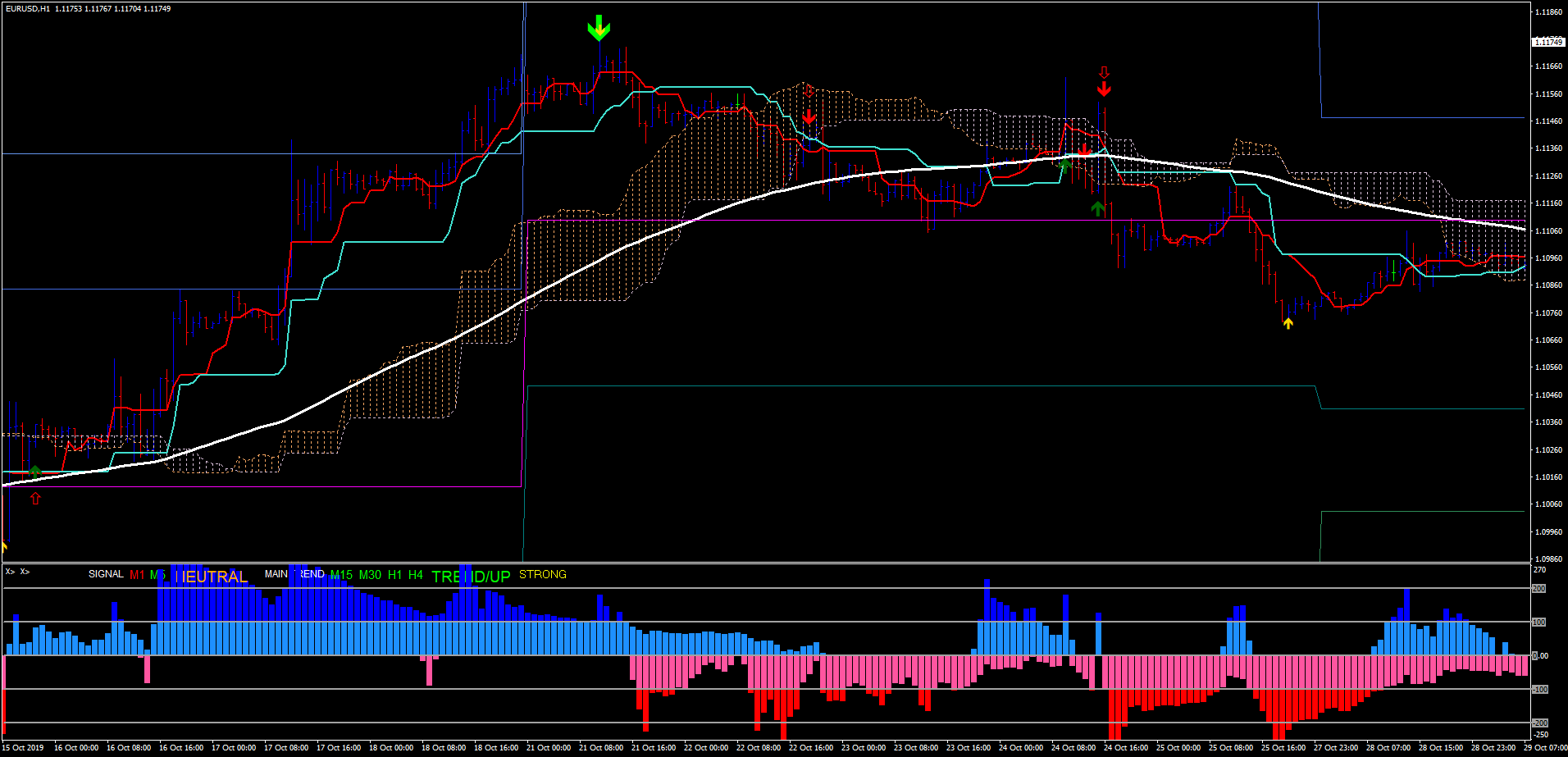

Options Trading with the Ichimoku Cloud: A Strategic Approach

Armed with a deep understanding of the Ichimoku Cloud’s fundamentals, let’s explore how to harness its power in the dynamic world of options trading. By identifying key signals and interpreting market behavior through the lens of the Ichimoku Cloud, you’ll gain a tactical edge in navigating options markets.

