What are Options?

Options trading is a financial instrument that grants the buyer the right, but not the obligation, to buy or sell an underlying asset at a predefined price within a certain time frame. This unique characteristic makes options an attractive tool for investors seeking to protect their portfolios, speculate on price movements, or generate income through premiums.

Image: www.adenshop.rs

History and Evolution of Options

The history of options trading dates back to ancient Greece, where merchants employed a rudimentary form of options known as “futures contracts” to manage risks associated with crop yields. Over time, options evolved into a more standardized and regulated market in the 17th century Netherlands, where traders used them to hedge against price fluctuations in the lucrative spice trade. The modern era of options trading began in the 1970s with the establishment of the Chicago Board Options Exchange (CBOE), which revolutionized the market by introducing standardized options contracts.

Types of Options

Options contracts exist in two primary forms: calls and puts. A call option grants the buyer the right to buy the underlying asset, while a put option conveys the right to sell. Each option contract specifies the following key elements:

- Underlying Asset: The asset that is being traded, such as stocks, bonds, or commodities

- Strike Price: The predetermined price at which the option can be exercised

- Expiration Date: The date on which the option contract expires

- Premium: The amount paid by the buyer to the seller to acquire the option

Benefits and Uses of Options

Options trading offers numerous advantages for investors of all levels. Some of its key benefits include:

- Flexibility: Options allow investors to tailor strategies based on their individual risk tolerance and investment objectives.

- Hedging: Options can be used as a risk management tool to protect existing investments by hedging against potential losses.

- Leverage: Options offer a form of leverage, enabling investors to control significant positions with a relatively small investment.

- Income Generation: Options trading can provide income through premium payments or the sale of options contracts.

Image: www.aislac.org

Risks of Options Trading

While options offer potential rewards, it’s crucial to acknowledge the inherent risks involved. These risks include:

- Loss of Premium: If the option expires unexercised, the buyer loses the entire premium paid to acquire the option.

- Unlimited Loss Potential: In certain scenarios, particularly when trading naked options, the potential losses can be substantial and exceed the initial investment.

- Time Decay: The value of options erodes over time as the expiration date approaches, known as time decay.

Strategies for Options Trading

Options trading offers a wide array of strategies that can be tailored to specific market conditions and investment goals. Some common strategies include:

- Call Option Strategy: Buying a call option with the expectation that the price of the underlying asset will rise above the strike price.

- Put Option Strategy: Buying a put option with the anticipation that the price of the underlying asset will fall below the strike price.

- Covered Call Strategy: Selling a call option while owning the underlying asset to generate income through premiums.

- Protective Put Strategy: Buying a put option to protect against potential declines in the value of the underlying asset.

Tips for Successful Options Trading

Mastering the art of options trading requires a combination of knowledge, experience, and discipline. Here are some tips to enhance your success:

- Understand the Basics: Thoroughly comprehend the fundamentals of options trading before venturing into the market.

- Develop a Strategy: Carefully analyze the market, identify opportunities, and create a sound trading plan that aligns with your investment goals and risk tolerance.

- Risk Management: Implement sound risk management practices, including limiting exposure and setting stop-loss orders.

- Seek Education: Continuously expand your knowledge through seminars, courses, and resources to stay abreast of market trends and strategies.

- Practice and Patience: Practice trading with paper money or simulated accounts before committing real capital. Patience is key in options trading, and waiting for the right opportunities can often prove more rewarding than hasty decisions.

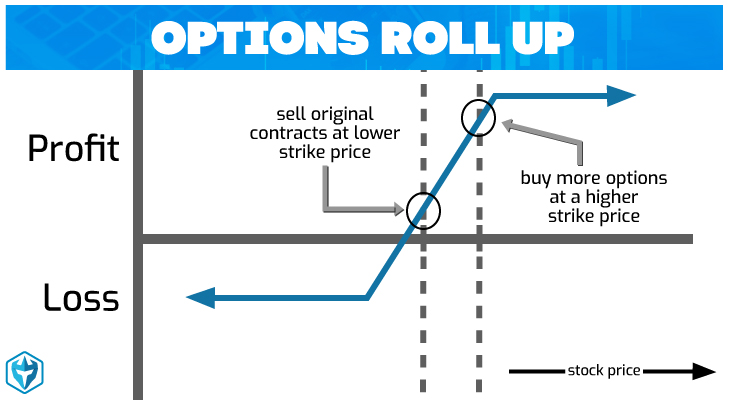

Options Trading Defined

Image: voxt.ru

Conclusion

Options trading is a versatile and multifaceted financial instrument that can unlock both rewards and risks for investors. By embracing its complexities and employing prudent strategies, you can harness the power of options to protect your portfolio, speculate on market movements, and navigate the dynamic landscape of financial markets with confidence and determination.