In the dynamic realm of options trading, diagonal spreads emerge as a versatile strategy that empowers traders with nuanced control over risk and reward. Blending the principles of calendar and vertical spreads, diagonal spreads provide a multifaceted approach to portfolio management.

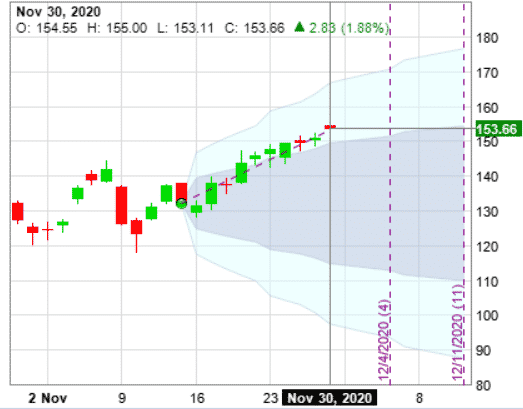

Image: tickertape.tdameritrade.com

Delving into the Mechanics of Diagonal Spreads

Diagonal spreads, also known as calendar-vertical spreads, are formed by simultaneously buying or selling options of different expiration dates with varying strike prices. By combining these components, traders create a more complex spread that offers flexibility and precise risk management.

To illustrate, a call diagonal spread involves buying a long-term call option with a lower strike price and simultaneously selling a shorter-term call option with a higher strike price. Conversely, a put diagonal spread involves selling a long-term put option with a higher strike price and buying a shorter-term put option with a lower strike price.

Harnessing the Advantages of Diagonal Spreads

The strategic advantages of diagonal spreads stem from their unique risk-reward profile. Unlike vertical spreads, diagonal spreads have a wider range of possible outcomes, allowing traders to tailor their positions to specific market conditions.

Neutral to bullish market sentiments favor the implementation of call diagonal spreads. These spreads benefit from a moderate increase in the underlying asset’s price while limiting downside risk. Conversely, put diagonal spreads thrive in neutral to bearish market conditions, generating profits from sideways or downward price movements.

Furthermore, diagonal spreads provide superior flexibility compared to calendar spreads. By incorporating vertical components, diagonal spreads enable traders to fine-tune the sensitivity of the spread to time decay and volatility. This flexibility allows traders to adapt their positions as market conditions evolve.

Navigating the Risks of Diagonal Spreads

Despite their potential rewards, diagonal spreads carry inherent risks that traders must carefully assess. Margin requirements for diagonal spreads are typically higher than for vertical spreads due to the involvement of multiple options. This increased capital commitment necessitates proper risk management to avoid potential losses.

Additionally, the decay of time value can impact the profitability of diagonal spreads. As the expiration dates of the options approach, their time value diminishes. Traders must carefully consider the time horizon of their trades to mitigate the erosion of premiums.

Image: www.snideradvisors.com

Practical Applications in Options Trading

Diagonal spreads find practical applications in various options trading strategies. For instance, they can be employed for income generation through premium collection or to hedge against potential losses in an underlying asset. Diagonal spreads also offer opportunities for speculation, enabling traders to capitalize on anticipated price movements within a defined timeframe.

Options Trading Diagonal Spread

Image: optionstradingiq.com

Conclusion

Diagonal spreads offer a sophisticated tool for options traders seeking enhanced risk management and precision in their trading. By combining the strengths of calendar and vertical spreads, diagonal spreads provide a versatile strategy for navigating various market conditions. However, thorough understanding of their mechanics and risks is paramount before embarking on diagonal spread trading.