-

Trend Identification: The Ichimoku Cloud excels at identifying the prevailing market trend. When the Tenkan-sen is above the Kijun-sen and Senkou Span A is above Senkou Span B, an uptrend is indicated. Conversely, a downtrend is signaled when the Tenkan-sen is below the Kijun-sen and Senkou Span A is below Senkou Span B.

-

Support and Resistance Levels: The Ichimoku Cloud provides clear visual cues for identifying support and resistance levels. When the Tenkan-sen and Kijun-sen converge, a potential support or resistance zone is formed. The Chikou Span can also provide additional confirmation of these levels.

-

Momentum Assessment: The Chikou Span plays a crucial role in assessing market momentum. When the Chikou Span is trading above the current price, it indicates positive momentum and the likelihood of continued price increases. Conversely, when the Chikou Span is trading below the current price, it suggests negative momentum and the potential for price declines.

-

Trade Entries and Exits: The Ichimoku Cloud offers valuable insights for determining optimal trade entry and exit points. A bullish entry signal occurs when the price breaks above the Tenkan-sen and Kijun-sen, while a bearish entry signal is generated when the price breaks below these lines. Exit signals are similarly identified when the price crosses in the opposite direction.

-

Risk Management: The Ichimoku Cloud assists traders in effectively managing risk by identifying potential support and resistance levels that can serve as stop-loss or take-profit targets. By placing stop-loss orders below crucial levels or take-profit orders above them, traders can mitigate potential losses and maximize profits.

Expert Insights and Actionable Tips: Unleashing the Ichimoku Cloud’s Potential

To further empower your options trading journey, we’ve gathered invaluable insights from seasoned experts and crafted actionable tips that will enhance your strategy execution.

Expert Insights:

-

“The Ichimoku Cloud is not just an indicator; it’s a complete trading system that provides a holistic view of market dynamics.” – Mark Douglas, renowned trading strategist

-

“The key to successful Ichimoku Cloud trading lies in understanding the relationship between its different components and how they work together to tell the market story.” – Steve Nison, pioneer in candlestick charting

Actionable Tips:

-

Master the Basics First: Before diving into live trading, thoroughly understand the concepts and components of the Ichimoku Cloud. Practice using it on historical data to gain proficiency.

-

Consider Multiple Time Frames: The Ichimoku Cloud offers insights across different time frames. Analyze the cloud on multiple charts, such as daily, weekly, and monthly, to gain a comprehensive view of market trends.

-

Use the Cloud as a Filter: Rather than relying solely on the Ichimoku Cloud, use it as a filter to narrow down trading opportunities. Look for signals that align with other technical indicators or chart patterns for increased confidence.

-

Stay Disciplined and Manage Risk: Ichimoku Cloud trading, like all forms of trading, requires discipline and risk management. Stick to your trading plan, set clear stop-loss and take-profit levels, and never trade with more than you can afford to lose.

-

Continuously Educate Yourself: The financial markets are constantly evolving, and so should your knowledge. Stay up-to-date on the latest trading strategies, market trends, and incorporate them into your Ichimoku Cloud trading approach.

Image: whats-binary-options.logdown.com

Options Trading With Ichimoku

Image: www.forexstrategiesresources.com

Conclusion: Embracing the Power of the Ichimoku Cloud in Options Trading

The Ichimoku Cloud is an indispensable tool for options traders seeking to navigate the complexities of the market with confidence and precision. By mastering the principles outlined in this guide and incorporating the expert insights and actionable tips provided, you’ll gain a competitive edge in unlocking the full potential of the Ichimoku Cloud in your options trading endeavors.

Remember, successful trading involves continuous learning, adaptation, and discipline. Embrace the Ichimoku Cloud as your trusted ally, but always approach the markets with a healthy dose of respect and a commitment to ongoing education. With dedication and perseverance, you’ll master the art of options trading with Ichimoku Cloud, transforming the financial markets into a realm of opportunity and triumph.